Market intelligence outfit Newzoo has just produced a 42-page report looking at the state of the Chinese games market.

It's in-depth, and free - so you should get registered and download it - here.

In terms of mobile games, however, what's clear is that compared to western and other Asian markets, China remains nascent.

This is something I've been arguing for awhile now.

Sure it has massive potential, but it also has massive challenges, especially for non-Chinese developers and publishers, but even for Chinese developers and publishers who aren't properly plugged into the ecosystem.

Conclusion - it's a friction-heavy place in which to operate for companies who just rely on their creative smarts.

Slices of the pie

There are three graphs from Newzoo's report which demonstrate this.

The first is one we've all seen before. Android is the key mobile OS in China, both in terms of install base and revenue (although iOS still has around 25 percent of market revenue).

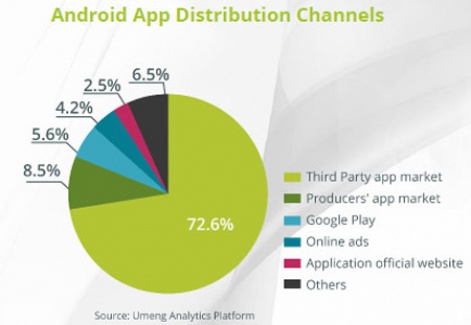

Yet, because of the absence of Google Play, the Android app distribution market is massively fragmented.

One outcome of this, is that revenues are also heavily fragmented. Unlike companies such as Supercell-GungHo and King, which suck up a massive percentage of global mobile game revenues, in China the biggest company is infrastructure outfit Tencent.

it's the biggest internet company in China as well as being the biggest games company in China, and is also pushing out into mobile games thanks to its mobile social network WeChat.

Newzoo reckoned Tencent had 15.5 percent of the Chinese mobile gaming market share in Q3 2013, with LocoJoy (I AM MT) second with 6.1 percent, and Playcrab (now part of OurPalm) third with 4.6 percent.

Obviously, however, the most important element of this graph is 'Others', which have over 50 percent of the market.

Market in transition

This is something that will change over the next 12 months, as China experiences the rise of superhit games and certain companies consolidate their market share.

There will be a few winners and many, many losers.

Combined with this change, is the more general massive opportunity of the Chinese mobile games market. At the moment, mobile games only account for 13.5 percent of the total Chinese games market, but this is changing very quickly as web and client PC gamers switch to mobile gaming.

That's why the big PC games companies such as Shanda, Giant, Perfect World, Renren, Snail, KongZhong, NetEase, ChangYou, The9 and Kingsoft are all shifting as fast as they can to mobile.

The next 12 months will prove fascinating.