Byungjo Kim is the mobile business department director of Nasmedia, a Korean digital media agency.

While top global games such as Clash of Clans, and Candy Crush Soda Saga have been basking in glory for a long time in Korea, Chinese games have been catching up fast.

Looking at the top 50 grossing games on the Korean Google Play market in June 2014, 10% were from China.

However, the June 2015 chart shows a remarkable change: Chinese titles now account for 25% of the top 50 list.

This means not only are there a lot of Chinese games present in Korea, but they are rapidly climbing up the local ladder in both performance and recognition.

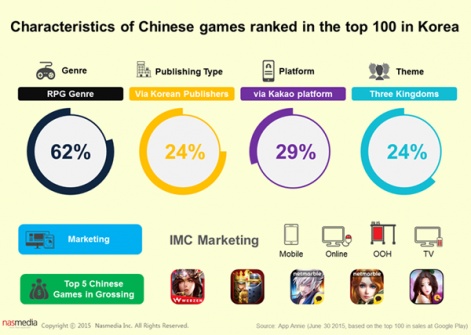

According to Korea’s media agency Nasmedia’s report Current Status of Chinese Mobile Game Publishers in Korea, the common characteristics of Chinese games ranked on Google Play’s top 100 grossing games on 30 June 2015 can be classified as follows:

The popularity of RPGs is overpowering in Korea, and it is no exception when we consider Chinese games.

62% of the Chinese titles ranked on the Korean Google Play’s top 100 grossing chart are RPG such as MU ORIGIN and OneTwo Sangokukji.

Strategy games account for 24% and action accounts for the remaining 14%.

Chinese titles account for 25% of the Korean top 50 grossing chart on Google Play.

In addition, 24% of all Chinese titles in the top 100 are Three Kingdoms games; by the far the most dominant IP. This implies that Three Kingdoms as a gaming theme appeals to Korean gamers as well as Chinese gamers.

Helping hand

24% of the Chinese games in Korea are published via a local Korean publisher. Hence when Chinese games enter the Korean market, most of them are self-published or published under big Chinese publisher names.

Dota Legend, which launched in 2014 by a Chinese publisher Gaea Mobile, is regarded as one of the most successful Chinese-published games in Korea.

Another Chinese publisher Elex Tech is also doing very well in Korea with its self-published title Clash of Kings.

Another trend: the-once industry pioneer of the Korean mobile gaming market, Kakao Game Platform is now seeing its glory fade. Only 29% of Chinese games are listed on Kakao Game Platform.

In an attempt to resurrect its presence and attract more games, Kakao is now providing an extensive amount of support for new Kakao titles in Korea, including the grand launch of Top of Tanker.

This support takes many forms including an KaKao emoji reward event, as well as financial support for the overall marketing budget.

The growth of integrated marketing

Integrated Marketing Communications (IMC) marketing is regarded as the mandatory strategy for a lot of Chinese game publishers in Korea.

Dota Legend was the first Chinese title to execute IMC marketing in Korea, followed by Top of Tanker, Taichi Panda and MU ORIGIN, which executed large scale IMC marketing campaigns, covering multiple channels such as pre-registration, mobile, online, TV and out of home marketing, etc. with great success on the charts.

Due to greatly diversified channels and increased competition among game publishers, it is of utmost importance to integrate online and offline communication for an effective campaign.

Investment strategy

Chinese game publishers are vigorously expanding their businesses in Korea.

As a method to enter the Korean market, Chinese publishers used to establish Korean branches or invest in Korean publishers.

Now, however, they have become bolder, undertaking backdoor listings or providing direct investment by acquisition.

They are also becoming increasingly proactive in their Korean business expansion endeavors such as gaming system planning, local BM development and securing global IPs.

For example, Longtu Games has acquired a Korean online education company INET-School and Locojoy acquired a wireless communication device development company ENUStech and listed on KOSDAQ.

Nasmedia is the biggest media agency in South Korea, specialized in marketing mobile games on a variety of multiple channels such as mobile, web, outdoor, internet TV, promotion, viral, etc.

Also, Nasmedia participated as an exhibitor in Chinajoy 2015 B2B, where they shared professional insights on Korean media and successful IMC campaigns, based on their own successful experiences including Supercell’s Clash of Clans, King’s Candy Crush Soda, and Gaea Mobile’s Dota Legend.