Sam Forrest is director of global communications and Content at KamaGames.

In this era of big data, it can be tricky to find that most valuable nugget of information, that one stat that tells a much bigger story.

We’ve seen these nuggets before when economists evaluate an entire country’s financial health based on the average wage, or the value of a city based on price of rent per square metre, or even the cost of living derived from the price of a cheeseburger.

When it comes to a sub-continent like India, one number that tells a much bigger story is this: How many of the locals use smartphones?

From that one figure, one can get a picture of other details, like disposable income, the cost of mobile data and even the region’s technology infrastructure.

So looking at the number of mobiles and smartphones in pockets throughout India right now, it's clear the country is rapidly becoming a massive market for mobile developers. In fact, India has over one billion mobile phone subscribers, a number they passed in 2016 and smartphone ownership is expected to exceed 530 million in 2018.

Getting granular, Indian Express also reports that: “India currently has in between 300m to 400m smartphone users. Two out of three Indian mobile users – or roughly 433m people – are planning to upgrade their phones in the next year.”

India became the fifth biggest gaming market globally in 2016 thanks to a surge in sales of low-cost but powerful smartphones.

We’ve seen this snowball effect in other regions before as smartphones become part of everyday life, from commuting to daily banking and, of course, gaming, ownership accelerates. This, unsurprisingly, is a big story for social casino developers.

Data

A region’s phone and data access are the two most important pillars for social casino (or indeed mobile) developers. What use is a population owning smartphones if data is prohibitively expensive? Thankfully (and not coincidentally), the rise of mobile and smartphone ownership in India is happening parallel to its data revolution.

As it happens, India has arguably the cheapest phone tariffs in the world. Plus there’s an ongoing data price war happening in India, driving the consumers’ cost for 4G down even further.

Wi-fi and internet access are also gathering momentum in the country. India has, after China, the highest number of internet users on the planet. “The number of internet users in India is expected to reach 450m to 465m”, claimed a recent report from the Internet and Mobile Association of India (IAMAI) and market research firm IMRB International.

The report stated overall internet penetration in India is currently around 31 per cent. That means a vast, vast market of internet users, with room for over 300 per cent growth.

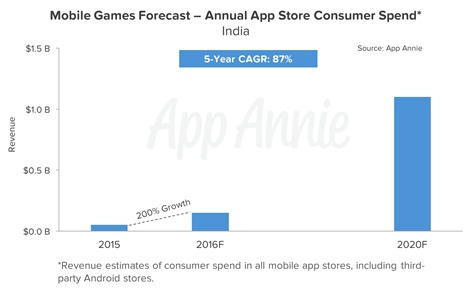

Jumping two spots up from 2015, India became the fifth biggest gaming market globally in 2016 thanks to a surge in sales of low-cost but powerful smartphones. According to mobile data firm App Annie the total games revenues in India, from local and foreign publishers, is estimated to reach as high as $1.1 billion by 2020.

Like China, India never really fulfilled its potential as a console market. But India India doesn’t need consoles (or even high-end gaming PCs) to be a thriving games market.

Between Q2 2014 and Q2 2016, game downloads in India more than doubled, with Google Play generating 13 times more downloads compared to iOS. The overall amount of time Indian users spend on mobile games grew sharply in 2016.

As you might expect, these numbers have prompted a veritable gold rush of investment in the region from mobile phone providers, data and telecom companies, and game devs. But, as many have learned the hard way, prior research and local knowledge are essential to breaking into a new market.

Bridging the gap

Conquering a new market is never without its challenges. Even a game as iconic and universally known as poker can’t just be thrown into a new region without some preparation and cultural understanding.

Simply put, Indian gamers and consumers play and spend differently from Europeans, Asians and Americans.

Simply put, Indian gamers and consumers play and spend differently from Europeans, Asians and Americans.

Firstly, and as alluded to earlier, the history and culture of gaming is completely different in the region. It hasn’t broken into mainstream acceptance there, and there’s no local, cultural history of gaming in India comparable to that in America or Japan, for instance.

Also, India doesn’t import its culture in the same way that other countries do. While Hollywood films and American, European and Japanese video games cross cultural borders and become mainstream hits beyond their own shores, those same properties don’t always connect when they’re exported to India.

That means that Indian audiences tend to prefer locally produced pop music, TV and movies. Hollywood films, for instance, can’t compete with the local popularity of Bollywood productions.

Mobile gaming is a relatively clean slate though. Accessible, affordable and not dependent on previous cultural cache, it’s not surprising to see it taking off in India.

The localisation challenge

The beauty of social casino games is their reach. KamaGames, for instance, has 400,000 daily players, and those players, whether they’re in Paris, France or Paris, Texas, are looking at the same screen when they’re playing Pokerist. This one-size approach, however, doesn’t fit all.

Experienced as we are, we felt we would benefit from a partnership in India. In collaboration with Asia publisher YooZoo Games we overhauled the look, name and game-play of our flagship title Pokerist.

Poker Champions is similar to Pokerist in its core gameplay. However, we tweaked it slightly for the Indian audience. This means faster-paced “party modes” and slightly augmented in-game mechanics to allow for a streamlined game-play experience.

The game’s look has been overhauled too, the cool blue colours of Pokerist have been replaced by plush shades of red.

Our first steps into the Indian market were taken after listening to local consumers and experts. Just like our other successful markets, we see our relationship with India as a two-way conversation.

The average time Indian consumers spend on their phones has increased by 50 per cent in 2017 and the numbers above suggest that those numbers will continue to climb. It’s a thrilling new market, if you have the time, patience and resources to take it on.