Without intelligence, market data is useless.

This caveat is particularly the case when considering data about the Chinese mobile games market, which was estimated to be worth $7.1 billion in 2015.

For example, whether or not it's true that the Chinese mobile game market is now the largest in the world - as claimed by Newzoo and TalkingData - matters less than the internal changes happening within that market.

The reason for some skepticism in the case of China's market size is the ability of anyone to track the thirdparty Android stores that account for a large chunk of revenues.

And the reason this matters less is China's population makes its status as the #1 market inevitable anyhow.

From PC to PC/mobile

As for those more important structural changes, one is the shifting balance between Chinese PC and mobile gaming revenues.

Back in 2012, Newzoo/TalkingData reckoned the split was 89/11% in favour of PC.

In 2019, they reckon the split will be a more even 52/48%.

And, more significantly, the reason for this movement is the way in which Chinese developers such as NetEase are releasing mobile versions of their successful PC games: cf Westward Journey 2 and Westward Journey Mobile.

From that point of view, the Chinese mobile markets remains much more PC-oriented than western markets.

Rise of RPGs

It's also important to note, that as with the wider Chinese economy, growth of the mobile games market is now slowing.

Partly this is due to saturation of handsets: down from 8% growth in Q4 2014 to 3% in Q4 2015.

It's something that's hit the headlines recently, thanks to the decline in iPhone sales, but more generally, the Chinese economy and mobile game market is fast maturing.

That means future revenue growth can only happen if developers learn to monetise their audiences better.

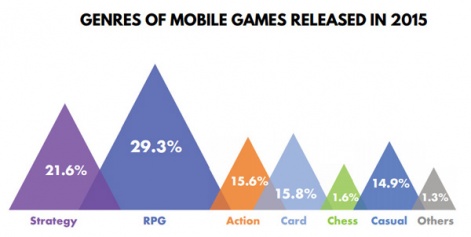

Something western developers are now grappling with, in China, this is reflected in higher production values and a concentration on high ARPU genres such as RPGs and strategy games.

Rise of fraud

Another report from Newzoo/TalkingData looks at trends in Chinese mobile advertising.

Here, what's significant is how the market is broadening with the rise in importance of non-gaming apps.

For example, Newzoo/TalkingData estimate that gaming accounted for 81% of advertising clicks in 2014. That proportion had dropped to 60% in 2015 as financial services, real estate and education apps gained importance.

While the Chinese mobile games market is maturing fast, it's clear that the advertising market remains immature.

Yet, while the Chinese mobile games market is maturing fast, it's clear that the advertising market remains immature.

For example, while the number of clicks generated by ads on iOS was up 255% in 2015, Newzoo/TalkingData reckons the app activations resulting where only up 12%.

This suggests there's a rise in incentivised marketing - where players are just clicking to get rewards - and/or high level of fraudulent clicks.

(Incidentally, on Android, clicks were up 112% with activation up 146% so this currently seems to be an iOS issue.)

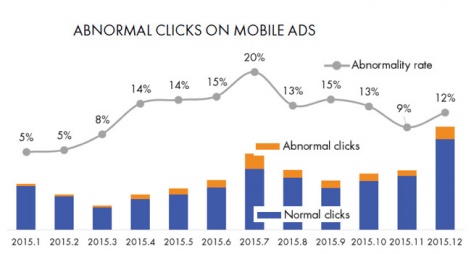

And looking deeper in this issue, Newzoo/TalkingData reckons 12% of all clicks within the Chinese mobile advertising sector are what it calls "abnormal" - something it labels "alarming".

Similarly, it reckons 11% of all activations are "abnormal".

You can download various Newzoo/TalkingData reports on China here.