Torulf Jernström is CEO of Finnish developer Tribeflame.

His blog is Pocket Philosopher.

You can read all his weekly PocketGamer.biz columns here.

After taking a good old Nordic-style (i.e. nice and long) vacation, I’m back.

This week is about selling game companies. Unfortunately, I have not sold mine for untold fortunes.

However, my friends at the next door game company sold theirs.

Let’s start off with why you would even consider selling your company.

Some people start game companies intending to keep them.

Investors usually call these companies “lifestyle businesses”. It is the sort of company where the founders get to work on the games they want, without ambitions of growing large and making fortunes.

Actually, working on the “games they want” might be a little strongly worded.

“Making the games the market wants” is unfortunately closer to the truth if the founders want to stay in business more than a few years, but you get the point.

Price is right?

For many companies, there are good reasons to consider selling, if someone offers enough money.

Companies are bought, not sold. The acquirer will be the one who initiates it all.

Basically any company with investors has to work towards selling the company. The point of investing in a startup is to tie up money for some 3-8 years, and then get it back with a nice profit (say 10x your money), so that you can re-invest it in the next startup.

For this, even a small trickle from sharing the profits will not be enough. The investors will usually want to free up all the money they put in, by selling their stake.

An external buyer will let them do that. Which is why any investment deal includes a clause stating that the aim of the company is to grow to point where it can be sold.

Derisk your life

Now let’s for a moment go back to my friends’ business. They did not have any external investors or shareholders apart from the two founders.

Why would you want to sell in such circumstances?

In short, to get some stability and lock in your gains. In case anyone missed it, the games market is very volatile, and you never know when you happen to hit a dry spell of several flops in a row.

Even for a successful company, a few years of developing games killed in soft launch will be very taxing for the company’s finances. Which means that an offer from a bigger acquirer that can provide cash for the founders, and a buffer for the company, can look very tempting.

Buying success

Now, let’s look at it from the acquirer's perspective. I have some experience doing that, as I worked for Nokia Corporate Business Development before founding my own company.

The acquirer wants some strategic benefit.

Basically, I was on the team looking for startups to buy.

For us as buyers, the question was always: “why is the startup more valuable as part of us than as an independent startup?”.

The acquirer wants some strategic benefit. Often it is about a large established company trying to play catch-up with the new trends in their industry.

For instance, EA bought Playfish in 2009 for $400 million to get into the social games boom that they were late to.

At the other end of the scale are the so-called “acqui-hires”. It’s a way for large companies of attracting talented workers by acquiring their companies as a way of hiring them.

This is quite common in boom times in booming areas where it’s otherwise hard to hire top talent. Which means that it happens in San Francisco, and hardly anywhere else.

A recent trend out of Asia, and China in particular, is companies buying revenue and profits. These companies have a lot of cash from an existing profitable business, or from investors, and want to show growing revenues in new areas.

They therefore invest their cash to be able to show growth e.g. in games business outside of China. This is usually done to look good to investors.

Time to negotiate

So much for why the parties come to the table to discuss buying and selling companies. Then the big question is “How much?”.

Answering that can be tricky, as there is not any generally accepted way of pricing startups. It comes down to how much the seller and buyer thinks it will be worth to them. In boom times, that’s going to be a whole lot more than at other times.

To get a starting point, we can look at how the company has been doing.

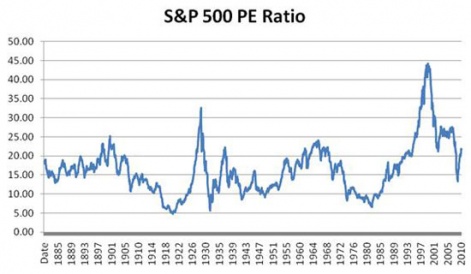

On the stock market, companies are usually compared with the Price/Earnings ratio - P/E or PE for short. You take the price of all the stock of the company (Price) and divide it by how much profit the made (Earnings).

For instance, for EA that would be some 300 million shares times $80 (price for a share) giving a total “Price” of $24 billion. This is then divided by the profit they made (1.1 billion), for a PE of slightly more than 20.

On the stock market, a rough rule of thumb is that a fair price is when the PE equals the growth percentage. Which means that investors buying EA stock estimate that EA can grow their profits by around 20% per year.

Of course, this is very rough. If a company makes a loss one year, their PE will be sky-high. Likewise in boom times.

So where has the PE been for recent game company acquisitions?

It was around 7 for the original sale of Supercell to SoftBank. When SoftBank sold to Tencent, they valued Supercell at some €9 billion, for €845 million in profits, for a PE slightly above 10.

For smaller companies, it seems similar. My friends’ company, was bought for mid-single digit millions and a high single digit PE - depending on what Price you use for calculating it.

Read the small print

Which brings us to the next part: earn-outs.

Of course, it’s not only about the money. There are other aspects to buying and selling companies.

The job of an earn-out is to get the founders to keep working as hard after the acquisition as they did before.

The biggest among them for the buyer is how to keep the team they just bought working efficiently. This can be done with carrots and sticks. The carrots come in the form of delayed payouts and earn-outs. The sticks in the form of non-compete agreements.

The job of an earn-out is to get the founders and key employees to keep working as hard after the acquisition as they did before. Therefore, part of the price they get will be dependent on them hitting some milestones in the years after the acquisition.

Some 2-3 years afterwards is typical, with targets concerning revenue, profits, downloads, daily or monthly active users or similar.

The buyer is going to push a large part of the deal towards earn-outs, as that removes risk from them. The startups earlier investors are going to push in the other direction, as they lose control of the startup, and then have a large part of their investment return dependent on something they can no longer influence in any way.

After all, the acquiring company can make changes to the team or strategy that makes it impossible to reach the earn-out targets. A few years can be a long time.

The other way of keeping key talent is simply forbidding them from leaving with non-compete clauses. Usually, that means that the key people (who got money in the deal), cannot just quit and start/join a competitor.

There is some suitable time, up to a few years, after quitting that they cannot do that, without facing significant penalties.

Sting in the tail

That’s the rough outline of how it works.

Now go out and sell your companies! Or actually… wait for someone to buy it.

That’s after all how it actually works. It’s very hard to sell a company.

Companies are bought, not sold. The acquirer will be the one who initiates it all.