This article is part of an ongoing series of data-driven articles from PocketGamer.biz and App Annie highlighting trends in the global mobile games sector using App Annie’s Game IQ analytics.

Game IQ enables mobile game developers to dig into the data and discover not only which games are performing best but what characteristics they have.

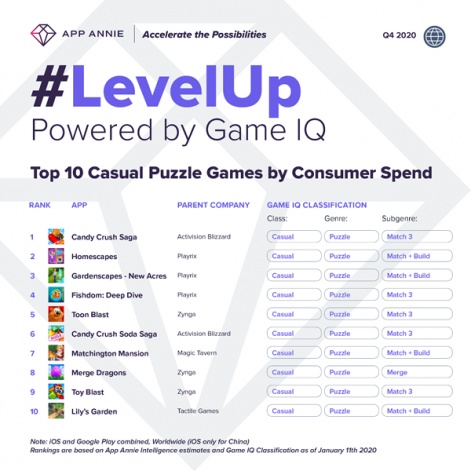

In this week’s column, we’re considering that staple of mobile gaming - casual puzzle games - which are ranked in terms of their top grossing status.

Match-3 and M&A

Of course, all of these games are a variation on match-3 gameplay and there are some very familiar names; these are some of the most beloved experiences in gaming.

But perhaps more significant to consider is the way in which commercial success in this genre has impacted the wider corporate world.

This was originally highlighted with Activision Blizzard’s $5.9 billion acquisition of Candy Crush developer King in late 2015.

It’s proven a great deal, with two Candy Crush games listed in the top 10 and the game that still defines the genre Candy Crush Saga still the top-grossing title.

Zynga’s presence on the chart is the result of more recent M&A activity.

In 2020, it spent $1.8 billion buying Peak Games and its match-3 games Toon Blast and Toy Blast. More interestingly, though, it spent $250 million in 2018 buying Gram Games and its Merge titles.

The difference between the two was Toon Blast and Toy Blast were already hit games before Zynga acquired Peak, while Merge Dragons was better described as being on the path to success.

The success of these top games lays in their comprehensive live ops plan, which provide special in-game events, keeping players engaged and driving consumer spend.

Hence, its ranking in this chart is a testament to the synergies Zynga and Gram Games have created over the past years.

Mash-up marvels

As for Playrix, its success is purely homegrown.

The Russian developer invented the match-3 + build mash-up genre and then built out the live ops and aggressive marketing required to scale Gardenscapes and its sequel Homescapes into multi-billion dollar franchises.

“Puzzle games were the most successful genre catered for Casual audiences in Q4 2020, the third in terms of market share of consumer spend after Core RPG and Core Strategy genres,” App Annie’s Director of Market Insights, Amir Ghodrati.

“These games offer simple but repetitive, mobile-friendly gameplay, and while longstanding hit titles such as Candy Crush Saga have been successful in maintaining and monetizing their audience base, we’ve seen newer titles driving growth in this segment.

“Games such as Homescapes have successfully combined familiar puzzle mechanics with deep story-driven simulation elements on top of the primary gameplay.

“Matchington Mansion combined home decoration mechanics to bring more diversity and keep players engaged. Part of the success of these top games lays in their comprehensive live ops plan - modeled after popular online RPG games services - which provide regular, themed and special in-game events, keeping players engaged and driving consumer spend.”

Game IQ is a vertically tailored analytics product, developed by App Annie, that provides insight into dimensions such as class, genre, subgenre and tags. Games can now be analyzed by broad category class (tuning), genre, subgenre, and tags (modifiers) such as IP, art style, settings, monetization mechanic, and more.

For more information register for a demo here