Created through various mergers and renamings (Macrospace, Sorrent, Superscape), the NASDAQ-quoted company (GLUU) has been focused on mobile gaming for a decade, riding the various trends - Java, movie licences, carrier focus, China expansion, smartphone - and now free-to-play gaming.

Equally importantly though those 'interesting times', as a US publicly-owned mobile gaming-only company, its financials have provided the clearest picture on how the market is developing month-on-month.

Competitors such as EA Mobile (financials obscured as part of EA corporate) or Gameloft (financials obscured by French accounting laws) don't provide the same transparency.

Indeed, in recent years, the company has taken transparency to the extreme, providing a depth of information about its operations that's almost too expansive.

That's one of the reasons for my delay in considering its most recent quarter; announced 2 November.

Apple turbulence

As I explained in my headline then, Glu's Q3 financials were hit by "a softening of market conditions".

It might seem ridiculous in the context of the 'current mobile gaming boom', but as a bellwether, the issues now experienced by Glu - an innovative, globally-operating $160 million market cap company (at time of writing) - will come to impact many others in this space.

The most obvious - because Glu highlighted it - is Apple's continuing hindrance to any incentivised consumer behaviour on iOS. Tapjoy is the company most often mentioned in this context, but such methods are used by many companies from advertisers to monetisation outlets.

Glu said Apple's efforts in this area would knock $1.75 million off its Q4 sales predictions.

Every free-to-play company operating on iOS - still the highest grossing platform per user - will be similarly impacted.

Too many?

A more worrying general issue is the rising level of competition in the various app stores, and what this flood of games means in terms of the retention of players and their level of monetisation.

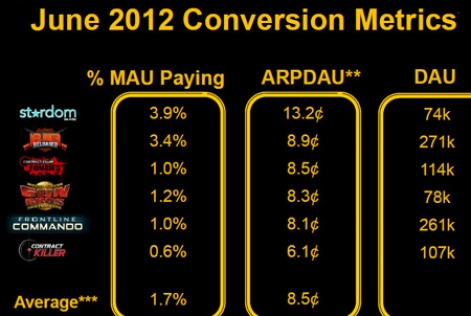

Looking at its conversion metrics for June 2012, Glu's best performing game was the female-oriented Stardom.

Average revenue per paying daily active user was 13.2c with 3.9 percent of monthly active players paying. However, the game had a relative small audience, limiting its ability to generate absolute revenue.

In contrast, the latest Deer Hunter game had three times as many active players, 3.4 percent of whom paid at a reasonable rate of 8.9c.

Three month decline

Moving onto September, Stardom's percent of active paying players was down two-thirds to 1.1 percent, while Deer Hunter had dropped further - a mere 1 percent - and its active audience had also collapsed.

Indeed, with the exception of Stardom, all of June's games had experienced a decline in audience, ARPDAU, and the percent of monthly active players paying.

On the upside, Glu could point to big audiences for newer games Blood & Glory: Legend and Eternity Warriors II.

Potentially, they could have caused some cannabalisation, but a drop of 1.7 percent to 0.7 percent in terms of average active players prepared to spend money in games isn't a good trend, especially combined with Apple clamping down on incentivisation.

Hit potential

Another warning sign for Glu - and other publishers - is how much harder it's becoming to get a hit.

Every game company is now releasing mobile games; many of them in the same young male space that Glu inhabits.

Companies such as Glu argue that taking a portfolio approach enables them to cross-promote new games to their existing audience, also collecting data on how players interacted in their games.

These factors, combined with prolonged beta testing, should ensure the hit rate for new games rises.

However, this wasn't Glu's experience, at least during the past quarter. As you can see, the proportion of the grey bar (failures) to yellow (successful games) jumped in Q3, after hitting a low of 25 percent in Q2.

More and more

All these issues combined pose a structure problem for the industry, particularly as many companies - including Glu - continue to look to increases the volume of releases to increase sales.

Just look at the likes of GREE, DeNA, Gameloft, TinyCo, Gamevil and Com2uS, who are all increasing their release rates.

Of course, with everyone releasing more games, the competition gets more intense and the situation becomes worse.

Then, the only option is to spend more on developing higher quality games and/or buying high profile licences and/or spending more on advertising.

Of course, some companies will argue that these issues are specific to Glu and that they - through whatever means - can do better.

Personally, I think that's unlikely for the vast majority.

Stuck to you?

As for Glu's future, it's got enough cash to see it through 2013, and it's already started to trim its operating costs.

Meanwhile, its head of studios is considering the company's portfolio of new releases that will focus on the highly lucrative PVP genre, and includes a sequel to one of the company's most successful games Gun Bros.

Certainly, after the hope offered by what's always been the key holiday season for mobile games, next quarter's financials - covering October to December - will be fascinating to unpick.

This article should not be taken as investment advice and I have no financial positions in any of the companies mentioned.