If Zynga’s Q2 FY17 financial report was a student term card, its teacher would be struggling to find areas to ask for improvement.

For the 10th successive quarter it beat earnings guidance, posting GAAP revenues of $209 million.

That’s up 8% quarter-on-quarter and 12% year-on-year, and the highest total since mid-2013.

More headline-grabbing still, Zynga posted its first GAAP profit - $5.1 million - since Q3 2015 and in that case, the company was only profitable due to a tax rebate.

Cashflow from operations was at its highest point ever too.

No wonder CEO Frank Gibeau is swinging from the chandeliers…

He’s not, of course.

“When you’re in a turnaround, never declare victory too early”, he sagely states.

“We have a lot more to do.”

Three pillars of success

There are three underlying reasons for Zynga’s turnaround, which broadly - but not entirely - started when Gibeau became CEO in March 2016.

The first is the company’s transformation from a web and mobile game company to one that’s now 90% mobile in terms of its daily active players.

Zynga posted its first GAAP profit - $5.1 million - since Q3 2015.

This has changed some aspects of Zynga’s structure, with much of its web operations - and some legacy mobile games - now handled by its office in Bangalore, India for example.

In turn, this has enabled its Western studios in San Diego; Eugene, Oregon; London; Helsinki; and its San Francisco headquarters to focus on high margin activities.

This has been reinforced by strong investment in live operations, what Gibeau calls ‘bold beats’.

It’s this that’s seen Zynga Poker reinvigorated with its mobile revenue up 61% year-on-year thanks to events such as the recent Weekly Playoff Tournaments for high level players.

Similarly, Zynga’s social slot games hit record monetisation performance in Q2, thanks mainly to the addition of tournaments in Wizard of Oz Slots.

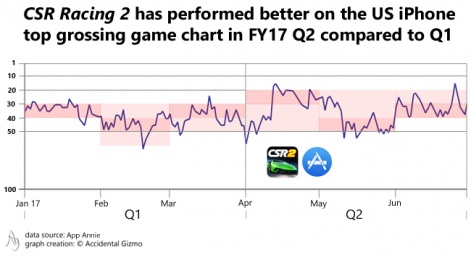

But Zynga’s single strongest game remains CSR Racing 2. Released over a year ago now, it remains the number one top grossing racing game on the App Store and during Q2 peaked within the US iPhone top 20 grossing chart.

“CSR 2 was our hero product, Gibeau agrees.

“We had a strong response from our events with Lamborghini and we look forward to future events such as those we’re working on with Ferrari around its 70th anniversary.”

Sweating the assets

The third pillar of Zynga’s turnaround is more prosaic but no less important for that.

Under Gibeau and new CFO Gerard Griffin, Zynga has been stamping down on its costs and improving its operational efficiency.

One reason for its Q2 GAAP profitability is stock-based compensation was at its lowest for three years. Similarly, the news Zynga was canning Mafia Wars in soft launch is something Gibeau points to in terms of the company having the confidence to invest in the best places for future returns.

Work on new games is well underway for 2018.Frank Gibeau

Another example of this ‘sweating the assets’ was the announcement that starting in March 2018, Airbnb is taking out a nine-year lease at Zynga’s San Francisco office.

What’s next?

Yet, as Gibeau points out, the company’s financial turnaround is only part of the task. Zynga’s wider reputation has been hit both by its disastrous 2011 IPO and weak management for long periods of time thereafter.

Even financially, improving the performance of existing games will only take the company so far.

“2017 is about continuing to perform, but work on new games is well underway for 2018,” Gibeau reveals.

Zynga’s Finnish studio is working on a new game in the publisher's ‘Invest Express’ category, while NaturalMotion’s London studio also has a new project underway.

In fact the only challenge our hypothetical teacher could throw Zynga’s way would be the performance of its advertising revenue.

Derived primarily from its Words With Friends game, advertising revenue was up compared to Q1. But even with the uplift provided by the $42.5 million acquisition of Solitaire games developer Harpan LLC in March 2017, advertising revenue was down year-on-year.

Zynga’s announcement of deeper integration with Unity’s rewarded video ad platform should go some way to improve this situation, although it still expects 2017 to be a soft year in terms of advertising revenue.

Disclosure: The author has shares in Zynga.