Michele Zucca works in Sales and Business Development at Rebound Mobile.

This article was originally published on Rebound Mobile.

Is the South Korean mobile market becoming more and more RPG dependant when it comes to genre and mobile games?

We know in South Korea it’s all about RPGs: the country currently ranks in fourth place by total game revenue with an estimated $4.2 billion in 2017 compared to $4 billion in 2016, according to Newzoo.

In recent years, the South Korean gaming market has been re-centred around mobile. While the mobile market has a high ARPU, it seems that the overall market is not very diversified.

The mobile RPG space is the genre which has been rapidly growing, with many developers investing massively into MMORPGs. But the Korean market, according to journalist Won Hee Lee, is in strong need of game diversification.

If we take a look at the Top 10 Grossing, we can highlight, together with the evidence of the dominant local developers, that RPG as the main genre:

Five out of ten titles are RPGs. This can be said to be also quite unlikely for a Korean top 10, as usually eight or even nine out of ten being RPGs is the norm.

This does not change when researching the top 100 Games for iOS and Android, and taking a look at the most popular genre, RPGs are still the most played. Unsurprisingly, Lineage 2 Revolution is the top grossing for both Android and iOS.

The game had generated more than $176.6 million USD in only one month following its release. Since then, developer Netmarble has successfully debuted on the country’s main bourse KOSPI initially above its IPO price.

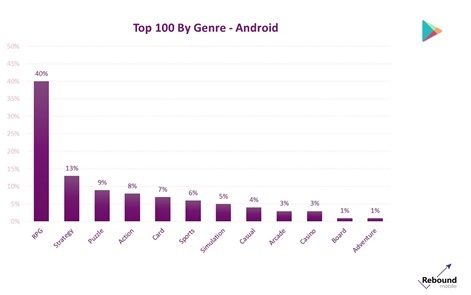

When looking at the Top 100 for Android (Google Play is dominant in the country, with Android having conquered 90% of the market, according to blogger Jini Maxin), we can see that most of the games all cover the RPG genre, representing 40% of the overall top 100, with strategy games falling second with 13%:

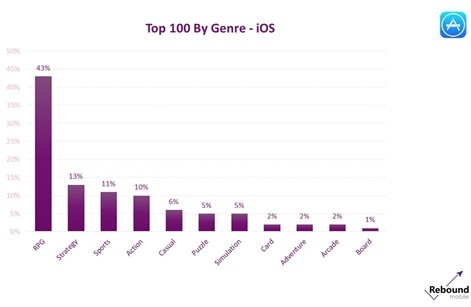

The situation does not change much if we look at iOS. RPGs represent 43% of the overall top 100, with strategy games far below at second place with 13%:

The situation at the moment, according to Won Hee Lee, is that companies are forced to use RPG elements (and especially MMORPGs) when developing and publishing games in South Korea.

There are several variants of RPGs, therefore a game genre, when titled simply as “Card”, can be deceptive, as some games like Yu-Gi-Oh! Duel Links can be defined more as RPG-Card than Card-casual.

We can find authentic MMORPGs (like Lineage 2 Revolution), casual RPGs, turn-based RPGs, and card-collecting RPGs.

Even casual and card-based games have elements related to RPGs, consultant Josh Burns reports. The RPG element is massively in the mind of Koran players, and games with RPG elements are key to succeed in the country.

Each game emphasises differentiation with different modifiers, but eventually the RPG factor is at the core of the game, and this is becoming more and more intense in the country, especially with highly competitive companies like Netmarble, NCSoft, Com2Us and Nexon taking the biggest shares of the markets among any genre.

Small and medium-sized developers have to invest on the same genre to get a share of the market. However, can they deliver the same quality as the industry giants with (much) less resources?

When we look at foreign games, these are mostly strategy, action or casual-based. Clash Royale has been hugely popular in the country, but then, where has Supercell's latest hit not been popular?

After all, the Finnish developer has invested a large amount of its money to break into the country with Clash of Clans (Josh Burns says about $20 million in AppLovin) in the past. It is also said to have spent a long time conducting extensive research with their marketing department, together with building a strong brand.

Some analysts and bloggers, like Jini Maxin, have stated repeatedly: “that’s not to say you shouldn’t try developing a non-RPG. [But] non-RPGs need to be backed up by a strong IP".

For foreign developers, a strong IP is everything when succeeding in the Korean market: you can make casual, but can you do it as successfully as Playrix does? You can do sports, but can you do it like Nexon or Netmarble?

Genres other than new 'RPG Mobile' products are often lost among the numerous titles in the App Store or Google Play store, swallowed by the highly competitive market and are forgotten.

FPS (First-person shooter) and AOS (most commonly known as MOBA - Multiplayer Online Battle Arena) genres, while taking a high share of the PC audience in South Korea, have not been very successful on mobile in the country.

Many developers have been releasing non-RPG genre mobile games with high ambition, but it’s no exaggeration to say that the revenues have certainly not been memorable.

Even Netmarble, when trying out an FPS with Final Shot, has not seen memorable results in terms of downloads and revenue since the game was launched in 2016, as we have noticed from analysing public data sources.

The 2017 releases from Netmarble are again, mostly RPG games with strong IP, like King of Fighters or Blade and Soul.

However, some non-RPG games, like Penta Storm have attracted a small number of industry stakeholders and gamers, according to Won Hee Lee. Penta Storm is a MOBA and has been recognised for its great gameplay.

Developed by an internal Tencent game studio, it has been released in English under the name Strike of Kings - both of which are based on China's Honor of Kings. It has all the basic features of the MOBA genre with great optimisation for mobile devices.

The initial response was not too bad for the game genre in the country, according to Lee and other public data sources. If the number of users increases for this genre after full launch, we could expect a successful market entry for these non-RPGs.

Netmarble’s New Release Penta Storm Shares Similarities with Chinese League of Legends (Image Credit: Netmarble)

The success of these type of games from local developers could hopefully give a push to non-RPG genres in the country, providing they they can sit stably in the market. This would be a positive sign in terms of game genre diversification of the South Korean mobile games market.

If only RPGs from Netmarble, Com2Us or Nexon continue to dominate, it's possible that other genres are more likely to disappear, and developers from both Korea and other countries will all need to adapt to this standardisation process towards RPGs, even for casual, card and puzzle titles.

It’s hard to find a new experience even in the major genres because RPGs totally dominate. With this structure, it is difficult to provide users with new genres or gameplay types that have not already been done.

So is the Korean market in the need of revolutionary, new products from local developers? According to Lee, without a change, the Korean game market is more likely to shrink.

Yet, with RPGs deeply ingrained in the mind of Korean players, how can developers disrupt this inner, unchanging user’s buying behaviour?

Sources:

Newzoo, 2016, Global Games Market Report, Newzoo Games

Won Hee Lee for Daily Game

Jini Maxin for Linkedin

Josh Burns for AppLovin

MMO Culture on Penta Storm – Quick Look at First Mobile MOBA Under Netmarble