This report is by Daniel Ahmad, analyst for Niko Partners, in conjunction with Sensor Tower.

Mobile games is the fastest growing segment in China and is projected to overtake PC Online games in 2018.

2017 was a huge year for mobile games in China that saw more than 550 million gamers generate over $10.5 billion in domestic revenue.

In August last year I wrote an article that looked at the top mobile games in the first half of 2017, this article will focus on the games driving growth in the second half of 2017 using Sensor Tower’s China data as the basis.

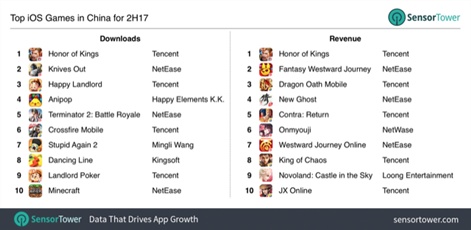

During the second half of 2017, a number of trends were in play. The big news is that Tencent continued to dominate the top grossing chart due to hit games such as Honor of Kings, but NetEase was not far behind.

Battle royale games began to chart in the download rankings and are set to make an even bigger impact in 2018. PC-to-mobile game adaptations are growing ever more important and social casino titles continue to remain popular.

Tencent and NetEase dominate the grossing charts

Tencent was the number one mobile games publisher on iOS in China during the second half of 2017, based on revenue. Tencent had five games in the iOS top 10 grossing chart for H2 2017. The company saw strong growth from existing titles such as Honor of Kings as well as new titles in the action, strategy and simulation genres.

NetEase was the number two mobile games publisher on iOS in China during the second half of 2017, based on revenue. The company had four games in the iOS top 10 grossing chart and three games in the iOS top 10 downloads chart for H2 2017.

The continued success of Fantasy Westward Journey and Onmyoji, paired with the launch of Minecraft and games in the battle royale genre allowed NetEase to have a successful 2017.

Honor of Kings remains the number one game

Tencent’s Honor of Kings took the number one spot on the iOS grossing chart for H2 2017, unchanged for the first half of the year.

The 5v5 MOBA game continues to be China’s most popular game and shows no signs of slowing down, even with the introduction of restrictions on minors' play time. The King Pro League In 2017 was bigger than the prior year and over 10,000 tickets for the esports tournament final sold out in a matter of seconds.

Battle royale is a trend to watch

The battle royale genre exploded in popularity this year due to the launch of Playerunknown’s Battlegrounds which has sold over 30 million units worldwide, with 10 million coming from China alone. The popularity of the PC game has inspired Chinese developers to work on their own versions of the game for launch on PC and mobile devices.

NetEase was one of the first publishers to bring its battle royale games to market. In the second half of 2017, the company launched a battle royale mode in a licensed Terminator 2 game as well as a standalone battle royale title called Knives Out.

Both games have been extremely popular around the world. In China, the games ranked in the iOS top 10 download chart for the second half of 2017.

Tencent also launched a battle royale mode for Crossfire Mobile as well as a standalone game called Glorious Mission. Both games performed well with Crossfire Mobile charting at number six on the iOS download chart for the second half of 2017.

PC-to-mobile hame adaptations continue to grow in importance

One trend that we continue to see is the success of PC-to-mobile game adaptations in China. This is when hardcore PC games are remade and adapted for mobile devices.

Half of the games in the top 10 iOS grossing chart for H2 2017 were PC-to-mobile game adaptations.

The use of existing PC game IP has several key advantages for building mobile titles. The first advantage is that they are based on well-known IP that have an already established userbase on PC. The second advantage is that PC-to-mobile game adaptations tend to boost the lifespan of both the PC and mobile versions.

Perhaps the most popular example of a successful PC-to-mobile game is Fantasy Westward Journey. An MMORPG developed by NetEase, the game first launched in 2004 for PC. The mobile version was the second highest grossing game on the iOS grossing charts for the second half of 2017.

Other popular PC-to-mobile game adaptations that charted in the iOS top 10 revenue rank for H2 2017 include Dragon Oath Mobile, New Ghost, Westward Journey Online and JX Online.

New IP brings life to the market

Whilst PC-to-mobile game adaptations are becoming increasingly popular, it’s important not to forget that new IP is the lifeblood of a market.

Onmyoji from NetEase continued to perform well during the second half of 2017 despite heavy competition. The turn-based RPG with card battle elements ranked at number six on the iOS top grossing games chart for H2 2017.

Another new IP that performed well during the second half of 2017 in China was Tencent’s King of Chaos which ranked at eighth on the iOS top grossing games chart.

King of Chaos is a strategy simulation game, similar to Clash of Kings or Clash Royale, and is set in the Three Kingdoms period of legend. The title was developed by the same studio that released Honor of Kings and is Tencent’s attempt to dominate the competitive strategy games market.

Casual and casino games drive download chart

Casual and casino games continue to remain popular in China. Happy Element’s Anipop continued to rank on the top download chart whilst new casual games such as Dancing Line, Stupid Again 2 and Minecraft entered the charts for the first time during the second half of 2017.

The free-to-play version of Minecraft was published by NetEase and accumulated over 20 million users in its first month.

Happy Landlord and Happy Mahjong, both published by Tencent, once again claimed spots in the top 10 download chart. Social casino titles are very popular in China, but converting winnings to RMB is prohibited.

Outlook to 2018 and beyond

We expect 2018 to be another year of growth for China’s mobile games market and long-term prospects for the market look great.

We expect China to have nearly 700 million mobile gamers and a domestic market size of $14.4 billion by 2021.

Watch this column for information on mobile games in China throughout 2018.