This report is by Daniel Ahmad, Analyst, Niko Partners in conjunction with Sensor Tower.

The largest games market in the Greater Southeast Asia region, Taiwan is very different from mainland China and the rest of Southeast Asia in terms of gamer behaviour, local game development, and the types of games in demand.

However, one similarity is the popularity of mobile games. Mobile games comprise 53% of total games revenue and are projected to rise to 60%, with more than half of Taiwan’s population playing mobile games by 2021. (You can find more topline data from our recent report on Taiwan here).

Below, we take a look at some of the most popular mobile games in Taiwan to shed light on some recent trends and the differences in the popular titles compared to other parts of Asia.

Overall Trends

We took a look at July 2017’s rankings to provide a snapshot of trends in the Taiwan market. The launch of Lineage II: Revolution grew the total mobile games market significantly, grossing nearly 3x more than any other game during the month.

Arena of Valor continued to rank in the Top 10 grossing and download chart, even 1 year after launch. The MOBA genre and mobile esports scene continues to grow thanks to this game.

Another trend that continues to gain steam is PC to mobile game adaptations. These games grow the overall audience for a game series and usually have higher engagement and spending.

Finally, we provide an insight into other popular genres in Taiwan.

Netmarble finds success with Lineage II: Revolution

One of the biggest mobile game launches this year is Netmarble’s MMORPG title, Lineage II: Revolution. The Lineage franchise first launched in 1998 on PC in South Korea. Since then, the popularity of the series has grown across Greater Southeast Asia, and the recent mobile game shows that the series is more popular than ever. This was demonstrated during the Korean launch when the game grossed over $176 million in its first month.

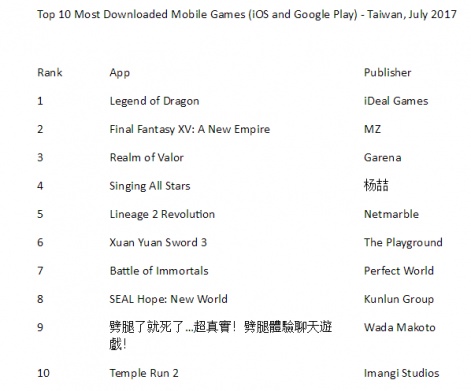

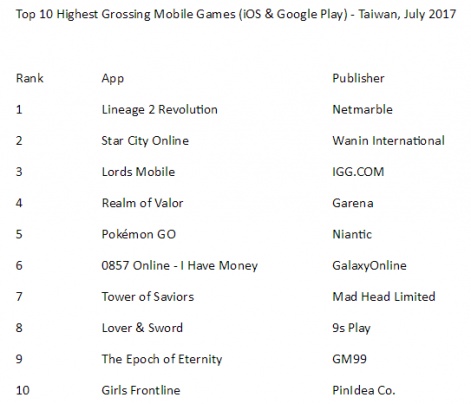

The game launched in the middle of June in Taiwan and instantly shot up to the top of the grossing and download charts. In July the game ranked #1 across iOS and Google Play by revenue and #5 by downloads. The game still remains in the top grossing charts as of the end of September.

RPG games have already been popular in Taiwan but Lineage II: Revolution takes things to the next level by providing a high quality PC-like experience on mobile for hardcore gamers.

Tencent and Garena succeed with MOBA genre

One of the big successes of the past year is Arena of Valor from Tencent Games, co-developed by Garena. The 5v5 MOBA, known as Honor of Kings in China, is published by Garena in the Greater Southeast Asia region. The game launched in October 2016 and since then has been a mainstay among the top 10 download and revenue chart. In July 2017, the game ranked #3 for downloads and #4 for revenue.

Garena has a strong presence in the region and has been able to successfully localise and promote the game in Taiwan. The company has continued to grow its presence in Greater Southeast Asia and was one of the publishers by revenue on iOS and Android during July 2017.

RPG games have been traditionally strong in Taiwan due to their popularity on PC. However, the launch of Arena of Valor and other MOBA games has shown that non-MMORPG titles are continuing to grow in importance. Games in this genre have also grown the mobile esports scene.

PC to Mobile Game adaptations enter the charts

A selection of new games entered the download charts in July: X-Game, Battle of the Immortals, and Seal Hope: New World.

Another notable title is Legend of Dragon, a Tencent game that is licensed and published by iDeal Games. The game is an MMORPG game that is based on the Three Kingdoms period of history. The game originally started off as a PC game, but a mobile version was released to reach a new audience. Games based on history tend to do well in China as these stories are usually familiar to gamers in Taiwan.

Battle of the Immortals is an RPG game developed by Perfect World and published by IW Play in Taiwan. The mobile game is adapted from a PC game of the same name that launched in 2009. The new game has crossover content with the new ‘The Mummy’ movie which has increased interest of the game.

Seal Hope: New World is a mobile adaptation of Seal Online, a popular MMORPG that launched In South Korea back in 2003. This continues a trend of traditional PC MMORPGs launching on mobile and finding success. The game is published by Kunlun in Taiwan.

RPG games dominate the charts

RPG continues to be the most popular mobile genre in Taiwan this year. There are five RPG games in the top 10 download list and four RPG games in the top revenue list. RPG’s have traditionally been popular in Taiwan on PC and the desire for hardcore RPG games has been growing on mobile too.

Games such as Lineage II: Revolution, Legend of Dragon, Lover & Sword, and Seal Hope New World are just some of the popular RPG games on mobile In Taiwan. The focus on hardcore titles in the RPG genre, coupled with the introduction of new games in the MOBA, strategy and shooter categories, has led to an increase in total revenue.

Social Casino games remain popular

Social casino games are an important mobile game genre in Taiwan with a good few games making It into the top 20 download and grossing chart on a regular basis.

Wanin, Galaxy, Gamesofa, and IGS are the key social casino game publishers, with most casino games published by domestic companies and a few others coming from Korea, US, or mainland China developers.

Other Trends

Local Taiwanese companies have struggled to find success with internally developed games in the mobile market. The most successful games published by Taiwanese companies are usually licensed from an overseas developer.

Chinese developers in particular have found success in Taiwan. We note that more than 5 of the top grossing games so far this year were developed by Chinese companies.

Methodology:

Each month Niko Partners provides analysis in this column on trends in mobile gaming in Asia based on data provided by Sensor Tower on monthly rankings of game apps by downloads and revenue. The country is selected by Niko Partners, out of the list of eight countries we track regularly: China, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Taiwan (Chinese Taipei), and Vietnam. Sensor Tower’s mobile data analytics provides information on iOS and Android mobile apps in all countries except China, where they currently cover iOS only.