Wes McCabe is Product Marketing Manager at SensorTower.

With a community of more than 400 million users, Instagram enables advertisers to reach an absolutely monumental mobile audience.

Major brands like Levi's, Taco Bell, and PayPal have been using the Instagram Ad Network for the past couple of years.

But only recently did the photo-sharing giant open the platform to all advertisers, large and small.

To "kick the tires" on Sensor Tower's new Ad Intelligence platform, we decided to take a look at some of the early adopters of the network since its official worldwide launch last month. Specifically, we wanted to know who these publishers are and the ways they're spending.

Here's what we found when studying Instagram ad data gathered during the month of October.

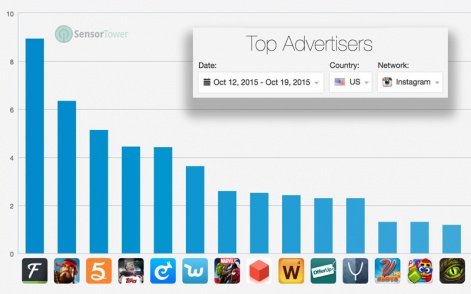

FanDuel Accounts for Nearly 1 in 10 Ads on Instagram

Leading the pack, FanDuel has been at the top of the charts for the past three weeks as the top advertiser on Instagram with a nearly 10 percent Share of Voice (SOV) - i.e., roughly 1 in 10 ads on the network is for FanDuel.

This should really come as no surprise, as the NFL season kicked off during this period and anyone watching on Sundays has seen plenty of FanDuel ads.

Its rival, DraftKings, appears to have taken a different approach to advertising on Instagram, as it represented only 1 in 200 ads during this same period.

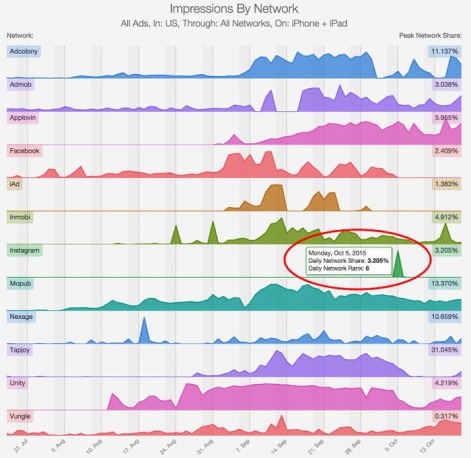

DraftKings tested Instagram early, but must not have seen a compelling ROI in its campaigns because it paused spending after only two days (see chart above).

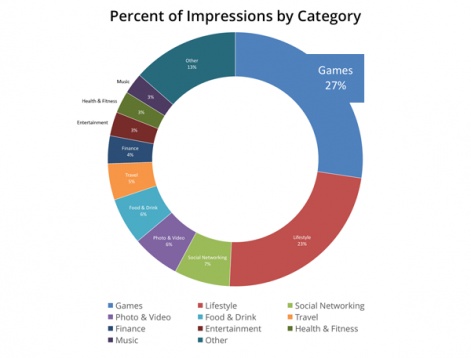

Game Publishers are Early Adopters

Game publishers represented 27 percent of all ads on Instagram in October, with Lifestyle coming in a close second at 23 percent.

We'll have to wait and see if a lot of these game publishers stick around, or if they're simply testing the waters with early campaigns.

For instance, we found that some larger publishers, such as Machine Zone and Scopely, used Instagram as a testing bed but then quickly paused their campaigns.

Issues in Ad Delivery: Sending Android Ads to iOS Devices

This one may come as a surprise, but we found that some of the ads served by Instagram directed users to the wrong app store.

For instance, a portion of iPhone users were served an ad that redirected to the Google Play store. It should be noted that this isn't affecting a large number of advertisers and represented a very small percentage of the total impressions we measured (less than 0.01 percent).

This delivery issue could stem from some users owning multiple devices (iOS and Android), and Instagram might simply be sending the ad to the device type that was active upon registration.

Machine Zone and Scopely used Instagram as a testing bed but then quickly paused their campaigns.

Regardless of the root cause, there are clearly some ad delivery issues at this stage. We haven't seen this error in ad delivery on Facebook or any of the other ad networks we measure.

Adoption is Growing, but Instagram is No Facebook or Google (Yet)

Early adopters of ad networks can benefit from the lack of competition; their bidding tactics can earn them significantly more impressions and share of voice over a specific audience in these developing environments.

In fact, earlier this year, we saw some early adopters of Tumblr's advertising network achieve a 50 percent SOV.

With Instagram, we've found that the number of advertisers has been growing week-over-week since we started measuring Instagram in our Ad Intelligence platform.

Despite this, it's still much smaller than the big mobile ad networks. Case in point: As of October 27, the number of advertisers on Facebook was four times larger than Instagram, while Google had seven times the number of mobile advertisers utilizing AdMob, AdWords, and DoubleClick.

This said, the future looks bright for Instagram's ad business, with lifestyle and social networking brands positioned as strong candidates to catch up to game publishers on the network in 2016.

Interested in learning more about how Ad Intelligence can revolutionize your app marketing initiatives?

Schedule an Ad Intelligence demo with our team, and we'll show you how!