In some ways, the news that Tencent has bought out SoftBank's stake in Supercell is entirely functional.

One large Asian company has bought an asset from another.

Sure, there's some interest in how the value of that asset has changed in a couple of years.

But, if you read the explanation from Supercell CEO Ilkka Paananen about the deal in one way, it's just another case of business-as-usual.

"We have agreed with Tencent that Supercell will continue to be operationally independent, exactly as it was under SoftBank's ownership," he writes.

"Our headquarters will stay in Helsinki and we will pay our taxes in Finland. All of this is very important for us."

Where it all went wrong

Of course, given it values Supercell - a company of 190 people - at $10.2 billion, the deal is anything but entirely functional.

For another, it's clearly not a deal Supercell instigated.

The trigger was SoftBank's calamitous decision to invest $21.6 billion in loss-making US mobile carrier Sprint in 2013.

Its continued troubles, combined with SoftBank's debt pile of over $110 billion, resulted in the company deciding to sell off its best assets, including its $10 billion stake in Alibaba and Supercell.

Our headquarters will stay in Helsinki and we will pay our taxes in Finland.Ilkka Paananen

In that context - and despite much previous talk about a business plan stretching over hundreds of years - SoftBank felt it had to sacrifice Supercell's success.

Playing the field

Not that Supercell CEO Ilkka Paananen is critical.

For one thing, it seems likely that Supercell had some sort of veto over any resale.

As Paananen explains:

"A while back, Masa (the founder of SoftBank, and our Chairman) told me that if we were able to find a new partner, he would like to sell SoftBank's shares in Supercell to finance what he called SoftBank's 2.0 transformation strategy.

"This meant we at Supercell needed to think hard and do some soul-searching. What is it really that we want to accomplish with Supercell?"

He also adds:

"As we started to spend more time getting to know potential strategic partners, it became apparent to us that a partnership with Tencent would secure everything that has made Supercell a success, while also enabling us to take a few pretty big leaps..."

We can all agree it's a very good deal for SoftBank.

In this context, then, the argument is this wasn't a deal that Supercell wanted, but that the outcome is advantageous for it.

Who are the winners?

Looking at it in another way - winner and losers - we can all agree it's a very good deal for SoftBank, which gains $7.3 billion with which to reduce its debt pile.

And assuming that - at worst - it's business-as-usual, the deal is at least neutral for Supercell.

The other big winners are Supercell's other shareholders.

In general, these are Supercell employees. As their options vest, they can sell their shares to Tencent at the new $10.2 billion pricepoint.

No doubt, they are very happy, and over time, some will decide to leave Supercell and/or fund the next generation of Finnish startups.

After all, the remaining 16% of shares not owned by Tencent are now valued at $1.6 billion

Incidentally, another winner in this context is the Me. Foundation, a charitable organisation set up by three Supercell executives including Paananen which has sold its shares to Tencent for $225 million (€200 million).

Tencent's POV

The deal isn't necessarily win-win-win, though.

Perhaps, the biggest question to ask is how does Tencent also win?

The deal crowns Tencent's longterm ambitions in the global games market.

Even for a company with a market capitalisation of $210 billion, spending $8.6 billion isn't an everyday occurrence.

And looking at the deal in traditional financial terms, it's hard to see how Tencent will make its money back.

Thanks to Clash Royale, Supercell is at the peak of its earning power, so even taking into account the opportunity to expand further in China and the likely success of future releases or eSports expansion, it's hard to see Supercell increasing profits as it has over the past couple of years.

But maybe spending $8.6 billion doesn't have to be justified on a financial basis.

For one thing, the deal crowns Tencent's longterm ambitions in the global games market; something that also plays well in terms of a broader Chinese socio-economic and political desire to been seen as first-among-equals.

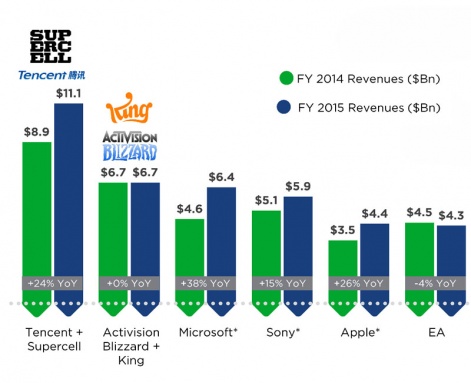

Indeed, the combined sales of Tencent and Supercell accounted for 12% of global games revenue in 2015, and that proportion could rise to 13% in 2016.

That makes it almost 100% larger than Activision Blizzard King, the world's #2 (and a company in which Tencent also has an investment).

On that basis, then, Tencent could also be seen to be a winner, even if not in financial terms.

Flipsides

Life is rarely all flowers and no tears, however, and it's clear the deal also has some potential downsides.

Although Tencent has a good track record with its western investments, as Supercell found with SoftBank, things can change.

In some senses, the likelihood of this is lessened in the case of Tencent given the individual power of its CEO Ma Huateng. On the other hand, powerful and rich people in China are anything but immune from changes in political fortune.

And the Chinese government has recently made a couple of negative structural moves when it comes to mobile games.

Equally, even the largest companies experience downturns in business. Whether that's down to their own actions or wider global economic travails, having large amounts of debt isn't good. Tencent currently generates a lot of cash, however, so it's hard to see it getting into SoftBank's situation.

The biggest issue would appear to be its impact on Supercell's staff.

Indeed, referring back to Paananen's original argument about "getting to know potential strategic partners", Tencent is one of the few companies with the scale not to see a $8.6 billion deal as being financially-lead; a pre-requisite to Supercell keeping its much-vaunted operational control.

For this reason, then, the biggest issue the deal creates would appear to be an internal, not an external one: its impact on Supercell's staff.

They're all shareholders and now they have the ability to sell their shares at a much higher price than previously.

Granted Supercell may be the most enjoyable place to work in the world, at some stage over the coming months and years the option not to work or work on new projects - maybe projects nothing to do with games: Finland has a wide startup scene - will now be harder to resist.

In that context, it's not about the money itself, it's about the opportunities it brings to a highly skilled and motivated workforce.

And despite given his protestations that he's (or wants to be) the "world's least powerful CEO," this situation is even moreso for Paananen himself.

As the linchpin of the world's most expensive game company acquisition, his attitude and the way in which he juggles his own increasingly varied workload - both inside and outside Supercell - will be viewed as a wider exemplar.

Ironically, he's never been more powerful.