Nintendo is about to make its biggest jump onto mobile yet with the release of Super Mario Run across the globe on December 15th.

Expectations are high and the free-to-start game will inevitably blow away the competition and set new records. Much like Niantic’s Pokemon GO did earlier this year.

Expect a wave of new people playing games in the mobile space, and more people purchasing the full game for $9.99 after its free-to-start period than ever before.

It’s quite the coup for Apple, which has bagged one of the biggest platform-exclusives ever. An Android version isn’t expected until next year.

Big forecasts

Super Mario Run already racked up some 20 million pre-registrations by October 2016, just a month after it was announced. It’s a number that’s likely significantly higher now.

Intelligence firm Sensor Tower is so bullish about the game that it predicts the auto-runner will earn more than $71 million in revenue worldwide during its first month. This would require over seven million people to pay for the game in just 30 days.

It also claimed that downloads in the first month will total 50 million, which it says is 56% higher than Pokemon GO’s estimated 32 million downloads on iOS during its first month.

Officially, Pokemon GO went on to surpass 500 million downloads across all devices by September 2016, just two months after its launch in July.

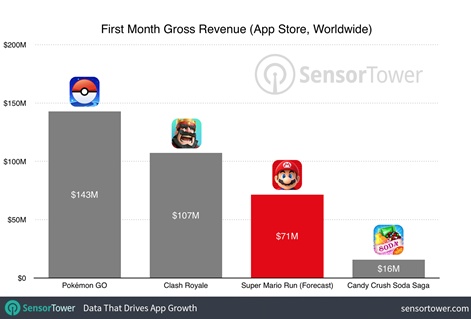

To put its forecast into perspective, Sensor Tower compared Super Mario Run to other big mobile performers.

It claims that Pokemon GO generated $143 million in its first month, Supercell’s Clash Royale made $107 million (Newzoo puts this at closer to $80 million) and that King’s Candy Crush Soda Saga brought in $16 million in 30 days.

Sensor Tower notes however that converting a vast number of players into paying users is a difficult task, and there are fewer paid apps than ever on the App Store.

Coin collector

But that’s no reason to discount Super Mario Run from hitting $71 million from over seven million paying users.

Below, we’ve compiled a list of how games starring Mario have sold on the Wii, Wii U, 3DS and DS, as well as total hardware sales to date.

Wii (102 million)

- Super Mario Bros Wii – 29.90 million

- Mario Kart Wii – 36.83 million

- Super Smash Bros Brawl Wii - 13.15 million

- Super Mario Galaxy - 12.72 million

- Super Mario Galaxy 2 – 6.72 million

Wii U (13 million)

- Super Mario Maker – 3.73 million

- New Super Mario Bros U – 5.45 million

- Super Mario 3D World – 5.19 million

Nintendo DS (154 million):

- New Super Mario Bros – 30.8 million

- Mario Kart DS – 23.6 million

- Super Mario 64 DS – 11.06 million

For comparison, 2DS Pokemon game sales were:

- Pokemon Black & White - 15.62 million

- Pokemon Diamond & Pearl - 17.64 million

- Pokemon Heart Gold & Soul Silver - 12.72 million

3DS (61.5 million):

- Super Mario 3D Land 3DS – 10.98 million

- Mario Kart 7 3DS – 13.94 million

- New Super Mario Bros 2 – 10.6 million

- Super Smash Bros 3DS – 8.35 million

- Luigi’s Mansion: Dark Moon – 5.03 million

For comparison, 3DS Pokemon games sales were:

- Pokemon X & Y - 15.64 million

- Pokemon Omega Ruby & Alpha Sapphire - 13.18 million

Console is a whole different market of course, but the numbers show strong love for Mario across every single game release. Even on the Wii U, where hardware sales were relatively small, Mario continued to be a big seller on Nintendo’s own platforms, at a far larger price and for a smaller audience (though these platform owners are invested in Nintendo's products).

These are lifetime sales - but given the vast available number of potential players on iOS, 50 million in a month downloading the game for free is not unfeasible, particularly given Pokemon's success.

A history of premium and big IP

Comparing it to paid mobile apps, the task of making money looks more difficult, though.

One of this year’s biggest premium hits, Nerial’s kingdom simulator and Tinder-like Reigns, nabbed 600,000 downloads just over a month after its launch in August. Though available on Android, iOS and Steam, most of those downloads were said to come from mobile.

As of May 20th 2016, it was revealed that the darling of premium apps, Monument Valley, had been downloaded 26 million times in the two years since its release.

That's officially at least, piracy of the game has been rife, particularly on Android, and has undoubtedly eaten into its earnings potential. Something Super Mario Run also likely suffer from once it goes live on Android devices.

From those 26 million downloads, and its add-on expansion Forgotten Shores, Monument Valley made $14,378,500, with $8 million of that generated in its first year and $6.3 million in the second.

Importantly, 73% of revenues came from iOS users, where Super Mario Run will make its debut.

But the $14 million – for a great game but one that doesn’t have the star pulling power of Nintendo and Mario – is still around a fifth of that required to meet Sensor Tower’s $71 million. And that took two years to reach.

The original Angry Birds, one of the major early mobile powerhouses - that still remains popular today - took over a year to reach 50 million downloads back in 2010 (though the mobile space is vastly different these days).

Angry Birds 2, which is free-to-play, took three weeks to rack up 20 million downloads in 2015.

Converting to paid

Given Mario’s star standing in pop culture and a pull that few games icons have, it’s entirely possible that Super Mario Run will be downloaded 50 million times and that 7.1 million people will pay for it.

Though just how receptive the general consumer is to Mario on mobile and whether fans will enjoy an auto-runner that doesn't rely on the series' precision jumps is anyone's guess.

Sensor Tower has given some big numbers, and it’ll take 14% of players at 50 million downloads to monetise after the free-to-start period and reach $71 million - better than most free-to-play spending rates.

If Super Mario Run comes even close to that, it’s a runaway success.

Full disclosure: I worked at Nintendo from January 2016 to May 2016. I did not have any knowledge of Super Mario Run at the time.