Update: Rovio has revealed further plans for its IPO with a $1 billion valuation, set for October 3rd 2017.

Original article: Given people have been talking about Rovio IPOing since 2013, the announcement it will finally be listing on the NASDAQ Helsinki exchange could be seen as an anti-climax.

Certainly, there’s some industry sentiment which argues that given Rovio’s recent difficulties, it should have floated earlier.

A mis-reading of Rovio’s announcement that it will be generating just €30 million ($36 million) by issuing new shares hasn’t helped matters either.

Yet, even a cursory reading of the company’s financials demonstrates why a 2013 or 2014 IPO would have been disastrous on a scale of a Zynga or a King.

Instead, Rovio’s management (and investors) should be congratulated on working through recent difficulties to create the conditions for the company to successfully list and create strong future opportunities for both investors and staff.

To explain why, we need to go back to 2010.

Force awakens

Launched in late 2009, Angry Birds was the right game released at the right time.

In 2012, Rovio was the hottest game developer on the planet. In 2013, it wasn’t.

With the Apple App Store starting to reach a mass market, the low-priced addictive puzzle game became the first viral hit on smartphones, generating thousands of headlines and selling tens of millions of copies.

Building on this trajectory with Angry Birds Season (2010), Angry Birds Rio (2011), and peaking with Angry Birds Space and Star Wars in 2012, Rovio was the hottest game developer on the planet.

But more than just mobile games, it had quickly embraced the value of its intellectual property with Angry Birds’ licensing deals covering everything from sweets, drinks, hats and clothes to toys, cook books, playgrounds and an animated TV series.

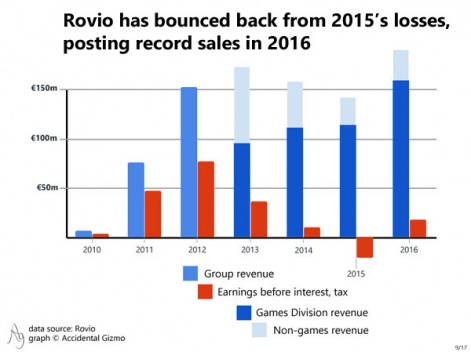

The result was Rovio sales grew 10-fold from 2010 to 2011 and then doubled in 2012 to €152 million.

The company’s profitability grew strongly too; up 15-fold in 2011 and then 64% in 2012.

Of course, in classic financial thinking, this would have been the opportunity for Rovio to have IPOed in terms of maximising its value. After all, this was the time some people were talking about a $9 billion valuation.

Yet as the figures from then-future years demonstrated, such ‘success’ would have been short-lived.

A great disturbance

As the most successful mobile games moved from a price point of 99c to free-to-play in 2013 and 2014, Rovio found itself scrambling to understand this new way of making games.

This isn’t to say it wasn’t releasing F2P games during this time, though. Both developed by external teams and published by Rovio, 2013’s Angry Birds Go! And 2014’s Angry Birds Epic were decent experiences but didn’t hit the top of the top grossing charts.

Coupled with this disconnect, the company was dealing with increasing softness in its licensing business.

We can clearly see this because 2013 was the first year in which the company’s financials were broken out in terms of its games and non-games (consumer products and media) activities.

Through the entire 2010 to 2016 period, Rovio’s game division has continued to grow year-on-year but the collapse of its non-games activities from 2013 forced the company into rounds of painful restructuring and redundancies.

The collapse of its non-games activities from 2013 forced the company into rounds of painful restructuring and redundancies.

These reached a nadir in 2015 when Rovio posted its second year of declining sales and a €21 million loss.

Having to deal with that situation as a publicly-owned company would have been a disaster, not only for Rovio’s share price but also in terms of management time (and stress) as well as creating opportunities for hostile takeovers.

A new hope

The situation in 2017 is very different.

Revenue in 2016 hit an all-time high of €190 million, and while profits before interest and tax were relatively small - €17.5 million - at least the company was profitable again.

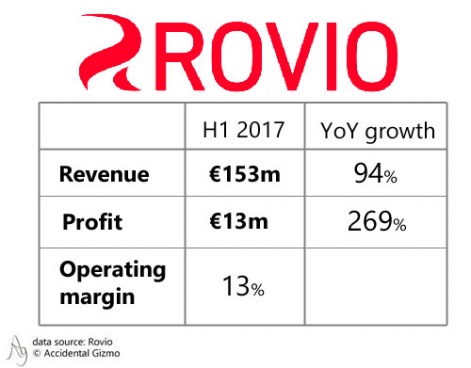

And the figures for the first six months of 2017 demonstrate the turnaround is gaining pace, with half year sales up 94% and profits up 26%.

If this continues through 2017, the year will see Rovio reporting record sales and record profits.

Ironically, of course, this is the same situation as was the case in 2013, only now Rovio has been through its restructuring and is clearly a better managed and more efficient company.

Sales and profits may not continue to break records in coming years, but it seems unlikely Rovio will be repeating 2015’s troubles anytime soon.

Return to growth

This confidence about the future can also been seen in the detail of Rovio’s IPO announcement.

As stated, the company is only issuing €30 million in new shares, although other investors will be selling some of their stake. Rovio’s three largest shareholders are Trema International Holdings (69%), Atomico (10%) and Silavano (10%).

Trema is the holding company of Kaj Hed, who’s the father of one-time Rovio CEO Mikael Hed, while Atomico and Silavano (aka Accel Partners) are venture capital companies which invested in Rovio’s early years.

Rovio expects to pay out 30% of annual net profits to shareholders as dividends.

In addition, some of Rovio’s past and existing employees will also be able to sell their shares, either as part of the IPO or when the company has floated. These include Peter ‘Mighty Eagle’ Vesterbacka, co-founder Niklas Hed (Mikael’s cousin) and Mikael himself. He now runs Kaiken Entertainment, which amongst other things, handles Angry Birds’ licensing and owns its animation studio.

Equally important will be the knock-on effect for for existing and future staff, who will now gain additional incentives to stay with the company via stock options.

A pragmatic future

Perhaps the most interesting items of the entire IPO announcement, however, are those which demonstrate Rovio’s goals for its long-term future.

The first is Rovio expects its game division to grow “faster than market growth in Western markets”.

This cleverly sets the bar not too low but not too high either. The Western mobile game market is maturing fast and hence double-digit annual growth should see Rovio meet this requirement.

The second is more ambitious in that it expects the game group’s operating profit margin to be 30%. For 2016, this was 9%and is only 13% for the first half of 2017, although the margin of earnings before taxes, interest and other accounting factors (EBITDA) was 26%.

Linked to this is Rovio’s target to pay out 30% of annual net profits to shareholders as dividends.

This is significant as it underlines Rovio’s board’s view that while the company will continue to grow, it won’t be the sort of high growth company which requires all its profits for reinvestment.

Instead, it’s happy to ‘give away’ a third of profits to shareholders as a reward for holding onto their shares. This is particularly important for investment and pension funds who prefer direct income to relying on rising share prices.

The road ahead

All-in-all then, Rovio’s IPO appears to tick all the boxes when it comes to company stability and IPO timing. To that extent, it’s a very Finnish IPO.

As I’ve previously stated, many companies manage to mess up their IPOs because their share price is too high. Rovio hasn’t announced its pricing yet, so that still may happen. Given it’s said it’s only raising €30 million in new shares, this seems unlikely, however.

This looks like an IPO aimed at sensibly taking advantage of the long-term opportunities of being a publicly-owned company, not one out to maximising the amount of cash it puts into its founders’ pockets.