Master the Meta is a newsletter focused on analysing the business strategy of the gaming industry. MTM and PG.biz have partnered on a weekly column to not only bring you industry moving news, but also short analyses on each. To check out this week’s entire meta, visit www.masterthemeta.com!

#1: Apple Removes More Than 2,500 Games in China

China continues to clamp down on developers who fail to follow its required processes, and Apple and Google remain the enforcers. To be clear, this isn't a surprise. China has had license requirements for years, but developers were still able to launch on iOS without formal approval.

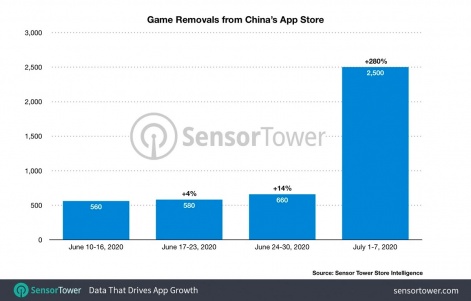

Now, however, games must get ISBN license numbers or else they get automatically pulled from app stores. Even though the law isn't new, the reality of thousands of games getting removed has brought the issue front and center again. The deadline for approval is technically July 31st, but Apple is taking proactive measures. As you can see, these removals have been happening for weeks and are currently crescendoing:

Some games certainly will go through the formal process to gain approval, but many companies won't find it worth the hassle (both time and money). It's worth noting that 97 of China's top 100 games have the required license, so the financial impact on China's mobile market will be minimal.

It also continues to set companies like Tencent and NetEase up well as partners of choice for entering the Chinese market, which ensures leading Chinese companies win whether or not foreign developers wish to publish in China.

As an outsider, it's impossible to like how China's protectionist and censorship-heavy actions influence the mobile gaming market. It's the largest mobile gaming market in the world, after all.

That said, the more interesting part of this story, in our opinion, is less how China is censoring foreign content and more how the tables might turn back on them (like how India recently banned a few Chinese apps and how the US is considering banning TikTok). It's worth paying close attention to how these stories unfold in the future.

#2: New EU Regulations Force More App Store Transparency

App stores are de facto monopolies, and monopolies without safeguards tend to make enforcement decisions in "black box" ways, where there doesn't need to be full explanations or "good" reasons behind why decisions — like removing apps — are made.

As it stands, Apple and Google can essentially enforce whatever they want. Regulations can go too far and have unintended consequences (like GDPR ultimately entrenching the most dominant digital businesses), but digital monopolies still need new rules to govern unfair and parasitic behaviors.

The EU's new regulations, supported by the European Games Developer Federation (EGDF), are designed to provide transparency around why certain platform decisions are made. This means providing clear reasons why removals will occur and a 30-day heads-up so developers can make any needed changes.

It also means more transparent ranking algorithms, data access rights, and disclosures around any preferential or differentiated treatment. Transparency in general is a positive, and forcing clear feedback about why apps will be removed in all circumstances should protect developers from Apple’s whims.

These rules aren’t perfect, of course. Transparency doesn't strip Apple or Google of power; it does nothing to affect platform take rates, reasons for removal, or how payments are conducted. What it does is give developers more time to react and progress the societal dialogue around how app stores should be further regulated.

In our opinion, even if we don't agree with every rule, there's only one way regulations will likely move: against platforms (and not just in the EU). Apple and Google have iron grips on their app stores — dictating payment systems, algorithms, take rates, etc. — and regulatory discussions around those more important elements (essentially whether developers should be given more choice and profits) will likely get noisier in the months and years ahead.

#3: An Outsized Quarter of Dealmaking

Over 100 video game-related deals were conducted in the second quarter, and even though that's a slight decline from last quarter, the total value of those deals was much higher ($7.8 billion). VC-level deals continue to get made at a healthy pace, but, as you can see in the chart below, the quarter was dominated by large acquisitions and accelerating public offerings.

A couple observations:

- Public offerings are partially driven by companies like Stillfront raising cash for future acquisitions, but much of this burst is Chinese companies like NetEase raising money in Hong Kong. Expect more of that in the future. However, it's also likely we experience another uptick as companies like Unity, Playtika, and maybe Epic Games IPO in the next couple years.

- M&A is a regular occurrence in the gaming industry, but this quarter saw larger than usual deals. Zynga’s $1.8 billion acquisition of Peak Games is easily the largest, but the acquisitions of Jagex and Machine Zone (both around ~$500 million) stand out as well. Interestingly, with deals like the potential sale of WB Games being discussed behind closed doors, deal sizes could grow even larger in the quarter ahead.

In general, even though deals will continue to occur at a lumpy pace, there are exciting opportunities to look forward to across every stage. Innovative startups continue to launch and scale, many companies (like Tencent, Stillfront, and Zynga) will continue to acquire, and there are some pretty sizable IPOs on the horizon. In other words, there's never a dull moment!

Master the Meta is a newsletter focused on analysing the business strategy of the gaming industry. It is run by Aaron Bush and Abhimanyu Kumar. To check out this week’s entire meta, visit www.masterthemeta.com!