As stats go, Nexon’s announcement that its mobile strategy game DomiNations has generated $100 million from 32 million downloads over two years certainly catches the eye.

Released in April 2015, DomiNations was developed by US studio Big Huge Games, which was technically the fifth incarnation of the original outfit, which debuted with PC title Rise of Nations in 2003.

Inbetween, the company was acquired by THQ, then acquired by 38 Studios, which infamously went bust, resulting in the formation of the Epic-owned Impossible Studios, which itself was shut in 2013.

Buying back the name, Big Huge Games lives again, although the success of DomiNations meant Korea-based Japan-floated F2P publisher Nexon bought the company in 2016.

History lesson over, the takeaway is the people behind Big Huge have been making strategy games for over a decade. They know what they’re doing.

March to glory

That was clear in 2015 when DomiNations hit app stores.

The game was deeper than the Clash of Clans-generation of tactical rush, and this was reflected in DomiNations’ strong early performance in Western markets - something we noted at the time.

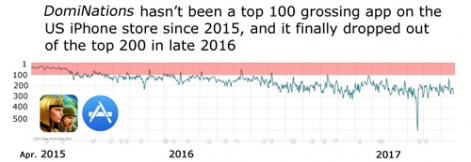

In the US, it sat in the iPhone top 100 grossing chart for a couple of months, before maintaining a steady top 200 position until mid-2016, although an end-of-year update spiked it back almost into the top 100.

Since then, DomiNations has slipped into the top 200 to top 300 range.

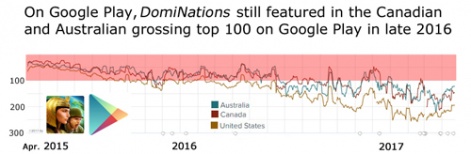

However, when we look at other English-speaking territories, it’s clear that the US isn’t a key market for the game. DomiNations has performed significantly better (around 100 places higher) both on the Canadian and Australian Google Play stores.

(Note: We show multiple countries in Google Play as the store algorithm acts over a longer period than the Apple App Store, and hence generates smoother graphs.)

Indeed, the late 2016 peak that nearly pushed the game into the US top 100 saw DomiNations almost reaching the top 50 in Australia and Canada.

It’s a similar picture in the key European countries, where DomiNations remains a top 100 grossing app in the Spanish Google Play store, and has only recently dropped into the top 200 in Germany, France and Italy.

This Western success is also reflected in the geographical split of the game’s 32 million downloads, 78% of which have occurred in the West.

Local knowledge

Aside from Western markets, DomiNations also received a specific Asian release, which generated the remaining 22% of downloads.

Drawing on Nexon’s local knowledge, DomiNations Asia has been released in South Korea, Japan, Taiwan, Hong Kong and Macau (but not China).

Its strongest territory has been Korea, where it remained a top 100 grossing Google Play app until late 2016.

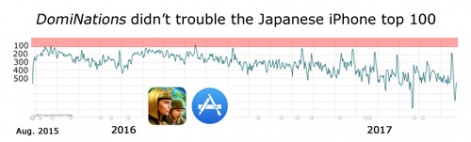

It wasn’t so successful in Taiwan and Hong Kong, although it was a top 100 grossing app until mid 2016, and didn’t trouble the Japanese top 100 grossing charts at all.

Limited success

Deconstructing DomiNations’ success in this way throws additional context on the $100 million of lifetime revenue.

For example, from these graphs, it’s clear the majority of that $100 million would have been generated in 2015, when the game was riding high in the top 100 grossing charts in the West and South Korea.

Equally, given the game’s current position, it seems unlikely it will reach the $200 million mark.

This isn’t to belittle DomiNations’ performance, merely to point out the limits of the current app store ecosystem.

Without a strong, sustained performance in some of the biggest three markets - US, Japan and China - it’s almost impossible to generate the $10 million per month required to accumulate +$100 million of yearly revenue.

Credit crunch

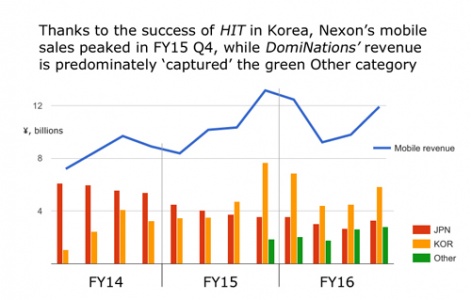

Indeed, if we look at Nexon’s financials over this period, DomiNations’ contribution isn’t obvious.

While the blue line shows overall revenue from mobile games, it’s clear that Nexon’s key market remains South Korea, which the big peaks in FY15 Q5 and FY16 Q1 provided by RPG HIT.

The majority of DomiNations’ revenue is captured within the green bars, which are Nexon’s revenues external to Korea and Japan. It’s not nothing ($100 million is around ¥11 billion), but equally it’s not been significant to Nexon either.

And this highlights another trend. As the mobile game market matures, there is increasing stratification when it comes the levels of success available to developers and publishers.

The vast majority of games generate less than $50 million in lifetime revenue. A couple of percent breakout into the +$100 million range, but the ability to be able to grow such success into the $250 million, $500 million, $1 billion range has become increasingly impossible.

There are some exceptions of course, Com2uS’ Summoners War is steadily building to a $1 billion total. But it launched a year earlier than DomiNations and as an RPG has a wider global appeal.

In this context, DomiNations’ $100 million is about as good as it gets.