The early gold rush days of F2P gaming on the app stores meant scaling quickly was everything.

Now, however, the ways and means of gaining new users are well understood, if expensive.

This doesn’t mean UA is dead. Glu Mobile is currently spending heavily in building what it hopes will be a long-term profitable audience for its Design Home 'game', and indeed for the entire company.

Demonstrating its more conservative nature, EA’s CFO Blake Jorgensen explained EA Mobile’s approach in its recent earning call.

“The key to our mobile business, and I think different than some other people in the industry, is we drive our business … to be profitable", he said.

“And we’re not going to try to drive top line growth simply with zero profitability.”

Of course, given EA Mobile is a small part of EA’s overall business (around 15% of total revenues) and EA doesn’t break out the profitability of individual sub-businesses, so we have to take Jorgensen’s word that’s the case.

But, in reference to “driving top line growth”, we can see how this has changed for EA Mobile, especially over the past 12 months.

Ups and downs

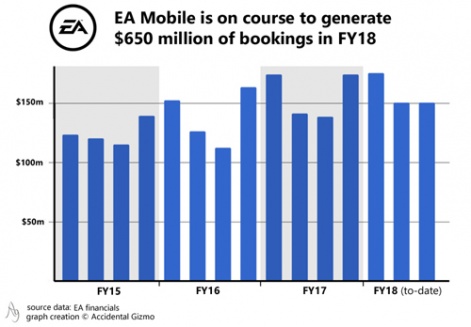

First off, it needs to be stated EA Mobile is still growing and its FY18 - the period April 2017 to March 2018 - is on track to break $650 million in terms of bookings for the first time.

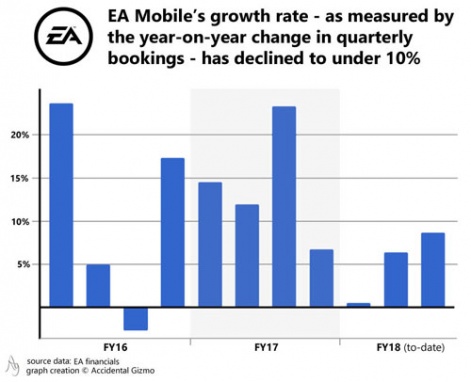

Yet when we consider the comparative year-on-year growth of EA Mobile’s quarterly bookings (bookings are the raw measure of sales during a period, ignoring the confusing deferred revenue requirements of GAAP standards), certain trends are clear.

During FY16, EA Mobile experienced instability; high growth (+24% in Q1) and decline (-3% in Q3).

Thanks to the release of Star Wars: Galaxy of Heroes in November 2015 and the recurring boost provided by Madden NFL Mobile, this was followed by four quarters of very strong performance (+10% growth).

Since then, EA Mobile has grown but hasn’t released any big new hits or reinvigorated older games.

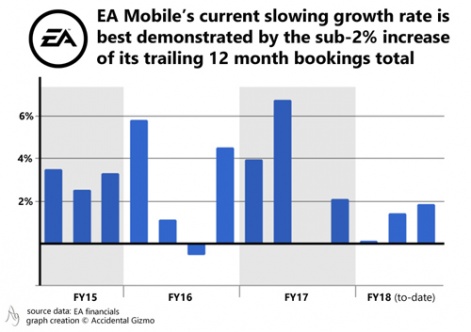

This is best demonstrated in the final graph, which tracks the growth in EA Mobile’s Trailing 12 Months bookings total. Because this is an accumulative measure, the change in any individual quarter’s total has less impact so long-term trends are easier to spot.

In this way, EA Mobile’s strong growth in late FY16 and FY17 is shown by three quarters of +4% growth, with FY18’s performance to date sliding down to less than 2%.

Looking ahead

So much for the present. What about the future?

Most obviously, The Sims Mobile has been in soft launch in Brazil (and other markets) since May, and Star Wars: Rise To Power has recently been announced too.

We’re not going to try to drive top line growth simply with zero profitability.Blake Jorgensen

But, according to EA’s executives, the game they expect to be EA Mobile’s next tent-peg is FIFA Mobile.

Despite having 113 million users, the game hasn’t yet demonstrated the level of monetisation of Madden NFL Mobile.

Bringing that expertise to bear in a year that will be soccer-heavy thanks to the 2018 World Cup should give EA Mobile’s financials a strong boost.

But even if this doesn’t happen in 2018, EA CEO Andrew Wilson isn’t overly concerned.

“We expect we will see monetisation grow in the coming year, but even if it took us three seasons in the same way it has with Madden, that would still be completely fine for us,” he told analysts.

Blake Jorgensen was even more bullish, suggesting in the long-term that thanks to the growing popularity of soccer in China, FIFA Mobile “could much larger than three times Madden”.

In which case, we’re going to need a bigger graph.