This article is part of an ongoing series of data-driven articles from PocketGamer.biz and App Annie highlighting trends in the mobile games sector.

For the next couple of weeks we’re taking a break from the global charts to focus on some of the key individual territories for mobile games.

First up is the US.

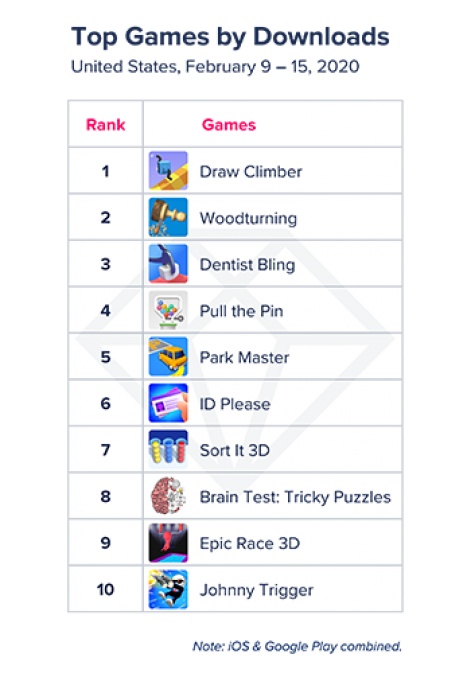

Compared to the global most downloaded chart, the US version is quite different.

Only four titles are the same:

- Voodoo’s Woodturning,

- Popcore’s Pull the Pin,

- Good Job Games’ Epic Race 3D and

- SayGames’ Johnny Trigger.

Similarly, the most downloaded title in the US is Voodoo’s Draw Climber, which doesn’t feature at all on the global top 10 download chart.

Also, well-known titles such as Subway Surfers and PUBG Mobile - which are always ranked on the global most downloaded chart - don’t feature in the US top 10. It’s entirely concentrated on hypercasual releases.

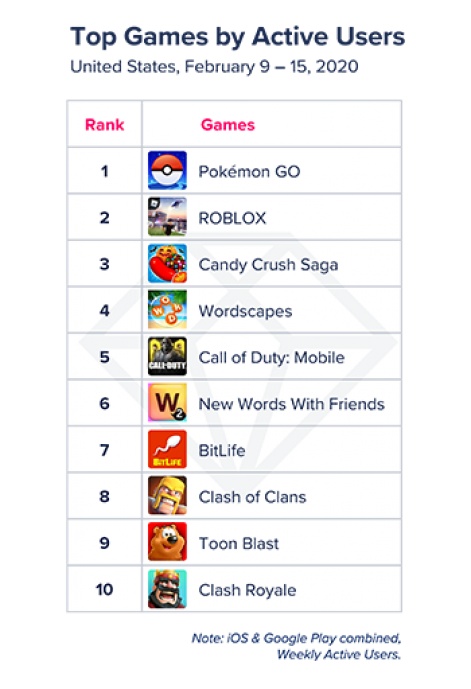

The situation is broadly similar when it comes to the engagement chart, measuring the top 10 games by weekly active users.

There is some crossover - notably Pokemon Go, Candy Crush Saga, Call of Duty: Mobile and Clash of Clans - but the overall tone is very different.

User-generated content platform Roblox positioned at #2 is one signal of this. The high ranking of word games such as Zynga’s New Words With Friends and PeopleFun’s Wordscapes is another. The presence of Candywriter’s BitLife is a final surprise.

It’s significant to point out the developers behind all of these games (and Pokemon Go) are based in the US. Even in the largest markets, local knowledge is vital for success.

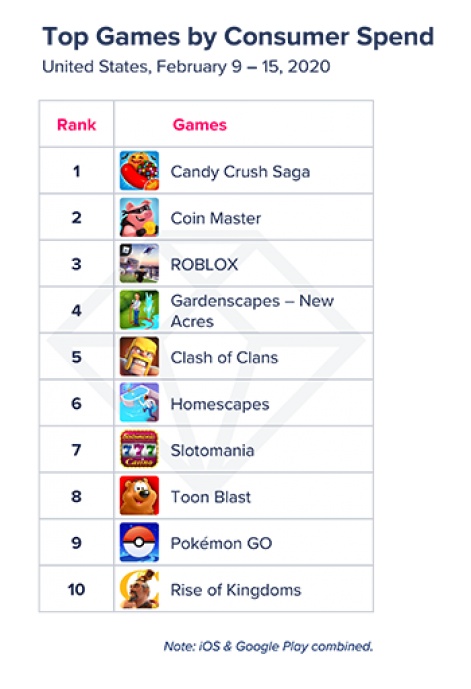

The casual nature of the top mobile games in the US is underlined (again) by the composition of the top grossing chart.

The global chart is generally dominated by hardcore action titles from Chinese, Japanese and occasionally South Korea developers.

Instead, the US top grossing chart is dominated by match-3 games such as Candy Crush Saga, Toon Blast, Gardenscapes and Homescapes, and social casino titles Coin Master and Slotmania.

Notwithstanding the relative youth of its key audience, Roblox also demonstrates the power of user-generated content (and access to parents’ credit cards), ranked at #2.

In conclusion, it seems clear the US mobile games market is much more casual than the global market.

The games that do best are also more ‘mobile’; that is best viewed as mobile-first experiences rather than being console-genre such as MOBA and FPS that have been repositioned for mobile because a large proportion of the local audience don’t have access to PC or consoles.

App Annie is the industry's most trusted mobile data and analytics platform.

App Annie's mission to help customers create winning mobile experiences and achieve excellence. The company created the mobile app data market and is committed to delivering the industry’s most complete mobile performance offering.

More than 1,100 enterprise clients and 1 million registered users across the globe and spanning all industries rely on App Annie as the standard to revolutionize their mobile business.

Find out more at AppAnnie.com