With the cost of user acquisition rising in the United States, Europe, Canada, and Australia, it's tempting to look into emerging markets like Latin America and India.

Bringing your game to these regions certainly isn't a traditional model for mobile success, but it's worked pretty well for companies like Nordeus.

Yet bringing a game to players in emerging markets isn't as easy as it sounds.

The vast majority of smartphone owners in this space are 'unbanked' (meaning, they lack credit cards) so monetising them requires a bit of finesse and a hefty amount of local knowledge.

We caught up with Jacob Hauskens of billing experts Fortumo recently to discuss the challenges that developers face in tackling emerging markets and how companies like Fortumo can help players pay for the content they love and value.

Pocket Gamer: How does Fortumo help developers overcome the 'unbanked' hurdle?

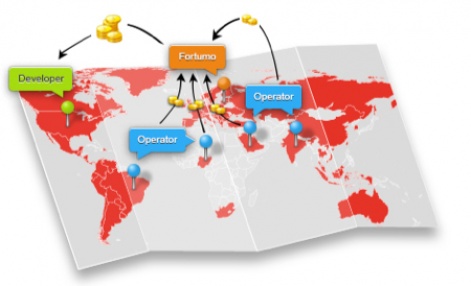

Jacob Hauskens: Fortumo provides a solution that enables developers to sidestep the unbanked issue by allowing consumers to use their existing financial relationship with their mobile phone provider to buy digital goods. So, whatever the customer buys from the developer is added to their normal mobile bill.

With Fortumo, the developer gets access to operator billing in 80 markets through 300 mobile networks and one integration enables payments in all of them.

What are some other the largest unbanked markets that developers should be aware of? Are there substantial monetisation opportunities in these areas?

The shortest answer to this question is that all markets outside of North America and Western Europe should be considered unbanked.

We have gathered data from central banks on credit cards and matched it up with mobile phone penetration in countries that we cover.

The largest opportunities lay in areas with few English speakers including China, South East Asia, India, Brazil, Russia, and MENA [Middle East/North Africa]. These markets are rapidly gaining connected customers who can afford to pay for digital products using their mobile phones.

Now, here's how the credit card ownership breaks down: there are 1.6 billion credit cards in the markets that we cover. 30 percent of these cards are owned by people in the United States and the EU 5.

That means the rest of the world has approximately 1 billion credit cards.

Meanwhile, mobile phones are distributed much more evenly: there are 6 billion phones in the markets that we cover. Of those, 771 million of these phones in the United States and the EU 5. Thus, the rest of the world has approximately 5.2 billion mobile phones

So if you look outside of Western markets, only every fifth phone owner is able to make credit card payments while every phone owner can use operator billing.

This is also why emerging markets with low credit card penetration are where we see the biggest revenue for operator billing on Android.

Because the iOS environment is based on credit cards, it seems unlikely that there's a large number of unbanked customers in this ecosystem. Does Fortumo have any plans to roll out an iOS platform?

Developers can sidestep Apple's regulations if their service works on multiple platforms and they take a carrier billing payment on the web, but iOS is a closed ecosystem which means that it depends entirely on Apple whether they want to enable operator billing for iOS.

Apple's market share is currently biggest in markets where credit card penetration is high, so unless they are planning to heavily expand into emerging markets, operator billing is not likely to be on their roadmap.

What's the end user experience like when making in-app purchases through Fortumo?

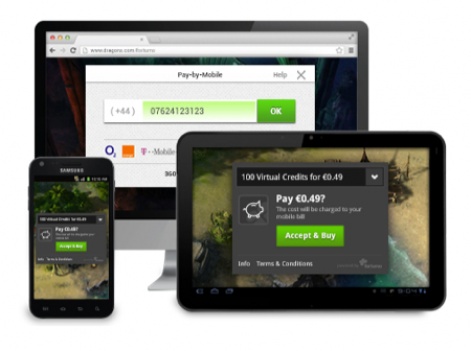

Fortumo in-app purchases provide a true 1-click experience on any device with a SIM card.

Because the mobile operator already has all of the information needed to charge the user, they only have to click the 'Accept & Buy' button and the payment is completed in a few seconds with no additional input needed by the end-user.

Because of the frictionless payment flow, our in-app purchasing conversion is around 30 percent.

Anyone can also visit m.fortumo.com through their phone and click 'Download In-App Purchasing Demo' to see how the payments look like. If you want to simulate payments on a device without a SIM card, enable 'Show widget'.

Fortumo recently launched Fortumo Expand for Chinese developers - are these developers mostly interested in launching domestically or are they targeting emerging markets as well?

We have approached China from two different angles.

Chinese developers have local payment solutions available to them (such as operator billing and e-wallets like AliPay) so within the country monetization is not a problem for them.

However, an increasing number of local developers are interested in global markets yet have little knowledge about them - and that's where we are helping them.

Meanwhile, for Western developers entering the Chinese market there are many roadblocks such as establishing a local company and acquiring a game publishing license, both of which can take up to a year to get done.

Because we have already partnered with all three mobile operators in the country directly, we significantly cut down on the time it takes for Western developers to launch and monetize their apps in China.

The Fortumo Dashboard is constantly being updated to meet user needs, how does its analytics help developers build more efficient monetisation campaigns?

The Fortumo Dashboard provides developers with a full overview of each transaction made, including the timing of the payment, country and item which the user purchased.

All of this information can be seamlessly integrated into the developer's own business intelligence solutions using our Reporting API which provides a real-time overview of payments.

Aggregating this data and analyzing it can be useful to the developer as it allows them to measure customer retention, frequency of repeat purchases, user buying behavior, and planning marketing campaigns.