Western market intelligence outfit Newzoo has just announced a strategic partnership with (and minority investment from) Chinese mobile data company TalkingData.

That makes it a good time to talk to Newzoo CEO Peter Warman about his views on the fast-changing mobile and gaming markets, and how this deal will enable Newzoo and TalkingData to better predict the changes.

PocketGamer.biz: Newzoo is a traditional market intelligence outfit, while TalkingData is more of a technology/analytics company so why have you described this deal as the best strategic fit for Newzoo?

Peter Warman: TalkingData and Newzoo are complementary in different ways.

Newzoo started off as a market intelligence outfit that wants to help companies navigate the ever-changing games landscape regardless of the type of data, research or analytics required.

TalkingData's origin is all about providing business intelligence software for companies in the financial, telecom and media sector to process and interpret big data.

Another difference is the scope of our data and clients. Newzoo serves clients across the globe, particularly in the US and China, with a product portfolio that crosses every country on the planet.

TalkingData gets real-time data on over 1 billion connected devices in China and traditionally serves the financial sector in China.

Being complementary is nice but means nothing without a shared vision.Peter Warman

While we already had our own app store analytics, revenue estimates and predictive analytics in place, we see the technology of TalkingData, as a huge leap forward in realizing our ambitions to offer mobile intelligence in a state-of-the-art way.

Newzoo will market TalkingData's unique data on the Chinese mobile ecosystem to Western markets and use its technology to provide global mobile intelligence services.

Being complementary is nice but means nothing without a shared vision. It was clear from the day we met with TalkingData that we shared the ambition to be a global leader in mobile intelligence. Since then, we have focused on formalizing the partnership and investment.

Meanwhile, Newzoo has entered into strategic partnerships with deltaDNA and Priori Data to ensure we have a broad offering of services from day one.

Equally important to the complimentary market intelligence of these partners is our common and intrinsic desire to innovate. This includes innovation in technology, data visualization, making data actionable and staying ahead of the curve when it comes to market trends.

How will the deal changes the services you offer your clients?

With most of our clients, we have a relationship that goes back years. As the co-operation deepens, more client-specific challenges are put on our plate, including ones that used to be outside the scope of our products and services.

Particularly on mobile, it requires various angles and data sources to come to truly unique and client-specific insights backing up smart strategic, tactical and operational decisions.

The formal strategic partnerships allow us to mix up data on a continuous basis and develop new joint products and services.Peter Warman

The formal strategic partnerships allow us to mix up data on a continuous basis and develop new joint products and services.

This new mobile intelligence consortium offers everything from consumer insights, granular revenue projections for every country in the world, app store data, device usage, ad intelligence to monetization metrics, on a global and local scale.

We have an ambitious product roadmap in place that will ensure our solutions are accessible and affordable for companies of any size in any market. Our clients highly value our custom analysis support that comes with all of our subscriptions.

We want to make sure that future users of any of the mobile intelligence products coming from us, and from our partners, experience the same.

TalkingData not only gives us real-time data on close to a billion connected devices in China, it also gives us an extensive business network within China. Its corporate event late last year, at which we both announced our partnership, was attended by 2,000 professionals from the biggest and most innovative firms in China.

Why is it so important for Newzoo to have a sizeable operation in China, as opposed to say Japan or Korea?

Firstly, China is the biggest games and mobile market in the world.

Secondly, the Chinese are the biggest investors into game and mobile companies abroad. The need for global market intelligence within China for investors and media companies alike is huge.

Vice versa, China is on every company's priority list. Having local intelligence to scope a realistic opportunity of entering China, or expanding business in China, is crucial.

Japan and Korea are mature markets. Huge but with lower growth figures and, in some cases, even higher barriers to entry for Western companies.

You've recently split Newzoo into Newzoo Games and Newzoo Mobile. What's the thinking behind this?

The year 2015 was Newzoo's biggest year-to-date showing enormous "organic" growth. We doubled our headcount in line with our increase in turnover.

As we grew, we re-organized our company structure and responsibilities to reflect our ambition to remain the world's leader in games and esports intelligence but, at the same time, accelerate our growth plans for mobile intelligence.

The roadmap going forward for mobile is so intense, it could easily pull away our focus on games and eSports.

Even though 75% from our business comes from the US, we are only now seriously building our San Francisco office.Peter Warman

We don't want to risk jeopardizing our reputation and client base of over 100 subscribers that we have built up over the years.

Internally, we now have a Newzoo Games Team which represents our main business and a dedicated Newzoo Esports Team of around 6 analysts and client directors that is focused on expanding our data sources and models behind our reports as well as serving our wide variety of eSports clients.

The third team is Newzoo Mobile that is focused on expanding our mobile product portfolio significantly in the coming months, with games as one of the categories of content.

On the reasoning behind the investment: We were not seeking an investment and certainly not from VCs. Still, the money involved in cementing our relationship with TalkingData comes at a perfect time as our growth strategy has never been clearer.

The investment allows us to accelerate this plan and dedicate more time to new product development, an even higher standard of client service and global presence in terms of staff.

Even though approximately 75% from our business comes from the US, we are only now seriously building our San Francisco office within the tech-hub RocketSpace.

You mention the new eSports team. Why is this market so important? After all, it's still sub-$1 billion so relatively small and fragmented compared to other gaming markets?

First of all, we are very proud that co-founder and CEO of ESL, Ralf Reichert, will be joining our advisory board. It reflects our ambition to maintain our leading position in eSports intelligence while we expand on mobile.

Esports is the shiny ball that press chase. The bigger trends behind it are reshaping the complete games and media landscape towards the future.

That is why eSports remains so important to us and to our clients.

In more words: Driven by the convergence of games and video, games are evolving towards cross-screen transmedia franchises. Esports is only the very visible part of a large scale change in the market that only occurs when various consumer, technology and business trends come together.

It is the biggest thing to hit the games market since the launch of the iPhone in 2007. Though not as tangible, it is equally as disruptive.

Just read the recently published ambition of Activision/Blizzard with eSports. In several years from now, game companies will be only partially dependent on revenues generated by the game itself. It is not VR that is providing this opportunity, but esports, and all the consumer, business and technology trends that are behind it

TalkingData's expertise is within the Chinese market, so do you think there are a lot of western companies still interested in getting into the Chinese mobile market, which is already dominated by big players such as Tencent and NetEase?

At Pocket Gamer Connects London 2016, I talked about the current success of Western companies in China, Korea, Japan and greater Southeast Asia.

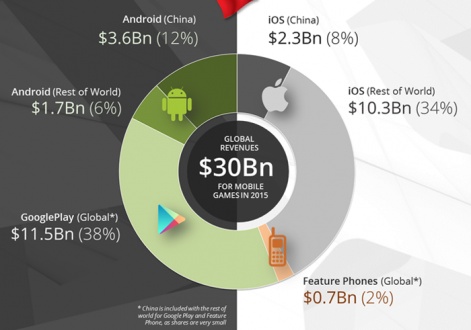

And indeed, when it comes to games, even less than 10% of mobile game revenues are generated by publishers outside of China. However, this still reflects a market of several hundreds of millions of dollars.

With the official launch of Google Play and the continued rise of iOS in China, I believe this share has the potential to go up.

That, in combination with a double-digit growth rate, makes China a market that is impossible to neglect. And don't forget that TalkingData's data has a much wider scope than games.

TalkingData was the first to report that there were 1 million Apple smartwatches in use in China in late 2015. Device data is just one example of mobile intelligence that we are bringing to the Western markets. App store data is just one component.