It's not quite above water yet, but the signs are that the share price of King (NYSE: KING) will soon be back in black.

Infamously, the company's stock opened 10 percent down on its float price of $22.50 in late March and has been dropped down ever since.

Well, no more it seems.

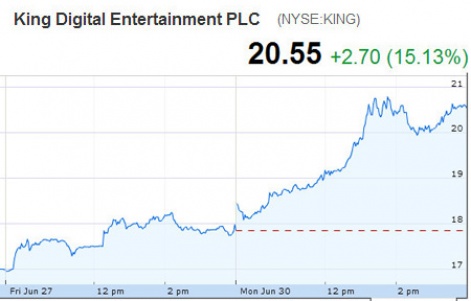

Hitting a nadir of $15.26 in mid-May, King's share price had been slowly rising, until the end of last week when it's jumped from $17, closing at $20.55, up 15 percent on Monday.

No reason has been provided, other than financial websites noting that the shares were experiencing a lot of trading volume.

Stuck to the ceiling

And King isn't the only US floated F2P mobile gaming stock on the up.

Glu Mobile (NASDAQ: GLUU) has also experienced a strong rise in its share price over recent days. From a price of $3.78 on Thursday, it's now $5.00; not far off its 52-week peak of $5.65.

Again, there's no particular news to pin this performance to; Glu's most recent release is a fashion game based on Kim Kardashian.

Yet, there is one F2P gaming stock that refuses to rise on this general market enthusiasm.

The share price of Zynga (NASDAQ: ZNGA) remains rooted around the $3-$4 range, way below its December 2012 IPO launch price of $10.