Mobile games publisher King (NYSE:KING) , which is being bought by Activision Blizzard for $5.9 billion, has announced its FY15 Q3 financials, for the three months ending 30 September 2015.

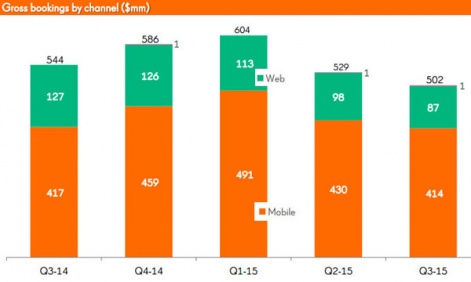

Revenues were $480 million, down 7% year-on-year and down 2% quarter-on-quarter.

Profits were $143 million, down 1% year-on-year, and down 13% quarter-on-quarter.

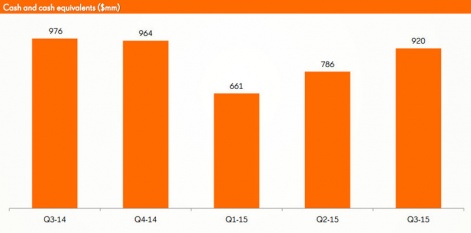

King ended the quarter with cash and equivalents of $920 million, up $134 million from three months ago.

"These results reflect our continued execution of our franchise strategy and the longevity of our brands," commented CEO Riccardo Zacconi.

Glass half empty?

As with Q2, the company finds itself dealing with the maturing (or slow decline) of its key Candy Crush franchise.

So while the revenues from what it calls its "non-Candy Crush Saga" games were up 14% year-on-year (60% of gross bookings), this wasn't enough to offset the decline.

However, as King points out, it had two games constantly in the top 5 top grossing on the App Store and Google Play Store in US, and three games in the top 15.

Big reach

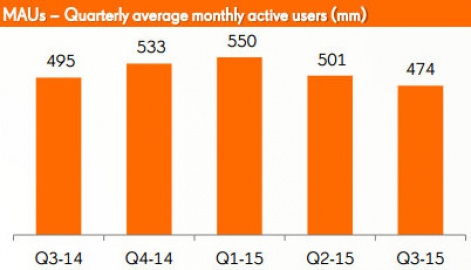

Mirroring the decline of revenues and profits, King's player base is also slipping.

MAUs were down 5% quarter-on-quarter or 4% year-on-year to 474 million; still much larger than all its competitors.

DAUs were down 6% quarter-on-quarter or 3% year-on-year to 133 million.

King had 6.8 million unique monthly payers during the quarter, while average bookings per paying user were up $1.19 to $24.45. King put this down to its improved live ops as players start to pay in multiple games.

[source: King]