Whenever looking to raise capital for a video game you must "always do your due diligence" to research the investor, their background and previous financing deals.

This was the advice shared by Coherence board member Nick Button-Brown at PGC Digital #6 during his session on 'How to Raise Money for Your Game' and the various sorts of investors that are available.

One of the easily options is raising money from friends or family.

This can bring more understanding as the 'investor' will know you more and believe in you personally, however can cause issues if you do lose all of their money.

Another was venture capitalists (VCs) - professionals that manage investment funds.

Here you will work with individual managers and partners that come from a wide background but tend to focus on specific sectors. They will often provide strategic support and help with networking, but costs and legal fees will come out of the investment.

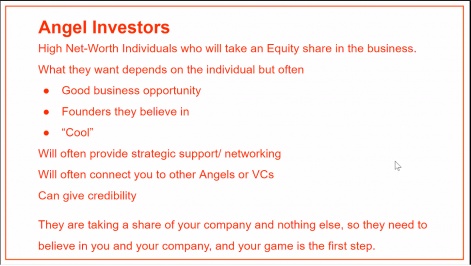

Angel investors

High net-worth individuals known as Angel investors were highlighted next, who take an equity share in the business.

With this select group, it's worth building networks, getting to know as many as you can and keeping these relationships going for the long-term.

"Angel [investors] will invest for emotional reasons," Button-Brown explained.

"There are some that will do a lot of analysis and due diligence but most of them do invest for emotional reasons - they like it, they want to be part of it.

Publishing deals and traditional project financing deals were other examples shown off. The main point that was urged to take away was that all investment funds will expect a return at some point and doing your research before committing is vital.

An incident was recalled by Button-Brown that during his time at EA someone approached the company with an idea for a game that would be "better than FIFA".

Trends

In response to a question from PG.biz, regarding whether there are certain sort of games that capital investors are more likely to finance, Button-Brown explained that the issue stems from the market constantly changing.

"There are hot trends," he said.

"VR was a hot trend and right now… NFT gaming. Some investors are getting extremely excited about it. Eventually, that bubble will burst so it's not like everything you do has to be an NFT game as it might have gone in three to six months."

"That doesn't mean they are fundamentally profitable. These are just trends and people want to get involved with the next sexy thing."

It was advised that one of the most useful things is to look at who has raised a lot of money and go from there, before adding that: "It's hard to do anything that has been done well. If you're going up against League of Legends, it better be damn good."

To keep up to date with all of our coverage, check out the roundups here. There's still time to sign up - to find out more and book a ticket, head to the website.