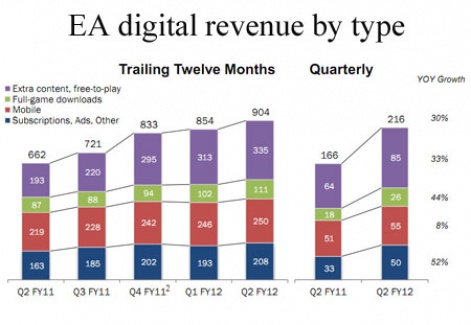

Mobile sales were $55 million, up 8 percent compared to Q2 FY11.

This accounted for 8 percent of EA's total Q2 FY12 revenue from digital platforms.

However, compared to Q1 FY12, its mobile sales were down 3.5 percent; a period which wouldn't have included any PopCap mobile revenue.

Confusing detail

Still, this didn't stop EA arguing its non-GAAP smartphone revenue in Q2 was up 87 percent year-on-year, although it didn't break out any figures.

It also pointed to what it called its "continued mobile leadership on iOS".

Clearly, the company is still balancing the fall-off of Java and other legacy platforms with the fast rising smartphone gaming market.

In terms of its trailing 12 month (TTM) figures (a metric the company suddenly seems very keen on), EA Mobile's 12 month figures (the red block below) were up 1.6 percent compared to three months ago to $250 million.

Its official annual sales in FY11 were $230 million.

Still on turnaround

In terms of overall company performance, it was another difficult quarter, with EA's GAAP sales up 13 percent to $715 million but it made a net loss of $340 million.

Non-GAAP revenue - which strips out one-off costs and income - was up 35 percent to $1.03 billion (higher than EA's predictions), while non-GAAP net income was $17 million.

The company made a loss of $211 million in terms of operating cash flow, up on $134 million loss it made a year ago.

However, keen to highlight the positives, EA said its TTM operating cash flow was $117 million.

TTM revenue for the digital part of its business (now including PopCap) was $872 million, up 42 percent year-on-year.

Payback time

EA has raised its prediction for non-GAAP full year FY12 net revenue to between $4.05 - 4.2 billion, with net income of between $51 - 121 million. It expects to make a loss during Q3 however.

The company ended the quarter with cash and liquid investments and securities worth $1.5 billion, down $158 million from 12 months ago. It's also added $529 million of convertible note debt to its balance sheet due to its purchase of PopCap.

As well as such recent acquisitions, EA has been buying back shares. To-date, it's spent $247 million repurchasing 11.8 million shares, which is designed in the longterm to increase the share price.

[source: EA (PDFs: press release/detail)]