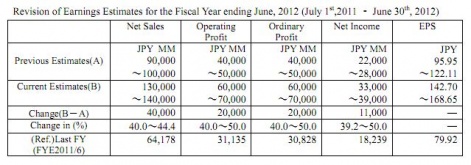

It now expects to generate net sales of between ¥130 - 140 billion (around $1.7 -1.8 billion).

Such figures represents a massive jump of 40 percent or more on the firm's previous projections, and would be more than double the ¥64.2 billion ($794 million) in net sales the firm recorded in 2010.

It would also see the company getting much closer to parity with its Japanese rival DeNA. Previously its sales have been around half that of DeNA's.

Up and up

As you might expect, a rise in revenue expectations is coupled with equally bullish projections when it comes to operating profit, which GREE believes could come in somewhere between ¥60 billion and ¥70 billion ($765 million to $895 million).

That would signal a significant rise - again between 40 to 50 percent compared to from the ¥31.1 billion recorded last year.

Re-stated net income is likely to be between ¥33 billion and ¥39 billion ($422 million to $500 million) more than double the figure recorded in 2010.

GREE commented that while paid service sales had been "stable" during the firm's most recent quarter, monetisation of the company's social output has been "increasing at a higher rate than originally expected".

It's growth that should enable the firm to offset "increased labour costs and recruiting costs with the expanding business" and those related to opening offices outside of its Japanese base.

[source: GREE]