Total sales were $24.4 million, down 17 percent year-on-year.

The company made a net loss of $2.9 million, compared to a profit of $199,000 a year ago.

It also used up $1.9 million of cash flow, compared to generating $1.6 million in Q2 FY12.

Blood on the tracks

The company said that 94 percent of its revenue now comes from smartphones, but after early success with F2P titles such as Gun Bros., Glu has been finding conditions on the app stores much more difficult.

During the quarter it only released two internally-developed titles Tons of Guns and Zombies Ate My Friends, which performed poorly.

The problem for Glu is that while it's not been profitable for years, at least sales rose during FY2011 and FY2012.

Despite recent cost-cutting, it's unlikely to regain consistent profitability if its sales start declining quarter-on-quarter.

Fill the pipe

So to turn the business around, it's looking towards third-party publishing operations.

Black Gate: Inferno, the first game from its publishing division was released in July, and the second - Odyssey: Age of Gods - is now out.

In this manner, it's reinforcing its global publishing capacity with new offices in Japan and Korea and with a deal signed in China with Qihoo 360.

In Korea, Glu can now publish on the Kakao Games Platform and with carrier SK Planet. Glu has also signed a deal with MGM to release games based on its forthcoming Robocop and Hercules movies.

Jam tomorrow

"Our second quarter results were primarily driven by the continuing traction with our strong Q1 launches, specifically Frontline Commando: D-Day and Heroes of Destiny," said CFO Eric R. Ludwig.

"We experienced an improvement in overall monetization and retention rates on these two titles during the second quarter, which was the result of updated content and live ops events.

"Our updated guidance reflects an adjusted launch schedule as we continue to invest in improving expected lifetime value of our games prior to launch. With over $19 million in cash at the end of Q2, Glu remains well positioned to execute its games-as-a-service growth strategy."

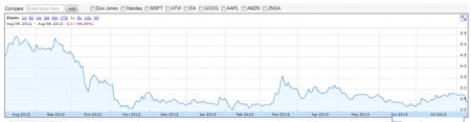

Glu's shares are now hovering around the $2.50 mark, down from a high of $5.50 in the summer of 2012.

This values the company at $165 million.

[source: Glu IR]