Still, it's easy to get lost amongst all those million and billions of dollars, euros, yen and won.

One way to spot trends can be to strip out absolute numbers and just look at rate of growth; something we considered last week.

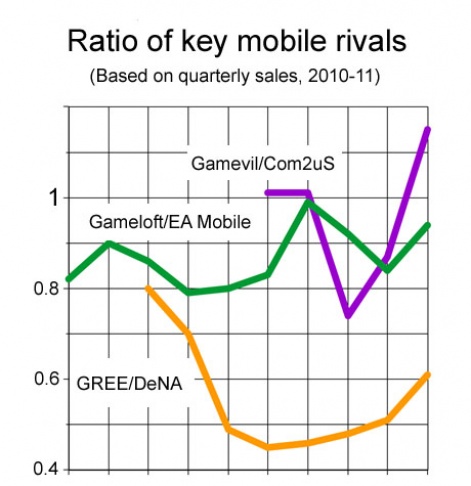

Another useful trick is to match rival companies that are operating in the same business sector and directly compare their performance over time.

Head-to-head

When it comes to mobile games, there are three obvious matches: EA Mobile and Gameloft; Com2uS and Gamevil; and DeNA and GREE.

EA Mobile and Gameloft are the two largest western mobile publishers; and are similar in size, as well as in business focus i.e. paid, premium branded mobile games across all platforms.

Hence, if we create a ratio of the companies' quarterly sales [the green line], we can gain an idea of their relative performance over the past two and a half years (10 quarters).

Gameloft has smaller sales than EA Mobile throughout (i.e. the ratio is always less than 1), although it almost reached parity in the three months July-September 2010. Since then though, EA has bought iOS publisher Chillingo, which has resulted in it pulling away from Gameloft.

It seems likely as the sales of more recent acquisitions such as PopCap and Firemint are added to its total, this will see the ratio drop down further (i.e. EA sales will grow compared to Gameloft).

Heart and Seoul

Korean mobile publishers Com2uS and Gamevil [purple line] offer up a similar situation.

Both built their business on the back of domestic feature phone sales, and have since been branching out in the global smartphone market.

Looking back five quarters, they were evenly matched for half a year, before Com2uS, which is the larger company in terms of headcount, pulled away for the next two quarters, mainly because of cyclical issues in Gamevil's release schedule.

However this masked the fact that Com2uS' sales peaked in 2009 and were now falling, while Gamevil's were growing fast, something that's now become clear as it's leaped ahead of its rival.

Value of being open

Japanese social mobile platform holders DeNA (Mobage) and GREE [yellow line] are our third comparison.

Again, their business models are very similar - social mobile portals that are mainly feature phone-based, but being migrated to smartphones. Both companies are also aggressively expanding overseas, with DeNA buying ngmoco and GREE OpenFeint.

What's interesting is that two years (8 quarters) ago, DeNA was larger but not significantly so (ratio of 0.8 so a quarter larger). However, as it opened up Mobage so thirdparty developers could launch their games on it, its revenues grew dramatically.

This happened so quickly, a year ago, it had more than double the sales of its rival.

Of course, as GREE has made a similar move, opening up the GREE platform to thirdparties, the line has started to curve upwards, although DeNA's sales remain two thirds as large as GREE's.