Assuming a certain size and corporate structure, there are only two things a company needs to get right if it wants to IPO.

The first is timing.

This is relatively easy. If you don’t have the right growth curve, you can’t IPO.

The second is pricing.

This is where everything can go wrong very quickly.

Pricing is complex because pricing shares too low means a company (and its investors) don’t make as much money as they could have. But pricing too high means first day investors are more likely to sell their shares if a quick profit is available.

Additionally, any sudden loss of confidence can see such shares slide beneath their launch price - just ask Netmarble.

Sometimes companies never recover from this, which can have serious long-term implications both in terms of investor sentiment and staff, whose share options become worthless - just ask Zynga and King.

Jam tomorrow

That dilemma remains in the future for US casual mobile developer and publisher Jam City, however.

It didn’t think that would be the case, but at the present time, it’s still debating timing.

At the start of the year, CEO Chris DeWolfe (previously of MySpace fame) was talking up a late 2017 IPO for the company he created by combining various US games developers - notably MindJolt, SGN and TinyCo - aided thanks to $130 million investment from Netmarble.

But, more recently, DeWolfe has dialled back, with a 2019 IPO now pencilled in.

Jam City has plenty of live mobile games, but two of its oldest remain its most successful.

Why the change of plan? Taking a look at the performance of Jam City’s most recent launches makes that apparent.

Harder times

Jam City has plenty of live mobile games available on the app stores, but two of its oldest games remain its most successful.

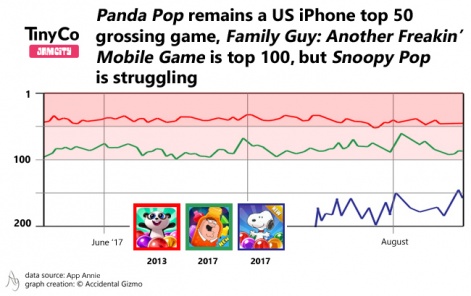

Released in late 2013, Panda Pop is a simple bubble match-3 game that took 12 months to gain momentum, but since which time has become a very solid top 50 top grossing game in the US.

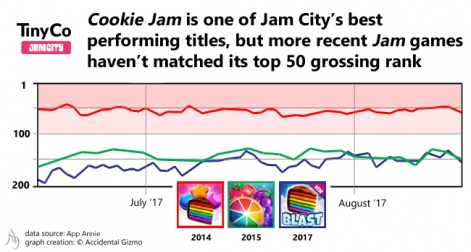

2014’s match-3 puzzler Cookie Jam has experienced the same trajectory. Peaking at 10th on the US iPhone game chart in November 2014, it’s only recently dropped outside of the top 50.

These two games have been the engine of Jam City’s growth.

More recent variations on these themes haven’t managed to capture large paying audiences, however.

2015’s Juice Jam has performed decently but never cracked the US top 50 and is now well outside the top 100 grossing. Released in June, Cookie Jam Blast’s peak position on the US iPhone game chart is, to-date, 135th.

It’s a similar situation with Panda Pop refresh Snoopy Pop.

Released in July 2017, it’s yet to make much of a dent in the US iPhone top 150 grossing game list, although another high profile IP launch has done better.

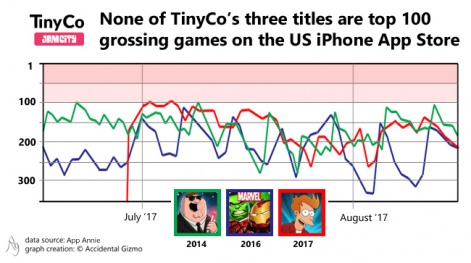

Acquired by Jam City in 2016, TinyCo had built its reputation from mobile games based around the Family Guy and Marvel licences.

Jam City was quick to combine its expertise in match-3 games with the former. The result was Family Guy: Another Freakin’ Mobile Game, which has been a solid top 100 grossing title.

The issue for Jam City is this minor success has been its biggest success of recent years.

Equally, none of TinyCo’s three live mobile games - 2014’s Family Guy: The Quest for Stuff, 2016’s Marvel Avengers Academy and 2017’s Futurama: Worlds of Tomorrow - are currently within the US top 100 grossing game charts.

What’s next?

This isn’t to say Jam City can’t IPO at some stage.

However, shifting the goalposts from late 2017 to sometime in 2019 is akin to putting a hard pause on the entire process.

This isn’t to say Jam City can’t IPO at some stage.

Partly, this state of affairs is a result of the competitive nature of the app stores, particularly within the puzzle and action match-3 genres in which Jam City is strongest.

Market leader King has similarly found it difficult to launch new titles outside of its multi-billion-dollar Candy Crush franchise, and its 2014’s IPO was a disaster.

With that example of what not to do, it will be interesting to see if DeWolfe and Jam City attempts to diversify into new genres, or uses its cash reserves and cashflow to build via acquisition. Or both.

Whatever happens, timing its IPO will be the simplest part of a two-stage process. The real test is yet to come.