In terms of headline growth, it would appear Gameloft has hit the buffers.

Revenues in 2017 were €258 million (around $320 million) compared to €257 million in 2016 and €256 million in 2015.

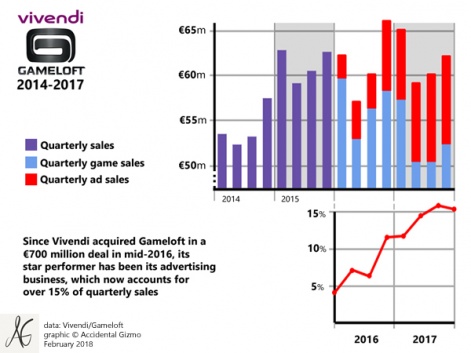

More positively, income from operations was €10 million ($12.5 million) compared to €8 million in 2016 and a loss of €12 million in 2015. That’s progress, but not much for new owner Vivendi to get excited about given it paid €700 million to acquire the company in mid-2016.

Yet, as Gameloft’s long-term CFO Alexandre de Rochefort is keen to point out, behind the scenes the veteran French mobile games developer is changing, it’s just happening very slowly.

“It takes a lot of time to transition. What’s important is we’re growing the strategic parts of our business,” de Rochefort argues.

“Our advertising business was up 93 per cent year-on-year, while smartphone game sales were up five per cent. This growth is new for Gameloft.”

The Innovator’s Dilemma

As is often the case with technological disruption, Gameloft’s historic success in mobile gaming’s pre-App Store and premium App Store-eras created a company that wasn’t nimble enough when the free-to-play revenues exploded.

One example is even following a sustained reorganisation, which most recent saw layoffs in its Madrid studio and its New Orleans studio shut, it still employs 5,700 staff spread throughout more than 20 offices globally. In stark comparison, Supercell has just 241 people, mainly in one office, although it does outsource some operations.

More pertinently, in terms of its financials, Gameloft also generates a substantial chunk of its sales (around 25 per cent) from selling and embedding feature phone games, mainly for developing markets.

Of course, this market is now in terminal decline, which skews Gameloft’s overall financials. Two parts are growing, one is falling. The result is low headline growth.

It takes a lot of time to transition. What’s important is we’re growing the strategic parts of our business.Alexandre de Rochefort

Indeed when it comes to those headline numbers, the situation is even more complex, because Gameloft is still reporting its app store sales net of the 30 per cent take of Apple and Google, confusing comparisons with other mobile games companies, especially those in the US.

De Rochefort says Gameloft will be changing its accounting principles to remove that issue. This would have boosted Gameloft’s 2017 sales to around $400 million.

Change of tone

Gameloft is changing in more substantial ways too, most notably in terms of its products.

It won’t be announcing details of its 2018 slate until Q2, but de Rochefort says what matters is a new focus on quality over quantity.

Partly because it employs so many staff, Gameloft has always released a lot of games. Indeed, for the past three years, market intelligence outfit App Annie says it’s been the number one mobile publisher in terms of the number of games downloaded from the App Store and Google Play. Its daily download average during 2017 was 2.5 million.

That’s testament to Gameloft’s reach but the consequential lack of monetisation suggests it hasn’t been releasing the sort of games in which people are prepared to spend. Inverting this situation means an increased focus on product, with Gameloft only expecting to release four or five titles in 2018 compared to 10 in 2017 and more than 20 a year prior.

Finding balance

Something that won’t change, however, is Gameloft’s attention to graphical quality, or “placing the quality bar super-high” as de Rochefort puts it.

“That is our DNA. It’s our strength,” he argues, although also happy to reveal the new games will be more casual experiences than the likes of Gangstar New Orleans and Iron Blade, two console-like games Gameloft released in 2017, which de Rochefort confesses were disappointing in terms of their sales.

“The market has moved. Players don’t want console-like experiences on mobile,” he says. “That’s why we’re changing our editorial strategy to focus on more casual experiences. In fact, we’ve reorganised the company with casual games in mind.”

That’s not to say all ‘typically Gameloft’ games have underperformed.

Niche strategy game War Planet Online is generating such high revenue per user, it ranked as one of Gameloft’s top five top grossing games in January.

Similarly, Asphalt 8 was one of the company’s top three grossing games in 2017, but the other two were Disney Magic Kingdom and Dragon Mania Legends.

So that’s where Gameloft finds itself at the start of 2018. A solid foundation, a fast-growing advertising business and the promise of a fresh start - one that will be more Minions Rush and Paddington Run than Gangstar and Dungeon Hunter.