Given Zynga’s spending spree has broken the $1 billion mark over the past two years, CEO Frank Gibeau remains remarkably unsated.

“We have a healthy cash balance and a new $200 million credit facility plus a valuable building in an expensive city,” he comments when questioned if the $560 million (split between cash and shares) Zynga has dropped buying 80 per cent of Finnish developer Small Giant Games is equivalent to ‘betting the house’.

In other words, don’t expect Zynga to stop looking for opportunities any time soon, especially if they’re as strongly accretive as this one.

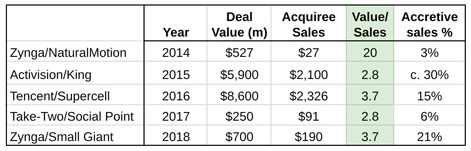

In traditional valuation terms, Zynga is paying 3.7 times Small Giant’s $190 million annual run rate.

That’s not cheap: it’s equivalent to what Tencent spent on Supercell. But for its money, Zynga gets a game - Empires & Puzzles - which was only released in 2017, is growing fast and, with 26 million downloads, still has plenty of headroom for expansion.

Its success to-date has mainly been in Western markets. Gibeau says that’s because Small Giant is seriously considering the changes it will have to make before releasing in the key Asian markets such as China, South Korea and Japan.

We have a healthy cash balance and a new $200 million credit facility plus a valuable building in an expensive city.Frank Gibeau

This is a non-trivial task. As what’s labelled a midcore game, which appeals both to casual and core players, Empires & Puzzles’ value is how well it manages to balance the differing requirements of each group.

Asian RPG fans are much more hardcore in their tastes, however.

A strong European footprint

That’s an issue for the future, though.

With at least one other game in the works, Small Giant fits into a corporate structure that has a strong European games development presence with two studios in Helsinki, Finland, two in London, UK, and two in Istanbul, Turkey. Zynga’s global headquarters is in San Francisco and it also has a large operation in Bangalore, India, handling everything from support to game development, including mobile and chat games and other emerging platforms.

Significantly, many locations are working on new games too, including a reboot of Zynga classic FarmVille and a Star Wars-licensed game (both out of Europe), as well as games based on Harry Potter and Game of Thrones IP.

Across all studios and including Small Giant, Zynga has nine games in development for 2019 and beyond, while recently released match-three builder Wonka’s World of Candy is also said to be performing well.

Indeed, tucked away within its Small Giant news, Zynga upped Q4 guidance by $10 million. Already consistently profitable, thanks to this deal the company will post annual revenues of more than $1 billion in 2019 (compared to around $900 million for 2018), and that’s something which hasn’t happened since 2012.

“After two and a half years as CEO, I’m confident the turnaround is complete,” says Gibeau.

“We hit all our goals for 2018 and we’re finishing the year strongly. Merge Dragons! is tearing it up and the Legends update to CSR Racing 2 is driving great engagement.

“And with Empires & Puzzles, we’ve acquired a game that’s already one of our Forever Franchises.”

The difference five years makes

The acquisition of Small Giant is Zynga’s largest purchase to-date, beating out the $527 million it paid almost five years ago to buy UK studio NaturalMotion.

The difference between the two deals is that, despite the valuation, NaturalMotion was a speculative purchase. Back in 2014, the mobile F2P games market was just getting started and so Zynga’s then-management team was betting big NaturalMotion’s future games would be hits.

For various reasons, this didn’t pan out as planned, although as Gibeau points out, NaturalMotion is larger, both in terms of its headcount and the revenue it generates through its games, CSR Racing 2 and Dawn of Titans, than ever before. Still, it’s fair to say Zynga heavily overpaid.

Now, however, the mobile games market is mature, which means top grossing games like Empires & Puzzles have become highly valuable.

On the flipside, it’s much easier for everyone to agree on just how valuable, which is why such acquisitions are priced in the range three to four times annual revenue rather than the 20-times Zynga paid for NaturalMotion.

This sort of thinking also has some commentators considering Zynga’s future. Floated on the NASDAQ exchange, despite its strong financial performance and rumours about interested parties, its valuation has remained steady around the $3 billion mark.

And that’s why large deals such as Small Giant remain on the radar for Frank Gibeau and the Zynga board.

In a fast-consolidating and mature market, it’s almost impossible for startups to create $100 million-plus mobile games, so to keep growing, large companies are looking to well-understood strategies such as making games based on high profile IP and acquisitions.

With games based on Star Wars, Harry Potter and Games of Thrones in development and over $1 billion spent over the past 24 months, Zynga is doing both.

And if, as seems likely, it will sell its San Francisco headquarters, rumoured to be worth over $500 million, its warchest will be replenished for more of the same in 2019.

NB: The author owns a small amount of Zynga shares.