This is an article in a regular series of guest columns from Nordic Game Bits.

Sune Blindkilde Thorsen is NordicGameBits' CEO and co-founder.

It was only a few years ago that the Finnish games industry was still the smaller brother of the Nordic juggernaut that is the Swedish games industry.

Much has changed in just a few years, however. Once the Finnish games industry started growing, it grew quickly. Very quickly.

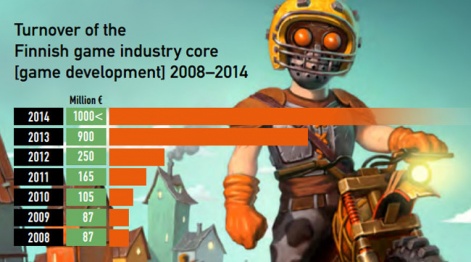

In fact, the total turnover of the Finnish games industry has risen from a mere €87 million in 2009 to an astonishing €1 billion by the end of 2014, flying past the €725 million that now smaller brother Sweden generated in 2013.

A young and fragile industry

Much like the global games industry, the Finnish industry consists of a few very large studios that have helped blast the total turnover passed the €1 billion mark, and a bunch of studios that generate nearly no revenue at all.

In 2014, only 20 studios generated more than €1 million in turnover, with a median turnover at only €100,000.

179 new games studios popped up in Finland between 2011 and 2014. An impressive number indeed. But the flipside is that most of these studios have to close down within a few years.

179 new games studios popped up in Finland between 2011 and 2014.

As the latest numbers reveal, only 17 out of the total of 260 Finnish games studios have survived for more than 10 years. And 69% of all Finnish games studios are less than 5 years old.

All-in-all, this means that you have a few studios generating the vast amount of total revenue, which means that if just one of these studios fail, the impact this will have on the industry can be devastating.

Per person

The quick growth in total turnover has also influenced the turnover per employee. The number of developers employed in each country is about the same at approximately 2,500 people.

In Finland, the total turnover and the number of employees in the industry grew at the same pace until 2010. From thereon, however, the turnover started exploding, growing relatively faster than the growth in number of employees.

As of 2010, the turnover per employee was a mere €97,300 in 2010, but only three years later, in 2013, that number had catapulted to an astonishing €409,000.

Second round startups run with the money

The growth in turnover generated by few very young Finnish studios in the last few years has meant that venture capital firms from all over the world have started looking towards the Nordic region, and specifically the Finnish games industry.

This is great for the industry as a whole, as it means that more money is being pumped into the Finnish games industry ecosystem. And we are not talking dimes and pennies here.

From 2011 to 2014, the total amount of financial VC transactions (investment, acquisitions, owner exits) was $1.8 billion.

When you start digging into the numbers and the studios that receive funding from VCs, a certain pattern starts showing up. Looking at the studios that received VC funding between 2011 and 2014 (note: not the same as total financial VC transactions), a total of 17 studios received more than €500,000 each.

Following the sale of 51 percent of Supercell in 2013 for $1.5 billion, the rest of the venture capital firms who were previously skeptical about the potential of the mobile industry, started eagerly looking for the next Supercell success - something revealed when looking at the games produced by the 17 studios that received VC funding, of whom 12 studios target the mobile platforms.

But - and this is where it gets interesting -15 of those 17 studios are second round startups, which means that they are companies that have been started by a team who have previously owned another studio.

A not-so-secret secret

While the numbers reveal that nearly all of the VC funding received by Finnish games studios went to second round startups, it has never been a big secret that second rounds startups have an easier time of acquiring VC funding in the games industry.

As a case in point, the past four months, have seen some of Sweden's highest profile veterans setting up shop again. Ben Cousins (previously of Lionhead, Sony, DICE and EA) and David Goldfarb (DICE, Starbreeze, Guerrilla) formed a new studio called The Outsiders, while King's Games Guru Tommy Palm left the Candy Crush Saga studio to form Resolution Games.

14% of Finnish studios established between 2011 and 2015 are second round startups.

Yet the Swedish and Finnish games industries differ in terms of their overall focus.

Because where the Swedish industry saw early success with triple-A developers such as DICE and Avalanche Studios working on PC and console titles, the Finnish industry focuses primarily on mobile games.

Still, despite their differences, it seems that both industries are starting to find great success in their second round startups. And we are not only talking about a few second round startups in Finland - 14% (or 25) of the studios established between 2011 and 2015 are second round startups.

"The fact that the Finnish game industry has been able to produce approximately 30 second round studios is also a clear indication of its maturity", stated a recent industry report (PDF) by Finnish non-profit industry organization Neogames.

In the end, this means that while it is true that most Finnish studios do not make it past the first 5 years of existence, they might have an easier time the second time around.

The second round startups aided the stable growth of the Swedish games industry, and they will do the same for the Finnish games industry.