Sam Forrest is director of global communications and Content at KamaGames.

Countless outlets – including this one – have reported about the exponential, global rise of social casino gaming. Nine-figure acquisition deals are commonplace now, especially between companies crossing borders and broaching new continents.

Indeed, according to a report from JP Morgan: “Global revenues from social casino games amounted to approximately $3.7 billion to $3.8 billion in 2016."

That’s startling enough, until you go deeper and see what they’re really saying. That same report says: “While [the survey] estimated $1.7 billion to $1.8 billion of the revenue – or close to half in the range – was generated in North America, it said it believed international expansion could provide the next leg of growth as smartphone penetration increases.”

In other words, there is immense potential for more money to be made and there are billions left sitting on the table.

Whilst we aren’t going to give anyone any investment advice, many Western social casino games developers are looking to Asia as their next market. And why not? Most countries in the region are fast-growing economies, with income, smartphone ownership and access to data climbing exponentially.

Here are a few things to consider for companies considering taking that step.

Data and phones

Up until recent years, smartphone ownership and access to data (both mobile and wifi) has been significantly lower in the Asia Pacific Region than in North America and Europe. That’s changing, though, and fast.

In fact, in many regions, PC and console ownership is relatively low, and the population are leaping straight to mobile devices (this phenomenon of skipping over a tech wave is known as “leapfrogging”).

In recent decades, games consoles were unavailable in some Asian countries and banned in some others (such as China).

This brings us to smartphone ownership: China’s mobile market dwarves its PC and console one, and emerging markets such as Vietnam, Thailand, Indonesia and India are taking a similar approach; opting for mobile devices over consoles and PCs.

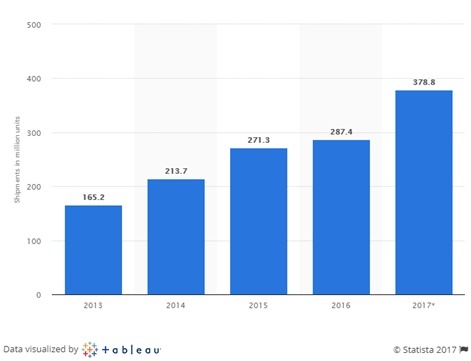

While not quite on par with their Western friends who queue up overnight for the new device, Asian consumers like their phones. As incomes have climbed, ownership has skyrocketed. Statista reports that approximately 378 million smartphones were sold in the Asia Pacific region in 2017, a jump of over 100 million units on 2016. It’s an exponential climb, as in 2013 the number was 165 million.

Emarketer estimates that: “The Asia-Pacific’s region will be home to 1.33 billion smartphone users by the end of [2017], and that their ranks will swell to 1.81 billion by 2021.”

This rise is coupled with the spread of 4G and wifi across these continents: GSMA Intelligence reports that the region will hit an important mobile internet milestone in 2018, as 41% of mobile connections in the region will be on 4G networks, with more 4G connections than either 3G (23%) or 2G (36%) for the first time.

Credit card ownership is still low (compared to Western markets), but there have been some innovations on that front too. For instance, in Indonesia, in-game payments can be paid for in advance with pre-pay deals or via monthly subscriptions.

And on top of all of this, wifi is spreading across the Asia Pacific region too, as it becomes a priority of both international businesses and local governments alike.

Social networks, games developers and social casino developers are only beginning to see the bubbling potential of these hundreds of millions of 4G and wifi-connected smartphones.

Money and social media

Phone accumulation and data consumption reflect what we’re seeing across the world; a general rise in disposable income. Indeed, within a generation, Asia has essentially transformed from a low-income region to a middle-income one.

Within a generation, Asia has essentially transformed from a low-income region to a middle-income one.

However, a key difference is that social media hasn’t evolved in the same way for Eastern audiences. While Western players often value gameplay and graphics, many Asian markets also enjoy the social aspect: Facebook is restricted or unavailable in many countries including China, Bangladesh and Malaysia, leading to communications via other social networks and with social casino gaming.

Why poker?

If you’re reading this in Europe or America, you already know of the cultural cache of poker: The game (and indeed Las Vegas itself) has seen a steady flow of cultural PR in the past two decades, from Casino Royale to the Ocean’s movies via Rounders and even films without card games as a theme, such as Girls Night and the recent Blade Runner sequel.

Poker has seen an upswing in revenue and profile in Asia too. As a result of the relative prosperity in Asia, regions like Macau see booming business: Its real money gaming revenue is expected to be up 19% year on year for 2017, an estimated $25 billion.

Macau’s profile has risen across Asia, as it hosts a growing number of international poker tournaments. Meanwhile, high-profile professional Chinese poker players like Dong Kim and Xuan Liu bring the game’s profile to a younger audience.

Beyond its cultural value, poker suits mobile customers for a number of reasons; a game can be as short as a dealt hand (less than a minute) or can run for hours and even days; it’s accessible to newcomers, but has a depth that allows for improvement over a lifetime; it’s sociable (players can communicate with words and with how they play); and the clear formatting of a hand of cards suits a mobile device perfectly.

Big deals in poker games

The past two years have seen immense investment in the international social casino game market, with eight-figure and nine-figure deals becoming more and more commonplace. These deals are frequently between existing gaming giants and mobile card and social casino games companies.

Australian slot machine company Aristocrat bought social gaming company Big Fish for $990 million. Zynga bought Peak Games’ mobile cards studio for $100 million. Penn National (which owns racetracks) bought Rocket Games (a US social casino studio) for $60 million.

On the Asian casino games front, Playtika (formerly owned by Caesars) was bought by a Chinese consortium in 2016 for a whopping $4.4 billion, bringing their portfolio of games to a whole new audience.

Meanwhile, in other parts of the region, Korean social casino company DoubleDown was acquired by DoubleU (also Korean) for $825 million.

Different region, same goal

Ultimately, developers and players want the same things wherever they are. Developers, from Texas to Thailand and everywhere in between, want a growing userbase at a reasonable cost per user. Players (whether they value graphics, gameplay or socialising) want a fun and engaging user-experience.

Once you iron out the gameplay and marketing, there are other issues to address, from local infrastructure knowledge, to legislation and beyond.

The Asia Pacific region looks different from the Western one at the moment. But the seeds are being sown, green shoots are already sprouting, and – if investment figures are anything to go by – those billions of dollars won’t be left sitting on the table for long.