As any good early stage VC will tell you, you invest in people (and companies), not products.

Until something sticks, products are ephemeral. But smart people and good companies can, if they properly process their failures, find the stepping stones to eventual success.

Yet as plenty of entrepreneurs have discovered, you can also spend multiple million-dollar VC rounds pivoting around the golden intersection of user experience and audience and never hit the target.

Smart people take you far, but only so far.

The colour (and velocity) of their companies’ P/L is the ultimate judge of whether an investment worked out.

On the up

Thankfully for US mobile game publisher Scopely, over the past years, it’s demonstrated an uncanny ability to simultaneously raise VC cash and release multiple successful products.

Its recent announcement of a Series C round of $60 million, which follows $55 million raised in 2016, brings total funding to almost $160 million.

Combined with the revenues generated by games as varied as The Walking Dead: Road to Survival and Yahtzee With Buddies, Scopely’s valuation is now somewhere between $540 to $600 million, depending on who you believe.

At that scale, the tricky decision becomes whether to continue to scale up and try for an IPO or start looking around for a Tencent, NetEase, or Netmarble-sized trade exit.

It’s a nice decision to make, although as Kabam recently demonstrated, being too public about the former can result in a messy latter.

For Scopely, the future is just the beginning.

For Scopely, however, the future is just beginning. It’s about to release a match-3 spin-off to one of the most downloaded mobile game franchises ever - Temple Run: Treasure Hunters - and has even managed to successfully mash-up match-3, role-playing and wrestling in the form of US top 100 top grossing game WWE Champions.

It was all rather different when the company’s launched its first With Buddies games in 2012, though.

High standards

Back then, social gaming platforms were still the rage, with the likes of DeNA’s Mobage duking it out with custom services from GREE, Gamevil and Gameloft, and for a time Scopely attempted to get in on the act with its multiplayer and monetisation platform, then labelled LevelUp.

It was also keen to position itself within the new wave of F2P mobile game publishers - Publishers 2.0 as we dubbed them - that were springing up.

According to CEO Walter Driver, Scopely wasn’t offering its partners publishing services. Instead they were signing up to 'a next generation consumer mobile entertainment network that provides an entirely new development and distribution model to developers'.

In practice what this meant was Scopely worked very closely with a small number of companies, but even that wasn’t a guarantee it would release your game.

"We test games in soft launch, but they can't meet our KPIs, we'll hand them back to the developer," Driver told us, back in 2013.

Yet it wasn’t until the release of The Walking Dead: Road to Survival, which was developed with veteran Canadian studio IUGO, that Scopely’s reputation rose beyond being a well-funded startup with a vision and some okay Zynga-style casual games.

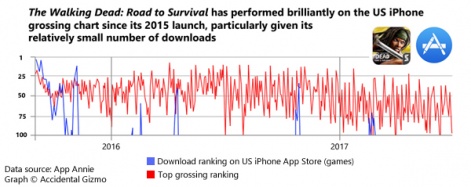

Road to Survival has been a very solid App Store US top 50 top grossing game since launch, and peaking at #8 in April 2016. Released later on Google Play, it’s been a top 40 grossing hit in the key western markets.

The resulting revenues have been the foundation for Scopely’s recent corporate performance, and the $110 million of VC cash it’s raised over the past 12 months.

Tightening the screw

There are, of course, many reasons why a company becomes successful. The interaction of smart people, smart business processes, and product selection and development can be difficult to unpick.

More recent deals have been deeper, often involving Scopely taking a financial stake.

Yet, there are some obvious ways over the years in which we can see how Scopely has improved operations.

As Driver stated, it didn’t release all the games it signed. From its original list of five partners in 2013, it only released one game - Rocket Jump Games’ Mini Golf MatchUp.

Since then, however, its hit rate - in every sense - has improved. It released Space Inch’s Disco Bees in 2013, while an investment in Digit Game Studios saw the acquisition of Kings of the Realm. Neither game has been a big success, but at least they were released.

More recent deals have been deeper, often involving Scopely taking a financial stake in the developer.

Its long term partnership with Kung Fu Factory has resulted in WWE: Champions, while its investment in Redemption Games will see Scopely publish its first two games, including debut Temple Run: Treasure Hunters, which is currently in soft launch.

We believe Scopely has “built the most extensive and effective marketing platform in the entire mobile industry”, Redemption commented when the deal was announced.

Decision-making

More public evidence of Scopely modus operandi comes from the long soft launch process its games undertaken.

WWE Championship was in soft launch for over a year before it was released, while another licensed game Breaking Bad: Empire Business was tested for a similar time until it was pulled from the App Store, presumed canned.

Post-Supercell, having the rigour to kill games that won’t meet sales prediction is, perhaps, considered commonplace. But neither it, nor holding back a licensed IP for prolonged testing, actually is.

And it’s this behaviour - and the promise of games like Temple Run: Treasure Hunters - that’s encouraged venture capital companies to keep investing in Scopely.

As they know only too well, smart people, a good company, and successful products are an explosive combination.