Master the Meta is a free newsletter focused on analysing the business strategy of the gaming industry. MTM and PG.biz have partnered on a weekly column to not only bring you industry moving news, but also short analyses on each. To check out this week’s entire meta, visit www.masterthemeta.com! The full version of this deep dive is available here to read.

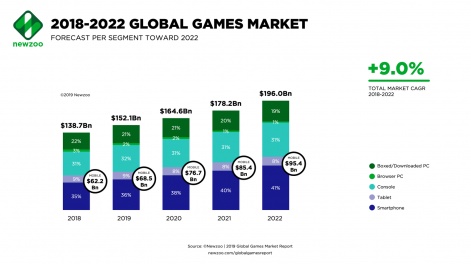

The emergence of smartphones and app stores a decade ago marked the beginning of a seismic shift in the gaming industry. As the years rolled on, it gradually became clear that mobile gaming would grow to become the dominant gaming platform both in terms of reach and revenue.

This new and massive market opportunity wasn’t something that the major PC/Console video game publishers could justify ignoring. Most of them made efforts to break into the mobile market, unlock significant revenue drivers and achieve staying power. But success proved harder to capture than it looked, and most large traditional publishers still haven’t cracked the mobile market in a sustainable and scalable way.

Today, two big trends are noticeable among various PC/Console-focused publishers -

- The implementation of free-to-play mechanics in PC/Console titles

- Continued efforts to grow a mobile business

We explore the second trend, with the key questions being - can traditionally PC/Console-focused publishers actually achieve scalable and sustainable mobile success? And if yes, what strategies and tactics can they use to get there?

While the answer to the first question is a simple “yes”, the second question is more complex. After analysing three major PC/Console publishers who found respectable mobile success, we developed a business strategy framework called the “6 Paths to Mobile”, which helps answer the second question in a more structured fashion.

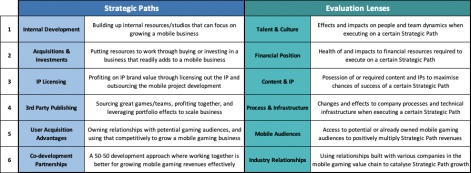

Introducing the 6 Paths to Mobile Framework

The “6 Paths to Mobile” framework has two key elements -

- Strategic Paths - Distinct business opportunities to capture the mobile market

- Evaluation Lenses - Key vectors to evaluate the effectiveness of each Strategic Path

In other words, the Strategic Paths help aspiring businesses map out exactly where to find mobile success, while the Evaluation Lenses help those businesses understand where they currently stand on that map.

Here is a quick summary of how we define each of the Strategic Paths and Evaluation Lenses -

Before diving deeper into defining the framework, it is important to understand that the framework design was driven by our analysis of three major PC/Console publishers who found respectable mobile success. So let’s understand these stories first.

Case 1: Warner Bros. Interactive Entertainment

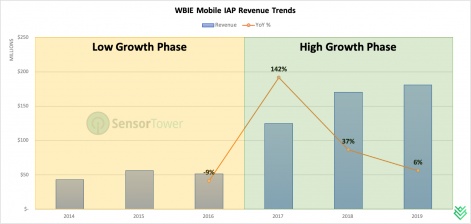

Warner Bros. started its video game journey in 2004 by founding Warner Bros. Interactive Media - now called Warner Bros. Interactive Entertainment (WBIE). Between 2004 and 2010, WBIE mainly focused on building a strong foothold in the PC/Console market. However, with mobile gaming growing more relevant, WBIE proactively expanded its focus in the 2010s. Although it took several years to find scalable success, the team eventually captured massive mobile revenue growth starting in 2017.

A mix of Strategic Paths were used by WBIE to get to this point, with “Internal Development” and “Acquisitions & Investments” being very lucrative during the High Growth Phase. We were not able to source revenues through “IP Licensing”, but given the number of popular brands Warner Bros. has at hand, it’s safe to assume this Strategic Path played a role too.

Pre-2017: The Low Growth Phase

Pre-2017, WBIE’s mobile revenue graph was dominated by Internal Development. And as you can tell by the mostly flat blue line above, WBIE hadn’t yet figured how to scale its mobile success. Many titles were released, but all of them followed a similar trend: an IP-fuelled monster release quarter followed by an inability to scale revenues over its lifetime.

Further, when splitting out Internal Development revenues by internal studio, it also becomes clear that NetherRealm Studios and TT Games were major contributors to the pre-2017 numbers above. In other words, even though the individual game concepts were great and popular IP helped ensure hit launches, longer-term live operations and growth scaling activities were conundrums throughout WBIE’s key internal development efforts. Major changes were needed and on the way.

Post-2017: The High Growth Phase

So how did WBIE turn its mobile fortunes around? As seen in the earlier graph, WBIE’s High Growth phase is marked by rising revenues from Internal Development and Acquisitions. When splitting those revenues out by studio, two studios and specifically two top-grossing games contributed to WBIE’s mobile turnaround -

- Golf Clash - an Arcade Sports title by Playdemic, which was acquired by TT Games in 2017

- Game of Thrones: Conquest - a 4X Strategy title developed internally by WB Games Boston

Playdemic - A Lucky, but Impactful Acquisition

It should be noted that when TT Games likely started acquisition conversations with Playdemic, Golf Clash was not a proven success. When the acquisition completed, the game was barely out of its soft-launch period. In fact, Playdemic’s pre-acquisition mobile games portfolio achieved only ~20M downloads and ~$16M in IAP revenue. So why did TT Games acquire Playdemic?

Based on publicly available information, TT Games wanted to quickly bolster its mobile games development arm and put Playdemic to work on its LEGO mobile games. Given TT Games’ mobile revenue track record, this move would’ve probably been welcomed by WBIE. Luckily, Golf Clash also came through and contributed to ~35 per cent of WBIE’s 2019 mobile gaming revenues. In hindsight, WBIE achieved 3 things through this single acquisition:

- WBIE strengthened its internal mobile game development revenues and resources.

- The company made TT Games more significant as an internal mobile studio.

- The team eventually learned from Playdemic’s live-ops process and cross-pollinated those lessons with other internal studios.

WB Games Boston - A Brilliant Transformation

In the revenue by studio graph above, WB Games Boston (WBGB) comes out of nowhere with a top-grossing 4X title named GoT: Conquest. But before getting into what WBGB got right with GoT: Conquest, let’s take a quick look at the studio’s beginnings.

While the long version is available here, the short version is that WBGB is the evolution of Turbine, Inc. after it was acquired in 2010 and went mobile-first in 2016. Turbine was a studio that primarily focused on creating PC MMORPGs, with LOTR Online releasing in 2007. In 2016, nearly 10 years later, Turbine saw its first mobile release -Batman: Arkham Underworld - which unfortunately flopped.

It’s important to note that it took almost 6 years after being acquired for Turbine to release its first internally developed mobile title, and 3 years of ongoing layoffs (starting in 2014) certainly didn’t help. Unfortunately, there was a lot of original Turbine talent lost over these years, and hiring the right mobile talent + shifting studio culture to a mobile-first one took significant time.

Then came GoT: Conquest in 2017, which proved to be a standout success. But how was creating such a success even possible after such tumultuous years? Our research suggests there are 4 key reasons.

#1: Hiring for Key Mobile Leadership & Roles: A quick LinkedIn stalking session of WB Games Boston’s company page reveals the breadcrumb trail. For example, the current studio head joined WBGB in mid-2016 and was previously the VP of Games at Zynga.

#2: External Acquihires: In addition to hiring the right people, WBGB further accelerated mobile specific competencies by acquiring The Tap Lab in 2017. Tap Lab’s CEO and CTO currently hold leadership positions on GoT: Conquest.

#3: Gameplay-IP Fit: In the simplest of words, Gameplay-IP fit is achieved when congruence exists between key IP pillars and three entities: the players, IP creators, and gameplay. In this case, the synergy between 4X gameplay and GoT’s IP pillars is particularly strong. With themes like reconnaissance, dynasties, alliances, tyranny, and war oozing out of Game of Thrones, the fit to highly social king-of-the-hill style 4X game is striking. It’s literally a game of thrones! Looking at this across the 4 X’s of 4X games and what key GoT characters stand for, the great fit becomes clear:

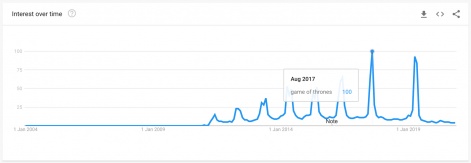

#4: Perfect Launch Timing: Apart from great product design, gameplay-IP fit, and project execution, 2017 was also the year when Game of Thrones was at peak interest levels (as supported by the Google Trends graph below). With GoT: Conquest launching a couple of months after Seasons 7’s last episode, the game ended up positioning itself as a perfect chase to the season’s high.

Framework Learnings from WBIE

In summary, it is clear that WBIE was able to turn its mobile gaming business around through a mix of:

- Acquisitions & Investments, notably Playdemic

- Internal Development, with a focus on hiring the right people to build for mobile

- Pairing valuable IP with a healthy dose of good execution, timing, and luck

It’s hard to be objective about luck, but WBIE’s narrative shows that even though Acquisitions & Investments can turbocharge certain efforts or skills, building a strong Internal Development team is mission-critical.

Check out the full analysis on Master the Meta! We cover the stories of two more companies (Activision Blizzard and Tencent), get into the details of the each Strategic Path, and finally apply the framework to Electronic Arts’ story to see how they could best approach attaining mobile success.

Master the Meta is a newsletter focused on analysing the business strategy of the gaming industry. It is run by Aaron Bush and Abhimanyu Kumar. To receive future editions in your inbox sign up here: