It’s the start of a brand new year and the perfect time to start looking ahead at what's to come in 2023.

And let's start with the good news. The mobile games market remains the most profitable sector of the games industry at $92.2 billion in 2022, according to Newzoo.

But the real excitement is around where we're headed, which is pegged to be a loud and lucrative market, according to GlobalData. It reports that the mobile games industry will be worth $250 billion by 2030. With its majority market share and an experimental approach driven by lower development costs compared with other platforms, mobile leads the games industry where others will ultimately follow.

So let's look at the top 10 new and emerging trends that will dominate the mobile games industry for the next 12 months and more.

1) Subscription-based monetisation

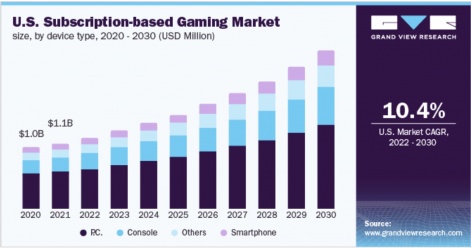

The global subscription-based gaming market is poised to surge. The market size was valued at USD 8.25 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.8% from 2022 to 2030, as reported by Grand View Research (GVR).

The research firm also forecasts that the smartphone segment will show the highest CAGR (16.8) for the period 2023-30. The total revenue for the subscription market will reach a whopping $24.1 billion in 2030.

But some regions will shine brighter than others. For example, the APAC region, which dominated the market with a share of over 40.0% in 2021, is anticipated to expand at the highest CAGR over the forecast period.

2) AAA growth as big publishers prioritise mobile

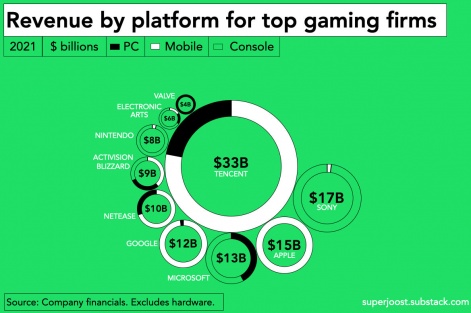

The 10 largest game companies in the world generated a combined $126 billion in revenue in 2021 (excluding hardware). And Sooperjoost data shows mobile accounts for the lion’s share.

It reckons Tencent generated $33 billion in revenue, more than three-quarters of which (approximately $24.75bn) came from mobile. That's more than the total of any of the other listed companies.

As a result, established games companies such as Activision Blizzard and Electronic Arts are growing the mobile share of their portfolios to capitalise on this trend. Ubisoft, in particular, has been vocal about its ambitions to grow its biggest IPs via free-to-play mobile releases.

You can be sure we’ll see more of this activity in the next 12 months.

3) Emerging Markets

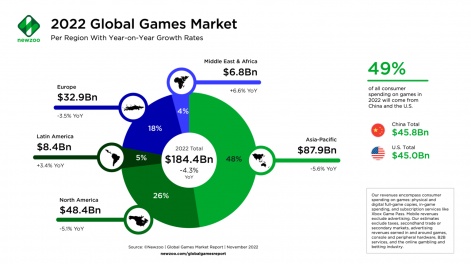

In a year of overall shrinkage for the games industry, just two territories saw year-on-year revenue increases in 2022, according to Newzoo:

- Latin America: +3.4% year-on-year to $8.4 billion

- The Middle East and Africa: +6.6% to $6.8 billion

A special mention for Saudi Arabia, where half the population identifies as regular gamers, while KSA's Vision 2030 initiative will see the state invest $38bn in the region from the Public Investment Fund via Savvy Games Group.

The Financial Times recommends that companies look east' for growing digital economies. But the recent avalanche of interest in countries such as Saudi Arabia is a sure sign that studios serious about maximising profit should look to the MENA market specifically.

4) Multiplatform releases

It only makes sense to make a game you can release everywhere, with even Xbox's Phil Spencer publicly lamenting the brand's lack of presence in the mobile sector.

Microsoft CEO Satya Nadella told CNBC, “Our entire goal is to bring more competition and more options, for both gamers to be able to play everywhere and for publishers to have more competition. Because the real issue is how do you really reach all platforms?”

Niko Partners highlighted Genshin Impact by MiHoYo as a multiplatform highlight, with the game being released on PC, PlayStation 4 and 5, iOS and Android. By May this year, it had generated $3 billion in revenue on mobile alone.

Expect to see this trend dominate in the near to medium future.

5) More company acquisitions and mergers

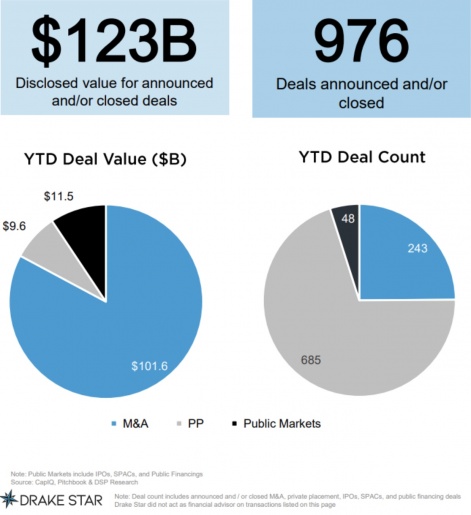

The first three-quarters of this year saw 976 games industry deals worth a total of $123bn. There were 81 mergers and acquisitions in Q3, up 11 on the previous quarter, including the yet-to-be-concluded Microsoft & Activision Blizzard deal - the most expensive video game acquisition of all time.

Other big deals include Embracer Group's acquisitions; Unity’s merger with ironSource; NetEase’s acquisition of Quantic Dream; and Sony’s acquisition of its first mobile studio, Savage Game Studios.

Interestingly, Pollen VC reports that 85% of all studios acquired under $1bn FY 21-22 self-published their games.

Expect to see more deals as the big names look to both establish their credentials and attract new users through business acquisitions.

6) Shift from hypercasual

This September, CMR reported a 27% surge in hardcore smartphone gaming in Western Europe. The same report found that hypercasual gamers declined 32% in the same timeframe.

In July, GameRefinery reported that the top 200 grossing mobile titles in the U.S. feature nine midcore versus just three casual games.

This change is driven by better mobile hardware specifications and increased attention from major publishers. This dovetails with PocketGamer.biz’s own prediction that Midcore games are indeed on the rise.

There will always be a place for casual games. Still, we are now seeing a transitionary phase where even users that haven't historically identified as 'gamers' are looking beyond gateway content to further enjoy their new pastime.

7) Play-to-own

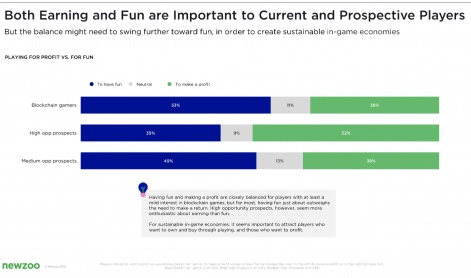

Play-to-earn was one of the early use cases of blockchain by financially rewarding gamers for their time investment. This has now fallen out of favour due to the lack of quality content, replaced by play-and-earn or play-to-own.

Significantly, play-to-own will benefit from the advent of an increasing number of metaverses - or metaverse-like products - where ownership of assets will become critical as the sector develops.

8) The metaverse

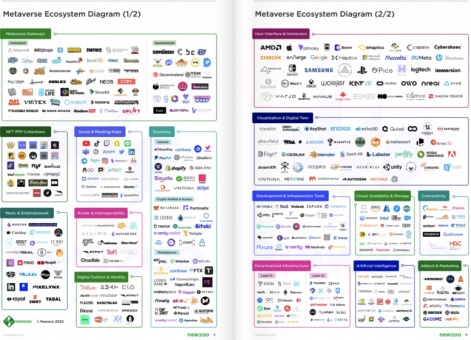

While the debate rages about what the metaverse is (and isn’t), there’s also rising interest and activity as companies jockey for position and buzz.

Lifestyle brands such as Adidas, Gucci and Burberry are already keen to get involved. And for a good reason, as Roblox and Fortnite are two of the leading proto-metaverses and gaining serious steam.

While the metaverse is a land grab right now, it will become increasingly important for new game projects looking to explore transmedia boundaries.

9) Independent game-specific stores

The leading mobile app stores - Apple's App Store and the Google Play Store - have been forced to allow developers to sell cross-platform. In practice, this paves the way for developers to monetize in-app purchases outside of mobile apps and with other payment services and mechanisms.

It’s not goodwill; it’s the law. The U.S. courts issued a permanent injunction in September 2021 in response to the Epic Vs. Apple lawsuit. The European Commission's Digital Markets Act (Nov 1, 2022) also comes into effect on May 2, 2023.

This is crucial for game creators because independent game stores serviced by third parties offer lower fees plus more payment options while enabling consumer-facing branded content.

Forward-thinking developers and publishers will continue to operate within established stores while funneling their users towards more lucrative outlets where possible - and that’s a smart move.

10) Generative AI

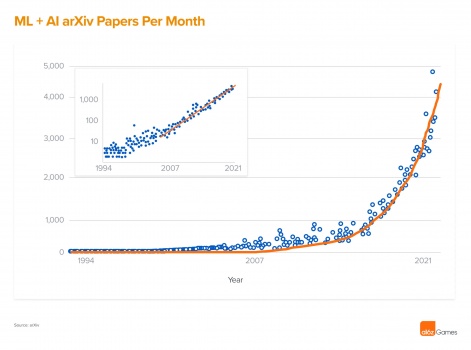

Look for Generative AI to dominate the games industry conversation and generate the most buzz over the next year. And Nvidia's recently announced Magic3D ensures it will be a mega-trend.

It's either the most cost-effective, time-saving approach to asset generation since the birth of video games or the most prevalent erosion of creator talent since copy/paste became a thing in text processing.

Whether you are morally put off or creatively turned on by the possibilities, AI makes making assets faster, so expect to see more games by more (smaller) developers to wash, rinse and repeat at every stage of the game life cycle with impressive results. But the best results will come when studios learn the soft skills to co-create with AI, not be bullied by it.

The end? Or the beginning? What comes next is up to you. I look forward to seeing what you create in 2023.