Master the Meta is a free newsletter focused on analysing the business strategy of the gaming industry. MTM and PG.biz have partnered on a weekly column to not only bring you industry moving news, but also short analyses on each. To check out this week’s entire meta, visit www.masterthemeta.com!

Playtika plans to go public very soon and raise $1.6 billion at nearly a $10 billion market cap. In preparation of IPOing, Playtika released its S-1 last December, and there are lots of interesting details. Playtika’s mission is “to entertain the world through infinite ways to play” and they realise it through “Technology and Data.” This translates into a company that:

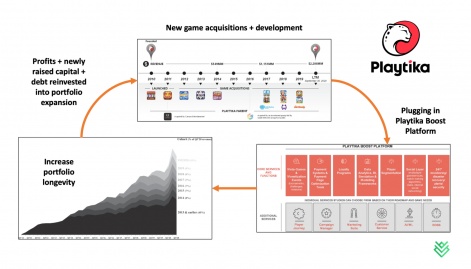

- Acquires companies whose product portfolios have broad appeal and are very fertile for live operations-driven growth (Jelly Button, Wooga, Seriously, Supertreat).

- Plugs them into the proprietary Playtika Boost Platform, a technology-rich suite of 13 services centered around automating, monitoring, and optimizing various product design, user acquisition, and backend game operations.

- Increases portfolio longevity using this platform and through a highly data-driven live operations process.

The above strategy (hi-res image here) has resulted in decent business growth over Q1-Q3 2020, which of course also experienced a COVID bump -

- Revenues grew +28 per cent to $1.8 billion

- Daily active users grew +15 per cent to 11.4M

- Daily paying users grew +39 per cent to 290K

- Average daily payer conversion grew +19 per cent to 2.5 per cent

- Average revenue per daily active user grew +12 per cent to $0.57

Given the above, Playtika has three notable future growth opportunities. However, it is also here where various business risks start to emerge:

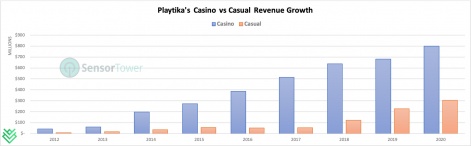

#1 - Continued portfolio revenue and MAU growth: Playtika has a proven track record in using its technology and processes to grow game revenues over multiple years. Four of its oldest casino-themed games still contributed ~65 per cent of total Q1-Q3 2020 revenues. While doing more of the same will be key to their future growth, they do have a 20 active game portfolio indicating some amount of revenue concentration in old Casino games. Further, their method is still being proven out regarding the newer Casual game portfolio.

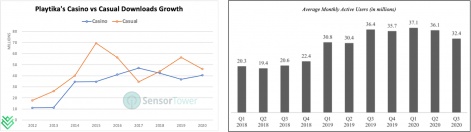

Additionally, Playtika’s MAU has suffered some stagnation since Q1 2019 and no growth over 2020. This could reflect hitting a portfolio-wide user acquisition ceiling, which has also been a long-standing issue in the Casino genre. User acquisition is not going to get any easier post-IDFA, and Playtika’s cash cow games are typically dependent on finding, acquiring, and retargeting high value “whale” players. Playtika has made significant strides in personalisation technology though, which will likely prove to be beneficial in a privacy-first world.

All considered, squeezing the lemon can only go so far, which means there’s growing pressure for the next two growth opportunities to better contribute.

#2 - New game development: Given Playtika’s product portfolio growth strategy, it is likely that new game development will come through their acquired studios. Unfortunately, none of them have been able to launch any significantly successful new games since 2017, a year when Wooga’s “June’s Journey” and Jelly Button’s “Board Kings” were launched. Playtika knows this and they did set up a Casual Games Lab back in 2019. While there are some new games currently in soft-launch, more recent and more frequent success with this growth avenue remains to be proven out.

#3 - New acquisitions: M&A is a cornerstone of Playtika’s portfolio growth strategy, but they’re highly selective with only three casual game developer acquisitions in the past four years. Further, 2020 showed us how heated the mobile M&A market is and how quickly the potential target pool is drying up with Stillfront-like roll-up strategies gaining prominence. It also means the remaining casual genre acquisition targets will likely grow more expensive.

Further, Playtika has heavy debt ($2.3B) and paid 60 per cent of its operating profits in interest over 2020! Strangely, it looks like they used cash flow for previous acquisitions, and this debt was taken on to provide a $2.4B special dividend in 2019. While Playtika can handle this debt, it does reduce flexibility to make big acquisitions. Wanting to pursue more deals may explain why Playtika’s going public to raise money, but the capital could also go to paying down existing debt. Either way, raising money is a means to increasing general flexibility, and there’s a chance Playtika targets new genres.

Overall, Playtika is a decent business with a great technology platform and a robust data-driven process to scale games. But we’re not blown away. Their casino revenue probably lacks meaningful upside, and a lot needs to be proven out in casual. MAU growth is stagnating and user acquisition will not get any easier post-IDFA. Success with new games is sporadic and needs to accelerate. And given the company’s heavy debt load, Playtika’s not entering the public market in excellent financial health, which could affect its ability to strike big deals at great terms.

In a nutshell, while Playtika has executed well until now and there is abundant opportunity left, it’s unclear what exactly will drive long-term growth, which adds risk. We’re looking forward to following the company and updating you all on its progress over time. Make sure you’re subscribed if you wish to receive future updates.

Master the Meta is a newsletter focused on analysing the business strategy of the gaming industry. It is run by Aaron Bush and Abhimanyu Kumar. To receive future editions in your inbox sign up here: