Master the Meta is a free newsletter focused on analysing the business strategy of the gaming industry. MTM and PG.biz have partnered on a weekly column to not only bring you industry-moving news, but also short analyses on each. To check out this week’s entire meta, visit www.masterthemeta.com!

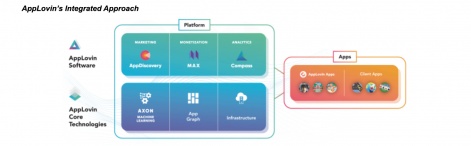

The long-awaited AppLovin IPO is finally seeing the light of day. The company filed its S-1 this past week, and it was a pleasure to read. Founded in 2011, AppLovin’s mission is to “grow the mobile app ecosystem by enabling the success of mobile developers”. It does so by providing a suite of Core Technologies and Software that drive both app growth and revenues for its business customers through an elegant six-step process:

- App Graph collects ad interaction data across all apps working with AppLovin.

- AXON uses that data in its ML algorithms to match app users to relevant ad content.

- AppDiscovery curates that ad content by matching advertiser demand with publisher supply.

- MAX powers those matches by running real-time competitive auctions for in-app ad slots.

- Compass analyses those auctions to deliver ROI insights through an analytics tool.

- Mobile developers are enabled by the above technologies and insights to not only drive more installs to their apps, but also continuously optimise the ad revenue generated per new install acquired and therefore drive towards a positive ROI equation.

Since AppLovin knew they’d build out the above reality for the vast market of third-party mobile developers, it probably was a no-brainer internal decision to apply the above process to their own portfolio of games, too. And that is exactly what they did in 2018 through AppLovin Apps - a portfolio of AppLovin owned and partnered on games that’s being built out through a mix of in-house development, third-party publishing, and strategic mobile game studio acquisitions to drive both its consumer and business revenue streams. This clever vertical integration results in a healthy business flywheel where AppLovin uses its unified marketing, monetisation, and analytics technology stack to drive user growth and revenues across the entire AppLovin Apps portfolio.

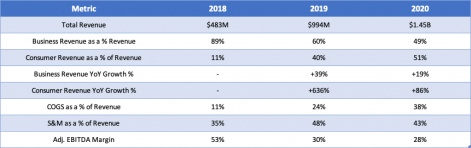

On the face of it, this flywheel might feel like AppLovin’s created major conflicts of interest with its 1,400 Business customers. But in my (Manyu, here) eyes, AppLovin is in the midst of a well-thought-out business model evolution, which is not only being executed on well, but also unlocks the company’s next stage of long-term growth. The reason why can be deduced from the following numbers, where:

- Business Revenue is generated from advertisers spending on Software and Apps. Software revenues, which is mostly from AppDiscovery, is generated from advertisers utilising various AppLovin’s core technologies and softwares. Apps revenues come from advertisers that purchase ad inventory on AppLovin’s diverse portfolio of owned and partnered on games.

- Consumer revenue is generated through IAP purchases made by users on AppLovin Apps.

Clearly, revenues continue to grow swiftly, even though 2020’s +46 per cent YoY growth rate was lower than 2019’s +106 per cent YoY growth. And notably, EBIDTA has taken a hit over the last three years (although still impressive and translates into strong cash flows) with 2020 ending at 28 per cent, which is mainly driven by increases in cost-of-goods-sold (COGS) and sales & marketing (S&M) expenses. So, why have both of these expenses been increasing? This is primarily because AppLovin is slowly transitioning its revenue mix over to first-party Consumer Revenues versus third-party Business Revenues. In other words, AppLovin’s focus is shifting to its own AppLovin Apps rather than its Core Technology and Software Business customers.

To illustrate this, AppLovin’s 2020 Business Revenues grew +$115M YoY, and ~92 per cent of this was driven by advertisers purchasing ad inventory from AppLovin’s diverse portfolio of apps. And this Business Revenue from Apps made up for 71 per cent of 2020’s overall Business Revenue. Only ~8 per cent of 2020’s Business Revenue growth was driven by Business Revenue from Software. Simply said, there is more revenue upside for AppLovin by selling ad placements within a highly downloaded and top-grossing first-party app portfolio. No wonder their first step towards AppLovin Apps in 2018 was to set up Lion Studios as a third-party publishing unit for primarily ad monetised games, and further backing it up with strategic investments into ad monetisation reliant mobile game studios such as PeopleFun and MagicAnt in the very same year.

Further, 2020’s Consumer Revenue increased by +$342M YoY, primarily due to a +41 per cent increase in the volume of in-app purchases, as well as a +32 per cent increase in price per in-app purchase. Apps acquired during 2020 generated ~57 per cent of the increase, while apps that were part of AppLovin’s portfolio prior to the beginning of 2020 and newly developed apps accounted for the remainder. The increase in IAP-driven revenues naturally results in higher platform fees that need to be paid out, which contributed to ~36 per cent of the COGS increase, while most of the remainder was driven by an increase in amortisation of acquired-technology due to increased acquisition activity. And as we all know, this level revenue growth requires heavy user acquisition investments, which is why S&M continues to be a significant cost sink that will most likely turn out to be ROI-positive in the long-run given the top-grossing apps these investments are being made in.

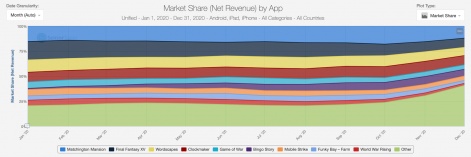

As AppLovin increasingly fuels its revenue through first-party content, the business risks move closer to that of any large mobile games publisher. The most imminent one is related to Apple’s deprecation of the IDFA, which is underscored by how a majority of revenue driving AppLovin Apps depend on targeted user acquisition and the consequent rise of S&M costs. In AppLovin’s defense and to slightly combat this risk, it’s good to see that no single game contributed more than 16 per cent of 2020’s total revenue and the portfolio is highly diversified across genres, such as word, hypercasual, match-three, 4X strategy, simulation, and card/casino. Further, AppLovin’s acquisition of Adjust will allow AppLovin to reuse Adjust’s technology to measure ROI performance across its entire app portfolio without having to fully own these partnered on apps.

Other key business risks are mostly the converse of three specific business growth opportunities:

- First - growing revenues from the existing portfolio of AppLovin Apps. Most of this will come down to how well its owned and partner studios continue to execute on the excellent live operations they’ve already been carrying out, and how well AppLovin can multiply that value generated through ROI-efficient user acquisition efforts as the market moves towards a privacy-first context.

- Second - utilising the relationships with its owned and partner studios to build new hit games. This is a key strength for AppLovin, as most of the studios in its portfolio have a strong track record in creating strong long-tail top-grossing titles. That said, we’re all aware of how hit and miss that effort can actually turn out to be.

- Third - pursuing more accretive strategic studio acquisitions and partnerships. Again, AppLovin has a very strong track record here (PeopleFun, Magic Tavern, Belka Games, Machine Zone etc.), but the M&A market is hotter than ever and that’s not making this growth opportunity any easier to achieve.

In conclusion, if I had to speculate about why AppLovin is executing on this business model evolution, my bet would be on a smart management team realising the importance of changing the game when the original game they were playing had the cards stacked against them. In other words, why take on Facebook’s and Google’s asymmetrically front-running ad network business, when AppLovin can utilize a proven technology stack as a strategic advantage to not only grow its total addressable market, but also gain market share over the myriad of competing mobile game publishers. This is simply a very good business and our best wishes are with the team for their first day of trading!

Master the Meta is a newsletter focused on analysing the business strategy of the gaming industry. It is run by Aaron Bush and Abhimanyu Kumar. To receive future editions in your inbox sign up here: