Global app revenues will reach $44.8 billion in 2016, with its growth powered by China and the US.

The new 2016 Global Mobile Market Report from Newzoo, which you can download here, delves into the state of the sector, its growth potential and the key drivers for this.

Global app revenues are expected to hit $44.8 billion this year, with 82% of that generated by games alone. Revenues will grow significantly by $35.8 billion to $80.6 billion by 2020, with much of this rapid growth driven by increasing internet and smartphone penetration in developing markets.

The share of revenue brought in by games is expected to fall to 72% by 2020, however. But rather than games revenues falling, this will be due to non-game app revenues growing faster over this period due to the increasing popularity and willingness from consumers to pay for other entertainment, music and social apps.

Worldwide growth

In 2015, China made more in revenue from mobile apps than the US for the first time in its history, and it doesn’t appear to be looking back. This year, it’s anticipated app revenues in China will reach $11.9 billion, compared to $9.4 billion in the US.

In fact, it’s more than the app revenues set to be generated in the entire of North America, predicted to bring in $10.1 billion.

China is expected to further the gap between itself and the US with mobile app revenues set to more than double 2015 figures to $18.8 billion in 2020. Of this, $14.9 billion (79%) will come from games.

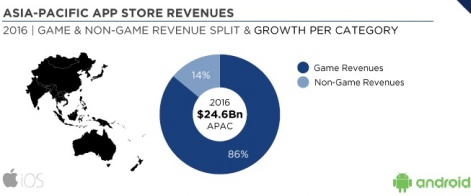

Overall Asia-Pacific mobile app revenues are expected to hit $24.6 billion in 2016, 86% of which will be generated by games. The region will grow to $42.9 billion in 2020. This growth will still be largely driven by China and Southeast Asia markets however, with Japan and South Korea showing slower growth than most other markets.

US growth is still no slouch though. Mobile app revenues will rise to $14.2 billion in 2020. Interestingly, games are estimated to make up just 57% of that – though this is still an impressive $8.1 billion.

European app store revenues meanwhile will reach $6.2 billion this year – with games making up 83% of all revenues. This will rise to $9.6 billion in 2020, with growth lower than the global average due to the mature market and slow economic growth in the region. Games’ share of revenues will drop from 83% to 69.5% by 2020.

Elsewhere, Latin America will generate $2.1 billion in mobile app revenues in 2016 and $6.4 billion in 2020, while the Middle East and Africa will rise from $1.8 billion in 2016 to $6.6 billion in 2020 – growth far above the global average.

Key gaming metrics

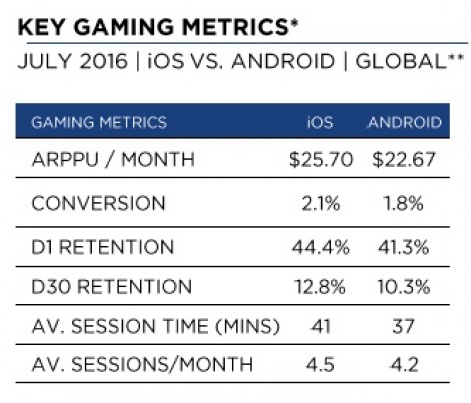

A particularly interesting section of the Newzoo report breaks down average global key gaming metrics between iOS and Android in July 2016. All game metrics are 75 percentile figures (for a full month), to benchmark against successful games.

The data shows that average revenue per paying user for iOS in July was $25.70, compared to $22.67 on Android. Conversion rates on iOS are also slightly higher on iOS at 2.1% compared to 1.8% for Android.

Day 1 and Day 30 retention were also higher on iOS than Android, as were average session times in minutes and over the course of a month.

Games accounted for 76.6% of 2016 global app revenues on iOS, and 87.1% on Android.

Android versus iOS

Despite strong growth for Android smartphones, Apple retained the highest market share of all mobile brands worldwide in July. 34.8% of all smartphones and tablets run on iOS.

Samsung has the second highest market share for its line of phones and tablets at 23.3%. Interestingly, the next three leading mobile brands are from Chinese manufacturers Huawei, Xiaomi and Lenovo.

Apple is the top mobile brand in North America, the Middle East and Africa and Asia-Pacific, while Samsung has the largest share of the Latin America and Europe markets.

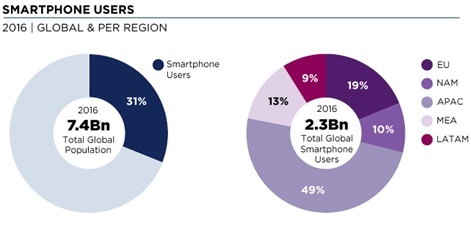

In total, Newzoo expects 2.3 billion people across the globe to be active smartphone users by the end of 2016 – 31% of the world’s population.

Nearly half of these (49%) are based in the Asia-Pacific region. It noted that the Middle East and Africa have the lowest smartphone penetration, with just 19% of the population using their smartphones regularly.

China itself accounts for 30.2% of actively used smartphones in the world.

Mobile demographics

The Newzoo report also delves into mobile consumer demographics to look at the gender split, age groups and other social elements.

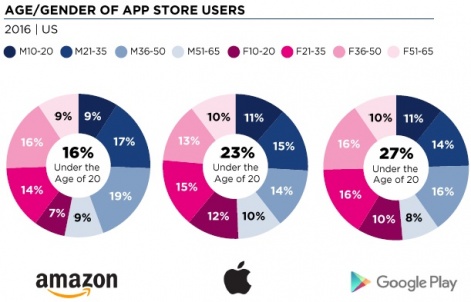

In the US, the gender split on the App Store and Google play is 51% female and 49% male. The Amazon appstore has a gender split of 47% female and 53% male.

Google Play has the largest share of users under the age of 20, while Amazon has the highest share of users over 36. Apple meanwhile has a fairly even split across the age groups, and its devices are particularly popular among men and women aged 21 to 35.

You can read about all the findings, including stats about Pokemon GO, in Newzoo’s 2016 Global Mobile Market Report.