This report is by Daniel Ahmad, Analyst, Niko Partners in conjunction with Sensor Tower.

China is the most important market in the world for mobile games. In the first half of 2017, multiple trends were in play driving the rankings.

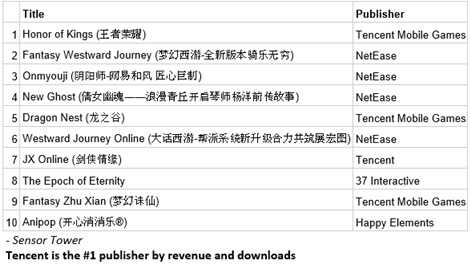

Tencent continued its market dominance with several titles in the top 10 rankings for iOS downloads and revenue. NetEase is close behind with hit games such as Onmyoji and Fantasy Westward Journey. Casual and social casino games also remain popular.

With PC online games at the heart of Chinese gaming, mobile games that are adapted from popular PC games are seeing major success. Finally, we provide an insight into mobile game approvals since new regulations went into place last year.

Tencent continues to dominate in China with its MOBA game Honor of Kings. The game was the number one title on both the iOS revenue and download charts for H1 2017. It saw its revenue grow over 300% year-on-year and downloads were up 135% year-on-year on iOS.

Both increases were driven by new content, in-game events and eSports competitions. In fact, the game is so big in China that it was also the number one most downloaded game on iOS globally for the first half of 2017, beating the likes of Super Mario Run and Clash Royale.

When combining revenue from iOS and all Android stores, Honor of Kings is the number one grossing game of the year so far on a global basis.

After strong performance In China, the company is now looking to duplicate the success of the game overseas. Tencent has already released Honor of Kings in South Korea under the name Penta Storm. In Southeast Asia the game is known of Realm of Valor. In the West, the game is known as Arena of Valor.

Tencent is gearing up to launch the game across North America and Europe in the second half of this year and aims to appeal to Western gamers by partnering with DC Comics to introduce well-known characters such as Batman to the game.

Honor of Kings introduces new restrictions for minors

Tencent recently announced that it would introduce restrictions on play time for minors in its Honor of Kings game. This move comes after new regulations were introduced on May 1st, 2017 that strengthened online gaming policies in China.

Players aged 12 and under can only play one hour per day and cannot log in after 9pm. Players aged 13 to 17 can play up to two hours per day. The company has also introduced real name registration for Honor of Kings this year.

The impact of this move has been limited so far as only a small percentage of players are under 12 years old and most of them don’t play more than one hour per day. We still expect Honor of Kings to see strong growth in the second half of 2017.

NetEase comes in at number two

NetEase continues to be the second largest games company in China. Fantasy Westward Journey, an MMORPG based on the Journey to the West tale, continues to rank just behind Honor of Kings on the iOS revenue chart. NetEase has also found success with other titles such as Onmyoji in third, New Ghost in fourth and Westward Journey Online in sixth.

Launched in September 2016, Onmyoji is a hit turn-based RPG with card battle elements. The game recently surpassed over 200 million downloads worldwide and its success in China is primarily due to its strong gameplay elements, anime style graphics and Japanese mythology.

The game gained traction among China’s anime, comics, games (ACG) fans before reaching a larger audience through media attention and word of mouth. The game is set to come West later this year.

Casual Games make up the download chart

Happy Elements had two casual games in the top 10 download chart for H1 2017. Anipop Beach Holiday ranked in third and Anipop was sixth. Anipop is a simple match-3 game that has over 30 million players worldwide and is one of the most popular casual games in China.

Another popular casual game in China is Snake Battle by Weipai Network which was second on the download chart. The game is very much a clone of Slither.io which found success in the West earlier this year.

One other casual game that is in the top download charts is Giant Network’s Battle of Balls at number eight. The title has over 300 million downloads, 100 million monthly active users and 25 million daily active users.

The title, which is like Slither.io and takes place in an arena, is a competitive multiplayer game. The game has become so popular that it has become a mobile eSports title in China with its own BPL Professional League.

Social casino games remain popular

Happy Landlord and Happy Mahjong, both published by Tencent, claimed spots in the top 10 download chart. Both games saw an increase in downloads compared to the same period last year. Social casino games are very popular in China, but converting winnings to RMB is prohibited.

PC to mobile game adaptations perform well

A trend that we continue to see month after month is the continued success of PC to mobile game adaptations. This is when a popular PC game is adapted to become a mobile game. In the first half of 2017 there were six mobile games in the top 10 revenue chart that were adapted from popular PC games.

NetEase originally released Fantasy Westward Journey for PC in 2004. The mobile version, which came out in 2015, was a hit and is the number two grossing iOS game in China for H1 2017.

The success of Fantasy Westward Journey encouraged NetEase to continue this trend. New Ghost and Westward Journey Online are also adapted from PC games. Both games now have a spot in the top 10 revenue charts for H1 2017 too.

Tencent has also had success with PC to mobile game adaptations. Dragon Nest Mobile, which launched in March 2017, is the fifth highest grossing iOS game of the year. JX Online and Fantasy Zhu Xian, which are also mobile titles adapted from PC games, rank at seventh and ninth on the revenue charts.

There are plenty more PC game to mobile game adaptations in the pipeline for this year and we expect this trend to continue through 2018.

An update on mobile game regulations

On July 1st, 2016, new regulations came into effect that required all mobile games to be approved before being published in China. It has now been one year since these new regulations went into place.

A total of 8,537 mobile games have been approved from July 2016 to June 2017. Around 5,000 games were approved in the first half of 2017 with 3,500 approved in the second half of 2016. China’s State Administration of Press, Publication, Radio, Film and Television (SAPPRFT) has promised to make the approval process easier and shorter.

The SAPPRFT is on track to approve more than 10,000 mobile games for the whole of 2017.

Total revenue generated by the top 10 grossing iOS games grew 45% year-on-year. The increase was primarily driven by the continued growth of Honor of Kings and other hit titles, as well as the successful launch of Dragon Nest Mobile.

Mobile games are the fastest growing segment in the China games market and the segment is projected to generate higher revenues than PC online games in 2018. Please refer to our China Data Report and China Mobile Games Topic Report, both available for sale on our online research store, for more details.

Methodology:

Each month Niko Partners provides analysis in this column on trends in mobile gaming in Asia based on data provided by Sensor Tower on monthly rankings of game apps by downloads and revenue. The country is selected by Niko Partners, out of the list of eight countries we track regularly: China, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Taiwan (Chinese Taipei), and Vietnam. Sensor Tower’s mobile data analytics provides information on iOS and Android mobile apps in all countries except China, where they currently cover iOS only.