In my annual round up of 2012 mobile gaming M&A activity, I wasn't a fan of Nexon's ¥36.5 billion (roughly $470 million) deal for Japanese developer gloops.

"If any of gloops' ten forthcoming mobile games for the US and Europe are hits, the Nexon board will consider themselves business gurus," I pondered, at the time.

"But given the sheer size of the deal, and gloops' almost total lack of success outside of Japan, those executives might do better to check the small print of their employment contracts."

One year on from the October 2012 acquisition and even ignoring the lack of success of "those ten games" - we can take a more informed view.

Past performance, not indicative...

The good news for Nexon has that buying gloops gave it immediate scale, at least in the Japanese mobile games market.

The company's quarterly mobile sales has risen from under ten million dollars a quarter to between $70 - $80 million per quarter since as it rolled gloops' revenue into its own books.

The bad news, however, is that the Japanese mobile games market has been undergoing massive structural change as closed feature phone platforms like GREE and DeNA have been hit by the rise of smartphones and their open app stores.

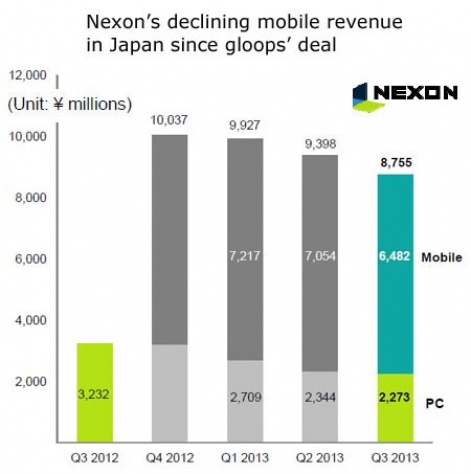

This has resulted in Nexon's Japanese mobile revenues (still mainly gloops' revenues) declining consequectively month-on-month.

Indeed, for Nexon's next quarter - the first in which it will have comparative sales as it's been over 12 months since the gloops deal - Nexon predicts its mobile game revenue will have declined between 9 to 17 percent year-on-year.

In retrospective, then, it was the worst time to buy a company like gloops.

The native demand

That's not say Nexon hasn't had any mobile successes in 2013.

In China, KartRider Rush Plus has had over 10 million downloads. Similarly, in Korea Fantasy Runners for Kakao has performed well.

Nexon has since made a strategic cash investment in its developer moonrabbit. The agreement - the amount of the investment wasn't disclosed - provides Nexon with global publishing rights to the Fantasy Runners series in addition to certain rights for new titles.

But more systematically, Nexon (and gloops') big problem has been their lack of experience in native game development. Previously, the majority of Japanese games for features phones were developed using mobile browser technology like HTML5.

Nexon's planning to launch five native mobile games during Q4 2013 in both Japan and Korea, plus an Android version of Euro Club Team Soccer Best Eleven.

Heavy investment

To overcome this deficiency, Nexon has also been very aggressively investing in start-up US developers, including ex-Zynga chief designer Brian Reynolds' SecretNewCo, ex-Zynga COO John Schappert's Shiver Entertainment, and ex-Call of Duty lead Robert Bowling's Robotoki.

In addition, it led the $17.5 million round in Rumble Entertainment.

Of course, given Nexon's 2012 IPO, it had a lot of cash to invest. And thanks to its lucrative F2P online games, it still has plenty, ending the current quarter with cash and equivalents worth $1.1 billion.

Yet investing in unproven start-ups is no guarantee of success.

And even if they are successful, there are likely to be a lot of difficult quarters for Nexon's mobile sales until the games from these new investments can feed in substantial revenue.