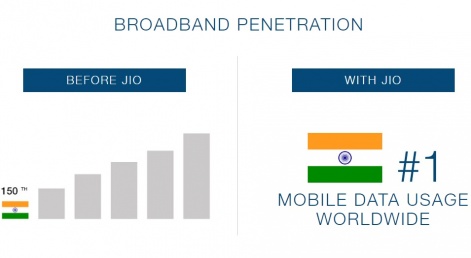

Since commercially launching in September 2016, Indian mobile network operator Reliance Jio has set about making mobile internet more accessible in the country.

This began with WiFi hotspot services in many of India's cities, but more crucially offered customers free 4G data connectivity for three months.

This in turn has made 4G data costs in India more competitive. And in the Indian gaming market, where internet connectivity is one of the biggest barriers to success, this has been making all the difference.

Mumbai-based developer Nazara Games has claimed that 52% of its players in April, May and June came via Reliance Jio, while its monthly active users have shot up from five million in December 2016 to 12 million in May.

Meanwhile, fellow Indian studios Games2Win and Moonfrog have also seen increases in monthly active users and revenue as a result of Reliance Jio ushering in more competitive data rates.

So we asked our Indian Mavens:

- Have you seen an increase in user activity since Reliance Jio started its free 4G data offer?

- Is this proof that better internet infrastructure can directly lead to better engagement and monetisation?

I don’t have anything personally to add since we haven’t published anything recently to compare against, but in general I hear the same sentiment across the industry.

Companies that have been targeting India have seen significant growth.Hrishi Oberoi

Companies that have been targeting India have seen significant growth in the last eight to 12 months.

I’ve also heard similar reasoning for this - i.e. Jio decreasing the barrier for 4G and consumers generally not worrying about data usage that much, and therefore overall data usage in the country increasing.

This increased adoption, along with the additional factors of increased propensity to spend digitally, has probably led to the higher downloads that we are now seeing.

Of course, we’ll have to wait and watch to see if this will be a prolonged effect or a one-time bump, but in general: yes, it does seem that overall numbers are up.

I believe user monetisation is a very different ball game from user-activity and engagement.

I share below my views both as a person who has run a company struggling to earn through app stores while also being a person values connectivity on the go.

I have been online on mobile since 2006 when I first started using Gmail on my Nokia 6630.

For me, Jio has been revolutionary and transformative in the way it democratised connectivity on the go - to the point that I own two Jio connections.

And yes, we have seen an increase in user activity since Reliance Jio started its free 4G data offer.

This massive increase in user activity spreads to sectors beyond gaming and has totally changed how the average Indian - who is not necessarily rich - perceives being online on the go.

People who would never have paid even one Rupee for data suddenly got access to data worth Rs.149 daily - the cost of one gigabyte of data on the Vodafone network in mid 2016 - or worth Rs.4500 every month.

And that access to data totally changed everybody’s perception of, and approach to, being online on the go - whether it was in terms of watching YouTube videos, downloading apps, or just being online on WhatsApp and Facebook.

Vodafone and Airtel still charge between Rs.5,000 and Rs.10,000 per gigabyte for those without an active data plan.

The analytics showed that around 70% of our game's users were on the Jio network.Nalin Savara

Compared that to the one gigabyte of free data that Reliance was offering during the introductory period for its Jio service, or compared to the Rs.303 per month Reliance is currently charging for 28GB of data.

Though we cannot directly correlate this user activity to an increase in game engagement, between late November 2016 and December 2016, one of our smaller games clocked a million minutes of gameplay and it was among our fastest to do so.

And not surprisingly, the analytics showed that around 70% of its users were on the Jio network.

This was amazing because for most part analytics show that most mobile users connect through broadband service providers - implying that Indian users had previously preferred to access the internet through WiFi rather than through mobile data.

But monetisation is different.

We have seen that players in India, whether rich or poor, are very savvy and engaged but also somewhat circumspect about paying unless they see specific and tangible business value.

This trend extends across Google Play and the Apple App Store.

The same trend was far worse for so-called emerging platforms like Samsung Tizen where, at least in late 2016 when we had several paid apps in the top 10 paid apps charts, we saw that even a top 10 paid app would earn less than $5 to $10 a month.

And these pitfalls in monetisation exist even while Indians are perhaps among the most engaged nation of people online - both qualitatively and quantitatively, on apps and sites across categories including gaming.

So, to conclude, I'd say that while Jio has definitely been a transformative force in enabling mobile internet on the go for many Indians, monetisation is a different game altogether and a harder nut to crack than engagement or activity.

With Jio free 4G data, the whole telcom industry is reformed with cheaper data rates and an increase in data consumption.

Most people in rural and suburban areas started playing games with their mobile data on - something previously excluded to only a few apps like WhatsApp, Facebook Lite and Hike Messenger.

Wer're witnessing an increase in engagement, even in the suburbs, with apps like regional video streaming services and online games (snooker, billiards, poker games, etc.)

When people opt to keep their mobile data on, it's healthy for us as advertising plays a major role in monetisation for games here.

As a work-for-hire studio, we had reservations on getting into products and launching own games.

Now we’re working on four titles by partnering with publishers in India and China - we should soft-launch two of them in Play Store by the end of August.

My name is Rituraj Behera and I am Co-founder of Cympl, an Indie game studio started back in November 2012.

I had begun my career as an application developer but I always loved playing games which attracted me to the fast growing mobile games industry.

I had started the organization with a vision to create high quality mobile games and an attitude to learn & improve everyday.

We have clearly seen most of the users coming into our game from Jio network.

Jio has definitely helped provide cheap (free for the most part) internet for the masses which has made users not worry about downloading games on a cellular network.

Even the most engaged audience, in terms of sessions, are also from Jio network.

That could also be because our games are rewarded video ad-friendly, and users do not mind watching ads over Jio 4G network.

Below is a snapshot of Flurry Data for our recently launched game: Masala Express which got over 150,000 installs within 20 days of launching the game on 10th June 2017.

Better internet, and most importantly affordable internet for the masses, could be the biggest enabler for people to download and start engaging with mobile games in India.

And I believe this is a process. We will not have a sudden increase in people who start engaging with and spending money in games, but this will be a gradual phenomenon.

As people discover and consume more games, we will see low retention.Rituraj Behera

As people discover and consume more games, we will see low retention, as most of them will be just browsing over what is good - since there is no fear of limited cellular data.

But as the days go by and masses get used to the culture of mobile gaming, the engagement, retention and monetisation graph will continue to move upwards.

Jio is definitely going to help get more installs, but not necessarily more engagement.

Also, what will help this further will be designing games that are friendly to rewarded ads, so that players do not hit a paywall and end up dropping out.

Only a small percentage of users - less than 1% in most cases - in India are used to the concept of paying real money to consume mobile games.

But if rewarded ads are offered, players will be more than happy to consume content as long as they enjoy the game and they do not need to pay - so that when they are ready to pay, we are ready to take their money.