One of the most interesting trends in mobile games throughout 2017 has been the surge of Finnish developers going public.

The country's games hub, once known for an abundance of games start-ups attracing big money, has matured over the last year with a string of IPO announcements.

It all started with Next Games back in March, which became the first ever games studio to be listed on the NASDAQ First North Finland.

From there, a number of other studios have followed suit. Remedy Entertainment, Nitro Games – which floated on the Swedish market – and Rovio have all decided to go public other the last 10 months.

Yet while the initial rush of revenue generated from an IPO can prove to be a serious boost for developers, there's still a long road ahead of them as a publicly listed company.

Going first

To understand this better, let's look at Next Games. The studio announced plans to IPO back in February 2017, with hopes of generating €30 million.

"The contemplated IPO plays a key role in supporting Next Games' development to an even stronger mobile game company. The proceeds from the contemplated IPO are intended to be used to support our growth," said CEO Teemu Huuhtanen at the time.

Fast-forward one month to its first day of trading, and the developer had generated €32.8 million in gross proceeds, with a market cap of €143.5 million. Share value on the day peaked at €9.50 by the times the market closed.

From there, Next Game's share value slowly dropped and settled, hovering around the €7.50 mark. It hasn't dropped below €7 since it began trading – the company's lowest value was €7.09 on July 11th.

Next Games saw its share prices double once it announced its next AR-based game.

That all changed in September, however, when its share price rocketed up from €7.47 on August 29th to €12 on September 1st. The cause of this spike was the announcement of a new licensed game, the augmented reality-focused location-based title The Walking Dead: Our World.

The price peaked at €15 on September 15th before falling back down to around €11 on October 24th, but it's still a good sign that investors are excited about Next Games' future.

Remedial effort

It's certainly a more encouraging story than fellow Finnish developer Remedy Entertainment. The PC and console developer IPO'd in May 2017, though it didn't offer up any concrete financial goals for going public at the time.

"We're developing our business in line with our strategy towards a multi-project model, which helps us release high-quality games to the global market more often. Our goal is to be one of most renowned game companies in the world," said Remedy CEO Tero Virtala in the initial announcement.

Remedy closed its first day of trading on May 29th at €6.69, before climbing to €6.82 just three days later. From there, it fell down to around €6.35, before bottoming out at €6 just under three months after its IPO.

Things are looking up for the developer, however. Its share price rose to €6.5 on August 17th, and has steadily climbed since, peaking at €6.9 on October 10th. It's likely going to fall slightly from there, but it looks like it should return to a similar price as it began, and stay there.

Boost to the system

Not every Finnish developer decided to go public in its own country.

There is a trend of developers losing value in the months following their IPOs, but begin gathering steam again once they make a big announcement shortly after.

Medals of War developer Nitro Games instead opted to IPO on the NASDAQ First North Stockholm.

"After exploring several options we believe that listing on NASDAQ First North Stockholm is the next phase in the progression of the Company, as we're looking to expand our business to self-publishing," said CEO and Co-Founder Jussi Tähtinen back in April 2017.

Nitro didn't have as lofty goals as fellow mobile dev Next Games – it hoped to raise around $3.5 million from its IPO to fund its new self-publishing business model, as well as gain some publicity for its games.

It certainly seems to have worked on the latter front. The publicity it attracted no doubt helped the developer secure a deal with Netmarble EMEA to publish Medals of War in Arabic-speaking countries.

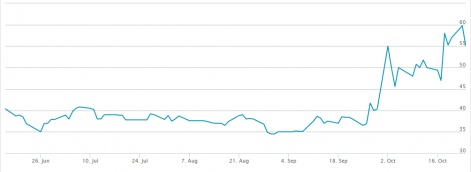

Its public listing seems to be going well too. After ending its first day of trading on June 16th at 40.4 Swedish krona ($4.91), its value followed the trend of other developers and fell slightly, eventually bottoming out at 34.5 SEK ($4.19) on August 30th.

From there, it's continually risen, leaping up to 55 SEK ($6.68) shortly after the Netmarble partnership. The share price has jumped around a little since then, peaking at 59.75 SEK ($7.26) on October 23rd before dropping down to 55 SEK again the next day, but it looks like it will remain steady at above 50 SEK ($6.08) for the time being.

On the up

What all this shows is a trend of developers losing value in the initial months following their IPOs, but begin gathering steam again once they make a big announcement a short while after.

Next Games saw its share prices double once it announced its next AR-based game, while Nitro Games' value shot up once it signed on with Netmarble EMEA.

Only Remedy hasn't seen similar levels of trading success, with its value only recently return to its initial price. The developer's biggest news – a publishing deal with 505 Games – came about before its IPO, and its only announcement since, revolving around new technology it's developing, came out a week before its share prices started to rise again.

It seems that these developers have exciting futures ahead and are showing just how far the Finnish games industry has come.

But this gives some indication as to what IPO newcomer Rovio might have in store from its share prices in the next few months.

High flyer

The Angry Birds developer had the highest goals of the bunch – it planned to reach a valuation of up to $1 billion from its IPO from the sale of 54.6% of its existing shares and €30 million of new shares.

For Rovio, going public meant a chance to grow the company even further, as well as raise additional funds for potential acquisitions.

"We are stronger now than ever before. The fact that we stand on this foundation, where we've ticked, in our opinion, the success factors you need to tick in free-to-play mobile gaming, it means that we can grow substantially into the future as well. We've grown very fast over the last year and a half," Rovio's EVP of Games Wilhelm Taht told us in a recent interview.

Its stock value has been off to a steady but hardly spectacular start. It opened trading on September 29th at €11.5, dropped to €10.75 on October 4th and then jumped back up to its peak of €11.87 two days later.

Since then, it's held its share value at around the €11.5 mark with very little fluctuation.

With another Angry Birds movie in the pipeline, a few games already in soft launch, and an expanding user acquisition strategy based on the apparent strong KPIs of its latest releases, Rovio could see its share value shoot up in due time.

Of course, it's impossible to know how the mobile market will behave. As we've seen in the past, even behemoths like Netmarble can suffer heavy share value drops, and Zynga still hasn't come even close to its initial value when it went public in 2012, despite recent positive signs from the company such as turning a profit in Q2 FY17.

As they say, only time will tell. But it seems that Next Games, Remedy, Nitro Games and Rovio have exciting futures ahead and are showing just how far the Finnish games industry, and the games sector as a whole, has come.