The Guinness Book of Records doesn’t have an official category, but the 21 months Dawn of Titansspent in soft launch must be the longest period of live testing a mobile game has received before release.

There are many reasons for this long gestation.

Having spent up to $527 million buying UK developer NaturalMotion in early 2014, Zynga wanted to ensure the most exciting title from its new studio was as polished as possible.

Formally announced in March 2015, with a late 2015 release date scheduled, Dawn of Titans started its soft launch journey in some interesting territories including Saudi Arabia, the United Arab Emirates and Vietnam.

Zynga, operating under restored CEO and founder Mark Pincus (following the departure of Don Mattrick), then decided Dawn of Titans needed more cooking time.

In November 2015, Pincus told investors Zynga was pushing the game into 2016, saying “given how strong the early monetisation is for the game, we believe that a move of 200 basis points (2%) in day 30 retention has the potential to make the game a breakout hit”.

Of course, we didn’t know pushing the game into 2016 meant releasing it on December 8th 2016.

Should Dawn of Titans been launched much earlier?

By that stage, Dawn of Titans was in soft launch in 15 countries, with Nordic locations such as Sweden, Denmark and Norway having gained access in October 2015.

Even Chile got in on the act in the final wave of testing in July 2016.

Late to the party

One thing we can be certain is Zynga generated a lot of data about Dawn of Titans.

But given how tastes and design changed in the mobile game market between early 2015 to late 2016, the question that needs to be asked is: Was the process justified in terms of honing a better and more financially successful game?

This can be considered by looking at some charts.

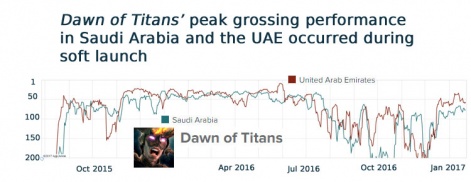

Two countries where Dawn of Titans clocked up a lot of soft launch time were Saudi Arabia and the United Arab Emirates.

Hitting the Google Play top 200 top grossing chart in August 2015 (we’re looking at Google Play because the lines are less volatile and hence cleaner than the Apple App Store), it’s clear Zynga did spend 2015 making the game better.

In November 2015, Dawn of Titans entered the top 50 top grossing charts in the UAE, where it remained until July 2016, peaking within the top 10 in May 2016. In Saudi Arabia, things took longer, but by January 2016, Zynga had a top 50 top grossing game, peaking within the top 30 in April.

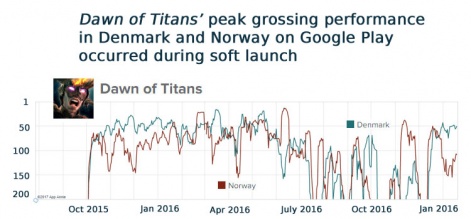

It was a similar picture in Denmark and Norway.

Denmark was - and remains - the better market of the two, and Dawn of Titans spent the latter months of 2015 and the first half of 2016 in its top 50 top grossing chart. In Norway, the game was a solid top 100 performer, but only had a prolonged period in the top 50 during May 2016.

What’s significant in the case of all four territories, however, is post-July 2016, the game’s top grossing performance collapsed: it dropped outside the top 100 entirely - even in UAE - also spending time outside the top 200 in Denmark and Norway.

Given the game didn’t launch until December, this four month period would seem to be a missed opportunity for Zynga.

Surely, Dawn of Titans should have been launched much earlier.

Failure to launch

There are some reasons why this was difficult.

For one thing, NaturalMotion’s other big title, CSR Racing 2, was launched on June 30th. Even for a company with Zynga’s scale, launching two big games close together is complex.

The other was in July, Dawn of Titans wasn’t considered ready for a global launch in terms of its functionality. It was updated 14 times in 2016 prior to launch, and eight of these updates occurred post-July.

This is demonstrated by the final two update prior to launch, which significantly speeded up the process of unlocking special units, streamlined the single-player campaign (which was too slow and cumbersome), and overhauled some key user interface components.

Yet at launch, the game still felt old fashioned in terms of the constrained way players are forced to build and upgrade their base, the length of time it takes to get into the action (no autoplay), and the lack of deep retention and monetisation features in its Alliance structure.

F2P mobile games had shifted with faster gameplay, deeper metagame and more flexible monetisation.

Given Dawn of Titans was designed in 2014 and 2015, this should be no surprise. Back then the mobile strategy genre still looked to Clash of Clans as the basis for innovation.

By mid-2016, however, Asian-inspired squad-based RPGs such as EA’s Star Wars: Galaxy of Heroes had been big successes, while card-collection elements and MOBAs were the cutting edge of F2P mobile game design: Supercell’s Clash Royale integrated both to generate $1 billion of revenue.

F2P mobile games had shifted with faster gameplay, deeper metagame and more flexible monetisation.

Do no harm

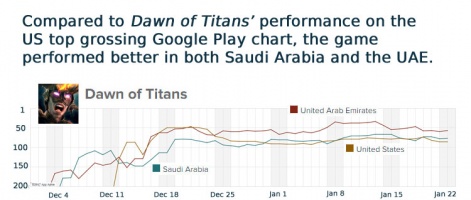

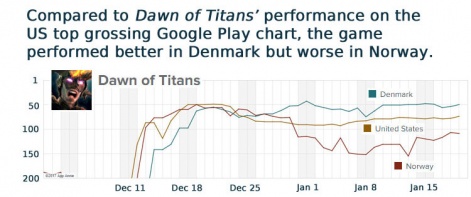

Still, it could be argued the summer and autumn months spent in soft launch do not appear to have diminished Dawn of Titans’ financial performance.

When it was finally released, its performance in Denmark, Saudi Arabia, and the UAE recovered and was better than in the US, showing the autumn decline in those countries was temporary. Of those four territories, only Norway underperformed the US.

In this way, the soft launch period appeared to improve performance at launch in the stores where it had been in soft launch compared to to non-soft launch countries.

Still, in none of the four countries has the game yet matched its best top grossing performance on Google Play, which occurred in the March to May 2016 period.

And despite Mark Pincus’ statement about the improvement in day 30 retention, and the many updates, Dawn of Titans’ top grossing performance doesn’t appear to have improved much after March 2016, even when the game’s look and feel did.

That’s something which could be attributed to changing market tastes.

The bigger picture

Of course, it should be pointed out, we’re only looking at the game’s top grossing performance and Zynga will have been looking at much more detailed retention and monetisation cohorts across different territories, devices and acquired through different UA channels and predicting the future lifetime value of its players.

But, aside from the game’s revenue, we have to consider the additional cost of running the Dawn of Titans’ dev and live ops teams between May and December, and the six months of revenue Zynga would have generated had it launched the game earlier.

Taking everything into account then, it seems clear while the first six to 12 months Dawn of Titans spent in soft launch were significant for the game’s relatively successful global launch, the best thing that can be said about the last six months is they weren’t.