This article is part of an ongoing series of data-driven articles from PocketGamer.biz and App Annie highlighting trends in the global mobile games sector using App Annie’s Game IQ analytics.

This enables mobile game developers to dig into the data and discover not only which games are performing best but what characteristics they have.

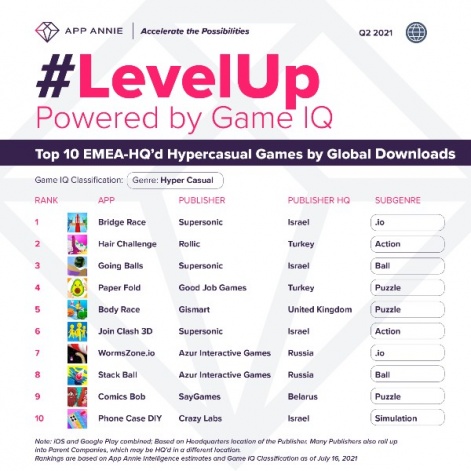

In this week’s column, we’re considering trends from the most popular hypercasual games from European-based mobile game companies.

Faster, faster

During the first six months of 2021, downloads in the hypercasual game sector grew 15 per cent year-on-year. The action subgenre experienced the strongest uplift up 35 per cent in part due to the performance of Supersonic's Join Clash 3D in the first quarter of the year.

During the second quarter, Zynga-owned Rollic earned the top action hypercasual game via Hair Challenge, a follow-on from Rollic's massively successful High Heels.

In this context, it's significant to note that many of the top hypercasual mobile game companies - including Supersonic and Rollic - are headquartered in the EMEA region. It's also interesting to see a lot of geographical clustering with Israel, Turkey and Russia being particularly strong in the hypercasual sector.

Supersonic, which is owned by Ironsource, had more games than any other EMEA publisher in the top 10 hypercasual games in terms of global downloads in Q2. Bridge Race from the studio was the most downloaded game globally.

Real-time

Bridge Race is in the real-time online game subgenre featuring an MMO-like experience with many players playing facing off against others. Supersonic also claimed the third most downloaded game in the shape of Going Balls. It's in the ball subgenre, which features gameplay focused on the control or movement of a ball.

"Hypercasual games are incredibly popular and tend to dominate the top gaming charts. They tend to monetise via in-app ads, but we are seeing more indications of hybrid monetisation models emerging in the space as the industry matures and competition increases," commented App Annie's head of marketing insights Lexi Sydow.

Game IQ is a vertically tailored analytics product, developed by App Annie, that provides insight into dimensions such as class, genre, subgenre and tags. Games can now be analysed by broad category class (tuning), genre, subgenre, and tags (modifiers) such as IP, art style, settings, monetisation mechanic, and more.

For more information register for a demo here