2022 proved to be a tumultuous year for the mobile gaming industry. Despite the massive success of new releases and several significant mergers and acquisitions, many companies posted year-on-year decreases in revenue, while regulatory changes worldwide led to an industry-wide contraction.

As a result of these issues, installs declined an average of 12% worldwide, with North America seeing the largest fall at 20% while Latin America, one of the world’s fastest growing markets, saw the smallest decrease at just 6%.

However, a new report by Adjust shows that installs rose 23% in January compared to Q4 2022, and 10% higher than the average for 2022 as a whole.

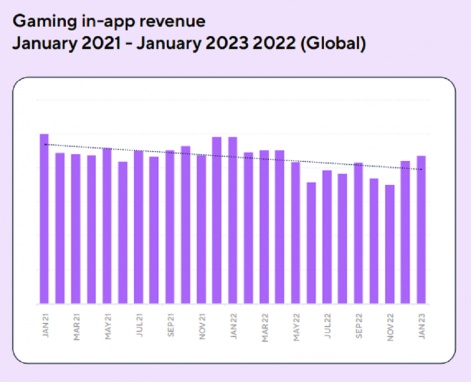

In-app revenue also experienced a significant bounceback, in what Adjust calls “a growth trend we expect to see continuing”. Despite falling 9% in 2022, there was a significant jump in revenue in December which followed into January, which saw in-app revenue stand at 6% above the 2022 average and 14% above the Q4 2022 average.

Despite the fall overall in 2022, several gaming genres saw significant increases in installs. Music led the way with an increase of 190%, followed by educational games at 124%. Racing games saw a 32% increase while board games rose by 20%. Word, sports, and arcade games also saw smaller rises of 7%, 5%, and 3% respectively.

The hypercasual genre accounted for 25% of the total game installs for 2022, representing a slight decrease from 27% in 2020 and 2021. Action came in second place for the year at 14%, followed by puzzles at 12%, and sports and casual games at 9%.

Similarly to installs, gaming sessions declined 17% in 2022 compared to the previous year, bottoming out from September to December. However, sessions are bouncing back, with figures in January 2023 standing at 11% above Q4 2022.

Again, North America had the biggest decrease in session length, with -25%, while Latin America proved comparatively resilient at -12%.

Several genres bucked the trend and managed increases in app sessions between 2021 and 2022. Racing pulled ahead at 58%, while music games came in second place at 37%, educational games rose 17%, and board and sports games each saw 3% increases. However, action games pulled ahead in terms of overall sessions, accounting for 25% of the total. Despite making up 25% of installs, the hypercasual genre accounted for just 7% of total sessions.

Play time

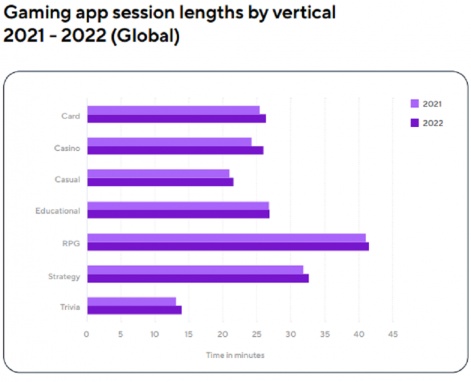

In addition to the fall in total sessions in 2022, there was a slight decrease in session length in markets all over the world, with an average length of 30.33 minutes compared to 31.5 in 2021. The highest average session length was in Asia Pacific, at approximately 34 minutes.

Only one market analysed in the study, North America, saw an increase in session length, rising from 24.65 to 24.99 minutes.

Among the analysed genres, RPG had the highest average session length at 41.49 minutes compared to 41.03 the previous year. However, the casino genre saw the largest increase, rising from 24.19 minutes in 2021 to 41.49 minutes in 2022.

Sessions per user per day followed a similar trajectory to 2021, with a drop off after day one and a slow increase between days three and 30. However, 2022 saw lower figures across the board, standing at 2.21 on day one compared to 2.25 in 2021. On day 30, players took part in an average of 2.19 sessions, compared to 2.28 in 2021.

Retention rates also fell slightly over an average 30 day period. While D1 retention rates remained consistent at 29%, D3 and D30 each saw 1% decreases in 2022 compared to the previous year, standing at 19 and 6% compared to 20 and 7%. Sports games had the highest D1 retention rate among genres at 31%, followed by casual and board games at 30% and RPG and word games at 29%. Despite pulling ahead in terms of installs, the hypercasual genre had the lowest D1 retention rates at 25%.

Want more facts and figures? To close out 2022, we examined the performance of the games market over the year.