Amazon's deal for Twitch, Facebook's acquisition of Oculus and Microsoft's Mojang/Minecraft deal have helped boost mergers and acquisition (M&A) activity in the game space during 2014 to $12.2 billion.

That's the headline from a report from the market analysts and advisors at Digi-Capital.

It's highlighted five mega deals (aka labelled "billion dollar" deals - the quote marks required as two of the five didn't quite add up to a billion) as being the reason that the first three quarters of 2014 have far outpaced the 12 months of 2013.

- Zhongji spent $960 million on DianDian

- Amazon spent $970 million on Twitch

- Giant was taken private in a $1.6 billion deal that valued the company at $3 billion

- Facebook spent $2 billion on Oculus, and

- Microsoft spent $2.5 billion on Mojang.

Bubble economics?

Of course, in its own way, each of these deals is an outlier.

As Digi-Capital itself noted:the Microsoft-Mojang transactions was massively over-priced compared to other large game deals; Amazon bought Twitch despite the video streaming platform demonstrating little or limited profitability; and Oculus still doesn't have a retail release date for its VR hardware.

Equally opaque was the move to take the NASDAQ-listed Chinese publisher Giant Entertainment private, while the thinking behind Zhongji, a Chinese construction company, buying DianDian - the casual game operation of Chinese publisher FunPlus - remains unclear and, for some commentators, highly debatable.

Mind the gap

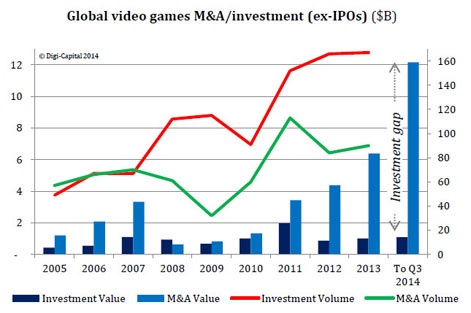

Perhaps more interestingly, Digi-Capital points out that if you ignore these deals, 2014's M&A run rate is actually similar to 2013, although the size of each M&A deal has increased by 145 percent to an average of $174 million.

VC investment activity is similar to 2013 in terms of the number of deals but up 45 percent in terms of the value of investments. To-date there has been $1.1 billion invested into game companies; although this excludes IPOs such as King and iDreamsky.

Digi-Capital notes that the difference between M&A activity and investment - what it calls the "investment gap" - is at a historical level.

Partly this is because investment activity peaked in 2011; something which is now bearing fruit in terms of M&A activity.

An alternative view is that M&A values are now too high and entering a late-stage bubble.

US companies get the fever

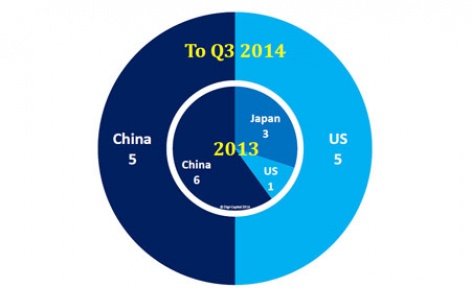

Something else worth noting in this trend is that in 2014 it's cash-rich US companies like Microsoft and Amazon who are getting caught up in the excitement and spending big.

During 2013, Chinese companies led the games M&A market with 6 deals compared to just 1 for US-based companies. In 2014 so far, the distribution is five each.

You can buy Digi-Capital's full 181 page report for $1,999 or get a 28 page summary for free here.