The rise of mobile and online games, particularly in Asia, will be the industry's engine for growth over the coming years.

That's the headline from the quarterly report from games investment outfit Digi-Capital.

It predicts the global games market - both hardware and software - will be worth over $120 billion in 2017. That's up from around $70 million in 2011.

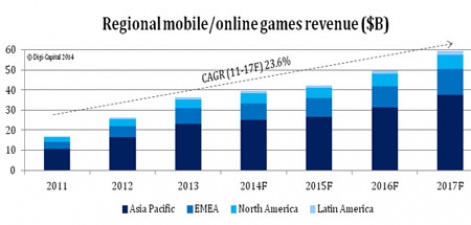

But while the console and PC segments remain steady, mobile and online gaming are growing fast.

Digi-Capital reckons that from around $15 billion in 2011, this market will be worth almost $60 billion by 2017; that's compound annual growth of 24 percent.

Mobile first

In terms of where that growth is happening, the report is clear.

The Chinese, Japanese and Korean markets are exploding, particularly as they move from big PC client games to highly profitable - and much cheaper to produce - mobile games.

Digi-Capital points to operating margins of over 50 percent for the most successful companies.

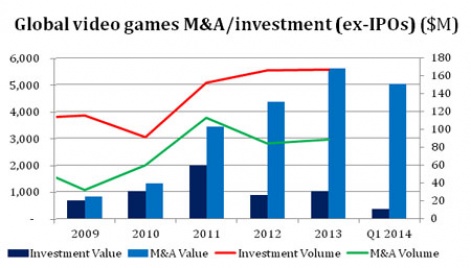

And this growth is being reflected in mergers and acquisition activity between companies.

Between January and March 2014, the value of M&A activity in the games sector was $5 billion: that compares with $5.6 billion for the whole of 2013.

Mobile games were the most active sector with 7 deals, worth around $1.5 billion.

Investment activity - that's generally VC companies investing in start-ups - was worth $346 million, compared to $1 billion for 2013.

Again, mobile games took the biggest share: 16 deals worth a total of $200 million.

You can see the sort of deals that have been occurring in our handy Deals section.

Floating a boat

IPO activity is more complex, however, partly because this is typically the only exit option for the largest companies and as King is proving, highly dependent on market and public confidence.

There were 7 game company IPOs in 2012 (mainly in China and Japan), compared to 4 in 2013 (all Chinese companies), and only one (King in the US) so far in 2014, although several Chinese companies are known to be considering the opportunity, despite warnings that they only have a six month window.

Yet looking at the longterm success in terms of the share price of companies that have floated, when indexed to back 2011, the only sector that has been successful - at least in terms of outranking Digi-Capital's All Games Index - is the MMOG sector.

You can read more about how Digi-Capital views the market - including purchasing its complete Q1 2014 report via its website.