Johannes Heinze is MD International at AppLovin.

For many mobile games developers looking to expand globally, Japan is usually one of the first markets they seek out, and for good reason.

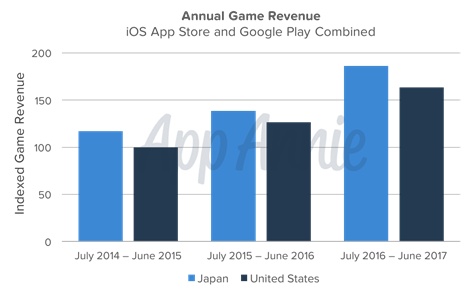

According to an App Annie study, Japan’s mobile game revenues rose 35 per cent in 2017, outpacing the United States, making the country the number one market for mobile game revenue.

One of the biggest reasons why Japan leads in mobile game revenues is because its players are far more engaged.

The same App Annie study found that Japanese players opened mobile games more than twice as much as those in the United States. This makes sense, as RPG and casual game categories made up over 55 per cent of mobile game downloads between June 2016 and June 2017.

Unsurprisingly, RPGs made the most mobile game revenue because of in-app purchases and high engagement.

However, these trends may change in 2018 due to a number of factors which we’ll go over in this article. If you’re looking to expand into Japan, these are the mobile game trends you need to watch in 2018.

App Store and Google Play revenues are nearly evenly split

App Store and Google Play revenues are evenly split in Japan, which is not the case in the US. In the US, iOS dominates mobile games revenues making it the “premium” platform for mobile game devs to target.

In Japan, however, Android and iOS market share is neck and neck. As of October 2017, Android made up 55 per cent of mobile market share in Japan compared to iOS’s 44.8 per cent. Although iPhone X sales were strong in Japan, iOS market share managed to slip 6.9 per cent.

We’ve noticed that more Chinese and Korean-made games are entering the Japanese market over the past year.

Compared to the US, Android makes up 66.2 per cent of mobile market share while iOS holds 32.9 per cent. So it appears that in Japan, choosing a platform to maximize revenue doesn’t matter quite as much as in the United States.

More Chinese and Korean games are making it to Japan, but local games still perform better

Japan has historically preferred locally-produced mobile games, but that could be changing over the next year.

Between July 2016 and June 2018, 80 per cent of Japan’s mobile game revenues came from games which were produced in Japan. In comparison, only 50 per cent of mobile game revenues in the US came from US-made games during the same period.

This is because Japanese players have very specific tastes, like their love for RPGs and high engagement rates. For devs, this means quality localisation is a must for games developed outside of Japan.

For example, Final Fantasy: A New Empire was developed by Machine Zone, an American company, but has found success in Japan thanks to its Japanese IP and good translation.

This trend appears to be changing, as we’ve noticed that more Chinese and Korean-made games are entering the Japanese market over the past year.

One reason is that Chinese and Korean game studios are investing heavily in user acquisition from the very beginning. This allows them to scale their businesses quickly. Although ROAS can be low at the beginning of a user acquisition campaign, it can divert mobile gamers from competitors’ games and will pay off in the long run.

As video ads become more accepted, Japanese developers are more able to scale their casual games globally.

Another big reason we see Chinese and Korean games breaking into Japan is the fact that developers have begun creating games specifically for the Japanese market, instead of trying to localise a global version. This means more attention is paid to things like character design, level design, language and more.

While it’s nice to see games from outside of Japan gaining traction, they are still predominantly RPG and strategy games, meaning Japan’s predilection for these games remains strong.

This is why RPG and strategy games provide the most revenue for Japanese game developers. These games provide developers with a lucrative monetisation cycle that utilises gaming mechanics like collectibles, weapons, boosts, gacha and other in-game items available for purchase.

Casual and hyper-casual games are rising

For the longest time, midcore and hardcore mobile games have dominated in Japan. But now the tides are beginning to turn and casual and hyper-casual games are starting to become popularised.

In addition to big companies like Disney and LINE creating more casual games, indie devs are jumping on the trend as well. For example, 1LINE and Kumitaisou are very popular and made by small development studios.

One of the reasons why casual games have had trouble gaining traction in Japan is the fact that midcore, hardcore and RPG perform so well that there hasn’t been much incentive for Japanese developers to create casual games.

However, as video ads become more accepted and are proven to monetise well, Japanese mobile games developers are more able to scale their casual games globally.

Established IPs still rule

Established IPs bring in the most money, largely because there’s a huge culture of anime and manga in Japan. As kids grow up watching and reading stories about their favorite characters, it’s natural that they will continue consuming them as they transition to mobile.

One company that shows the success of strong IPs is Nintendo. The company only got into the mobile games space a couple of years ago, but is already seeing great success because of their strong IP. While some may argue that Super Mario Run was a failure, there was considerable hype surrounding the game.

Other Nintendo games like Pokémon Go, Fire Emblem Heroes, and Animal Crossing: Pocket Camp are all doing very well for the company. It also announced that Mario Kart Tour will be coming to mobile sometime in 2019.

Japanese developers actually cater to women’s tastes

Another trend in Japan that remains strong is the “romance” genre, which is targeted towards women. These addictive games let players progress through a story, letting them meet virtual lovers.

One speculation about why these games are so successful is that they provide stress relief and mitigate the sense of alienation that’s common in crowded urban environments. These romance games are so popular now that they’re gaining traction in China as well.

Established IPs bring in the most money, largely because there’s a huge culture of anime and manga in Japan.

Alternatively, the “idol raising” genre is also quite popular among Japanese women. These games let you scout new talent to create the next big international superstar. In an exceedingly competitive games marketplace for Japanese men, these types of games offer more relaxed gameplay.

In contrast, the US only has few popular games targeted toward women, including games like Kim Kardashian: Hollywood, High School Story and Covet Fashion.

Wrap-up

For mobile games developers, Japan is an incredible country due to its voracious appetite for mobile games.

Although Japan’s population is two-fifths of the United States, its mobile games market has outgrown the US for the last three years running. This means Japanese players have a huge appetite for mobile games, have high engagement and spend tonnes of money on games and in-game items.

While Japan is undoubtedly an attractive place for mobiles developers outside of the country, it brings unique challenges. The fact that the most profitable mobile games are usually RGPs with established IPs will be difficult for indie developers creating games in the genre.

However, this also means that there’s ample opportunity for casual and hyper-casual games since these games provide global appeal. It’s heartening to see more competition from China and Korea break into the Japanese market and to see casual and hyper-casual games beginning to take hold.

Get the latest news, interviews and in-depth analysis on Twitter, Facebook and our daily newsletter.