China's mobile gaming industry underwent an unprecedented explosive growth in 2013.

In the first installment "China's Mobile Gaming Market: A Quantitative Deep Dive: The Gaming Republic" we explored the mobile gaming landscape and its unique history, illustrating the massive growth and revenue potential.

In this installment, we will look into the behavior of the users in the Chinese mobile gaming market.

Given the rapid growth in revenue size and players, the Chinese mobile gaming market has seen its share of market externalities and aberrations such as game content homogenization (known as "Fast-follow" in industry-speak), piracy, and inferior games attempting to "make a quick buck."

In the wake of the growth, we will analyze player behaviors in the key categories of app installation, app upgrades, usage patterns, payments, and uninstallation behaviors.

1. An overview of install behavior

Any new foreign entrant into the Chinese mobile games market facing the tremendous fragmented app stores will ask themselves the obvious question: What game genres do most users choose to play?

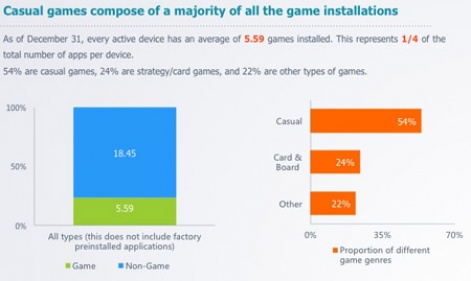

Based on the 2013 data from TalkingData, on an average mobile device,

- 54% of all games installed are casual games (Cut the Rope, Temple Run, etc.),

- 24% are board or card games (poker, casino, etc.)

- 22% are other games.

As to the numbers of games installed, an average of 5.59 games are installed on every active device.

The explosion of the mobile market in 2013 is largely attributable to the spread of smart mobile devices, the upgrades in hardware performance, the improvement in software usability, and the continued democratization in the accessibility for mobile users to obtain and download games.

All of the above have enabled more users to enter the game market.

From a demographics standpoint, the market is accelerating its reach to the two extremes.

From the core group of 18-30 year olds, the market is reaching out to the group under 18 years of age and in the meantime, the market for the group of 30-50 year olds is also undergoing development.

When gamers first enter the mobile market, casual games become the first choice due to the simplicity and accessibility. Low learning curves, attractive color schemes, and a simply game design contribute to this rapid adoption.

2. Player consumption cycles

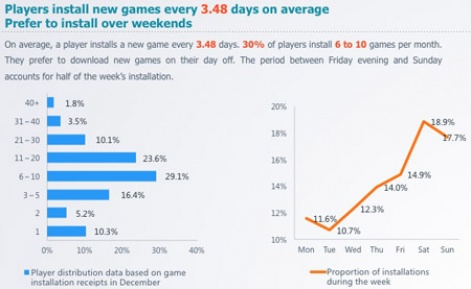

In terms of game installation cycle, mobile game users install a new game in an average of 3.48 days.

TalkingData focuses on the data for December 2012 and discovers that more than half of the mobile game users install 6-20 games in a month.

Of that, 29.1% of users install 6-10 games and 23.6% of users install 11-20 games.

Casual games dominate a users' initial gaming experience. As they become more mature gamers patterns of binge consumption and isolation emerge. In other words, players download an array of casual games, and narrow down the genre of games that are most suitable to their gaming needs.

3. Impact of installation times

In terms of the timing of installation, users develop a stable habit of installing games during weekends.

Numbers from TalkingData indicate that installations from Friday to Sunday comprise half of total installations in a week, and installations on Tuesday are the lowest within the week.

This has a significant impact on mobile gaming user acquisition and gradually influences the game advertising strategies of game developers and distributors as well.

4. Where users download - iOS

Apple's iTunes App Store continues to enjoy the highest market share of games developed for iOS at 65%.

In 2013, users in the Chinese market have gradually become accustomed to downloading games in the App Store. iOS system upgrades and iterations have become faster, therefore, users are less inclined to jailbreak their devices.

Also, a majority of the games in the Chinese App Store have adopted the IAP model. As of the end of December, quite a few traditionally paid games have started to offer free downloads and adopted the IAP model. In the meantime, non-jailbroken third-party iOS market has increased distribution in 2013, exerting pressure on the jailbroken market and the App Store.

These users are highly loyal due to the unique initial channel marketing, which has attracted a good number of mid-core and hardcore gamers.

5. Where users download - Android

Distribution through mobile assistant apps still dominates the Android market. Due to the open nature of the Android platform and the unique optimized experience of recommendation apps in obtaining, installing, and upgrading games, mobile assistant apps can access more mobile game users on a broader scale.

As mentioned earlier, the demographics of users have gradually extended to the two demographic extremes in 2013. These two groups of users, compared with the group aged 18-30, are more reliant on third-party market places such as mobile assistant apps to have one-stop service for obtaining, downloading, installing, upgrading, and uninstalling games.

Chinese game developers and distributors have also started to invest more in marketing such as in-app mobile advertising.

The choice of media targeting is shifting to groups under 18 years old and over 30 years old. Mobile developers and publishers still have room for growth as far as doing a deep analysis on these target demographic groups in order to acquire even more users.

6. Impact of upgrates on churn

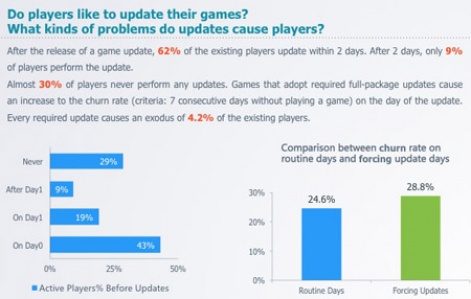

After the users have downloaded and installed the game, the next issue they face are the periodical upgdates. It is an issue that both single-player games and online games must deal with.

Each update essentially means churn, or a loss of the total player-base.

TalkingData indicates that when an update is released, 62% of existing users will upgrade within two days. After two days, only 9% of users will still choose to upgrade. Close to 30% of users will never update.

Games that enforce automatic update experience higher daily losses (Defined as no game activity in seven days in a row.). Each update results in a loss of 4.2% of the total users.

Unfortunately, updates introduce complications to users who are no savvy mobile device users. Therefore in the Android market, thirdparty markets such as mobile assistant apps play an important role.

7. Overview of usage behavior

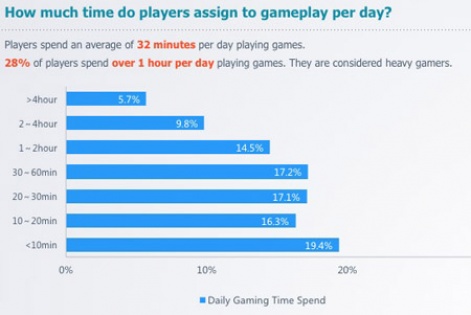

So how much time do users allocate to playing mobile games on a daily basis?

In 2013, there was a massive explosion of the strategy game sub-genre known as "Card Battle". As a result, a large number of users have transitioned to "mid-core.

With this shift from casual games to mid-core, the average daily time spent on gaming has reached 32 minutes, and 28% of users spend over 1 hour playing games every day.

8. There can be only one

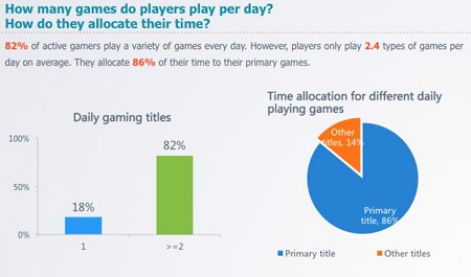

TalkingData estimates that 82% of active users play multiple games every day. With the hyper growth of the mobile game market, users have wider set of choices.

Despite the mass proliferation of games and on a user opening 2.4 games a day, the average Chinese mobile game player spends 86% of their time on a single game. This behavior helps increase the elimination of low quality games and fast-follows.

9. Game sessions mirror life schedules

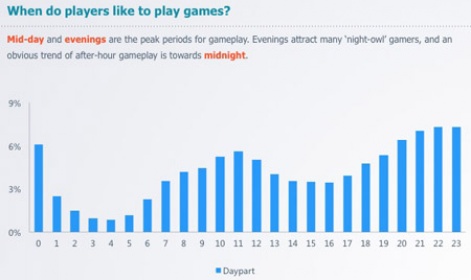

Player daily sessions have gradually been split into segments correlating to their work-life schedules.

Chinese developers focus on the in-game events of their titles by dividing a user's play time into four segments consisting of pre-work cycle, lunch time cycle, a pre-departing work cycle, and an at-home evening cycle between 10pm and 1am.

Different in-game activities and incentives are targeted at these four time segments to encourage and incentivize users to spend more time and money on the games. Lunchtime and evening time are segments with longer time affordability and better Internet connection TalkingData has discovered.

10. Player connectivity

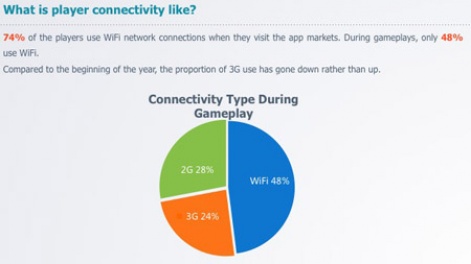

In China, the coverage of mobile broadband access is far from sufficient and the connectivity of common players is not ideal.

Based on TalkingData's research, in 2013, 74% of users use wifi when they download and install games from app stores. However, only 48% of users choose to use wifi to play games.

This is what is currently limiting the spread of online games to the average smartphone users.

Meanwhile, many data plans and the associated costs prove to be a barrier to the common user, preventing them from playing mobile games that require connectivity to the internet. Even then, the need to control data usage still proves to be an obstacle for existing players to play these mobile games extensively.

11. Overview of spending behavior

Whether developed overseas, or locally, and regardless of game type, most games have adopted free-to-play and in-app-purchase revenue models.

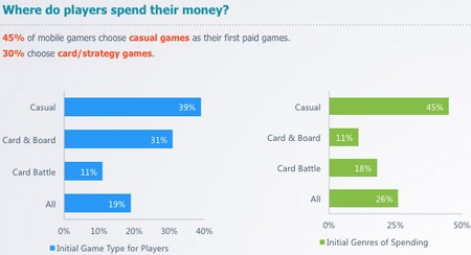

TalkingData indicates that 39% of users choose casual games as their first game, and that 45% mobile gamers choose casual games as their first paid games. This helps set payment behavior for users, especially in well-known thirdparty iOS channels.

In 2013, TalkingData found that 70% of all mobile game revenues were derived from card-battle, RPG, and MMORPG games. The low development cost and high profit nature of card battle games proved to be an attractive lure for game developers in China.

Casual games have increased its share of revenue in that year, which can be attributed to the gradual shaping of paying habits of all mobile game players.

But this came with a caveat: Due to the tendency to promote purchases that delivered short-term value, the efficacy would exhaust within a month for players

12. When do players spend?

There is a correlation between when users are most active and when they spend. This spend is most likely to happen during the evening.

In contrast, spend activity during the day is relatively low, mainly to due to when spending players are most active.

Another reason is the network connectivity required for making payments are less likely to be interrupted during evening hours. Because of this, game developers focus a lot of events and accessing of content during the evening to encourage spend during peak spend hours.

13. How do players spend?

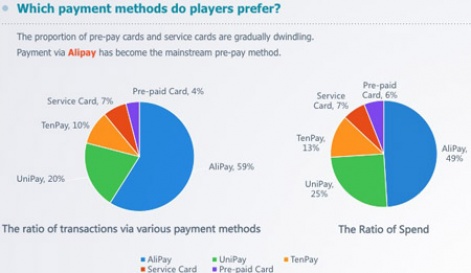

In terms of the number of transactions, AliPay and UnionPay have a joint share of close to 80%. Their share of "point" cards and pre-pay is shrinking, but overall the total share continues to be AliPay and UnionPay.

Important considerations for end-users are whether the experience of a payment funnel is smooth and safe. A lot of this has to do with network response when it comes to reloading (topping-up) or payment processing.

Overall the mobile game market and the way in which mobile games are operated in China is mirroring the path of web games.

20 days after a gamer has been playing a game, developers discovered that the LTV (dollar amount of a player's Life Time Value) could no longer be increased.

Consequently the overall average value of a single game for a given title became 4 RMB, less than $1.00 USD.

A good product and marketing alone is not enough to attract mobile user in 2014. More often than not, developers need to refine their development operations based on data.

This becomes the challenge for even the top-grossing foreign developers. After a long period of localization and culturalization, the Chinese audience can easily grow accustomed to foreign games.

14. Designed for short-term gains

Based on TalkingData's recent data, the short-term performance of the overall market is relatively stable. However, from a medium to long-term standpoint, the level of sustainability needs to be increased.

The short life cycle of games is a problem that is faced by the many developers. This is to say, many developers focus their revenue models and game design on quick wins. TalkingData believes developers are leaving a lot of revenue on the table and is largely an area of opportunity.

Usage data of players that churn out the first day across a majority of the mobile games in China, proves there is a lot of room for optimization in user experience and user acquisition targeting. This becomes even more imperative as cellular data infrastructure improves in 2014 and user expectations for game quality increases.

15. Efficacy of RPG genre

The RPG game genre has been a mainstay style of play for Chinese mobile gamers. In 2013, RPG games predominantly consisted of martial art themes. In 2014 we can expect to see RPGs raise the bar in terms of themes and reaching the quality level of PC games.

As far as themes, player demand for themes outside of martial arts and Romance of The Three Kingdom will grow to more Western fantasy themes. As far as play styles, we will see the traditional MMO and the ARPG (Joystick-controlled hack-and-slash RPGs) converge and presentation will be more akin to desktop PCs World of Warcraft.

Chinese gamers essentially skipped the console gaming era the West went through and jumped straight into free-to-play PC gaming. Mobile users new and old are accustomed to free-to-play payment patterns, particularly with RPG themed games.

A handful of large RPG game developers will find their own success in China, mainly because this core demographic have had exposure to this genre of games from the US, Europe, Korea, and Japan. Games from these markets will easily find their paying user base with a game design keeping the Chinese mobile gamer in mind

16. Efficacy of card battle genre

The Japanese-originated card battle game design has evolved into its own flavor in China. In 2013, card battle games in China were developed utilizing pirated IP and other Japanese card games, which saw a tremendous growth in popularity.

Developers who have mastered the commercial use of various IP are beginning to leverage this character-friendly low-cost-high-revenue game design. A major reason is due to brand-recognition, significantly driving down the cost to acquire users.

Developers whose existing pipeline afford access to media from traditional industries like entertainment will see strong success. More developers will leverage licenses from popular TV shows, movies, etc. to develop games and use the IP's pre-existing channels as viable user acquisition channels.

We will also see an incremental change in game design. In 2014, Chinese developers will strive to develop brand new card games integrating hybrid game mechanics, borrowing from other genres like SLG (real-time strategy) games and ARPGs (skill-based RPGs).

17. Rise of sports games

Another trend in 2014 will be the continued growth of the sports genre. The 2014 Winter Olympics and other major international sports events such as the World Cup will be great opportunities for Chinese developers to launch sport-themed card battle and casual games. SLG (real-time simulation) using the sports theme will also continue to see growth.

While some pirated foreign sports games will enter the market, domestically developed games will be introduced into the market as well. The typical demographic for sport-based mobile games in China are typically older. For example, the demographic for soccer-based games tend to be males over the age of 30.

This provides an opportunity for the mobile games, especially the SLG sports games, to acquire new mobile game users. Players that play sports-themed games tend to retain higher, have more disposable income, and tend to pay more. Like their Western counterparts, they are fanatic and loyal to their teams and tend to become "whale" users

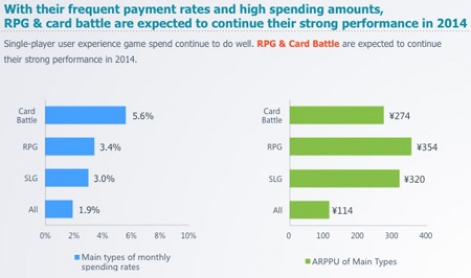

As the chart below shows, the ARPPU of SLG users is as high as 320 RMB ($52 USD).

18. Product innovations

Casual games in 2013 were largely re-packaged and fast-followed mobile games supported by heavy promotion. Card battle games mainly relied on the strength of the IP to acquire users, and a lot of midcore and hardcore games were really re-skins of existing games only applied to a different game mechanic.

Using what was learned from the market, developers in 2014 are and will continue to release more innovative mobile games.

No longer are Chinese developers copying Japanese games in 2014. Instead there is a movement towards hybridizing and improving on card battle game design. In fact, the mixture of different game design elements across different genres will begin to blur the line, where Chinese developers are picking the best of both worlds, surgically improving retention and monetization with more engaging features.

Looking forward

- In 2014, users' paying habits will come into shape after a few years of cultivation from Chinese and foreign developers alike.

- Revenues from the iOS market will still have a very large share.

- 2014 will see the genres of Action and RPG push the limits of user end.

In the iOS market, developers are less pressured to accommodate the operating system and will be able to enhance and push the boundaries of the user experience. This will continue to be a challenge for the Android market to deal with in 2014. Relatively speaking, the Android market has a broader user base and it is hard to control either the user's ability to use the device or the performance of the device, which are problems that need to be dealt with and solved.

TalkingData's review of the Chinese mobile game market holds a lot of promise to game developers domestically and across the globe. If anything is clear, it is the opportunity and the constant evolving state of player behavior and tastes in parallel with technology.

Supporting 20,000 apps from 8,000 companies globally, with 350+ million unique devices tracked, TalkingData is China's leading data service provider for the moblie internet. You can find out more about its services via its website.